The fintech sector in India has maintained its growth momentum even in the face of a looming global slowdown. In May 2022, Open became the 100th unicorn, taking the fintech unicorn tally to 21 startups

Supported by Slack, Akamai, and Beams Fintech Fund, Inc42 Fintech Summit 2022 is setting the stage for India’s leading fintech conference under one virtual roof to decode fintech’s trillion-dollar market opportunity

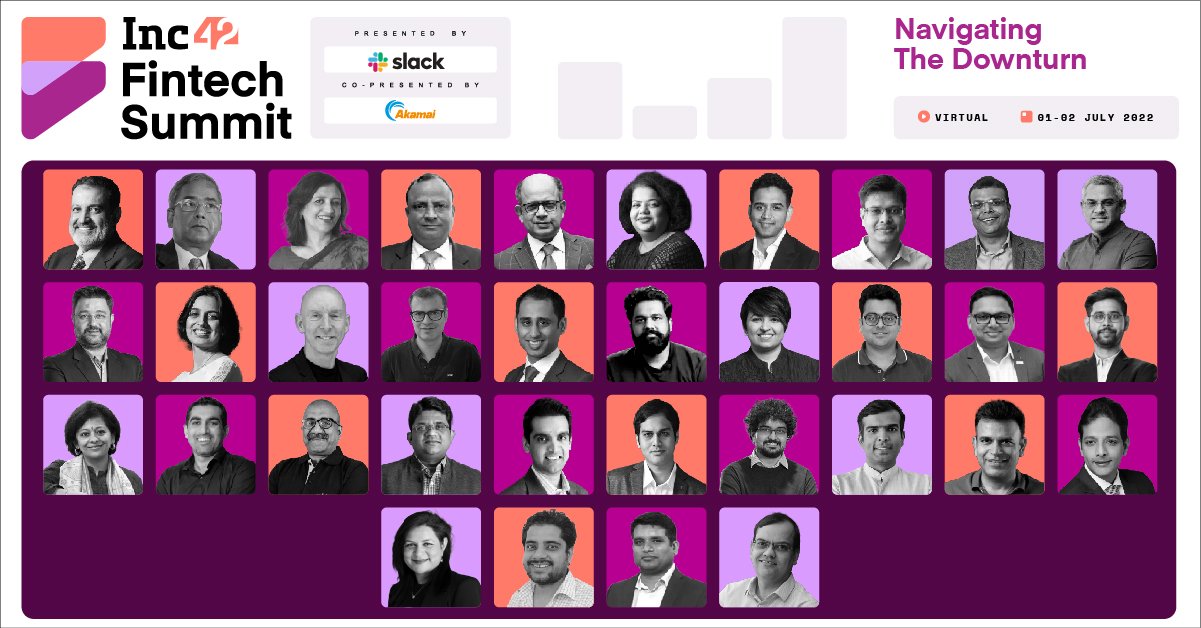

The summit will bring together 50+ startup founders, fintech experts and professionals, including the likes of Zerodha’s Nithin Kamath, Oxyzo Financial’s Ruchi Kalra, TV Mohandas Pai of Aarin Capital Partners, Open’s Mabel Chacko and more

From complementing to disrupting incumbent banks and legacy financial services, India’s fintech sector has come a long way. Last year, in particular, was a game-changer for the fintech industry in many ways. According to Inc42 data, fintech was the top-funded startup sector in 2021, raising a whopping $8 Bn.

As many as 11 fintech startups entered the coveted unicorn club last year, among these were India’s first two crypto startups, CoinDCX and CoinSwitch Kuber.

Incidentally, digital payment startups bagged 48% of the fintech funding raised in 2021 to top the list, according to Inc42’s State of Indian Fintech Report. This trend is hardly surprising as India is rapidly evolving from a cash-based economy to a cashless one. It further proves that the fintech sector remained an attractive choice for the majority of investors.

The sector has maintained its growth momentum even in 2022 in the face of a looming global slowdown. For instance, late stage lending tech startup Oxyzo raised $200 Mn in Q2 2022, followed by Pine Labs and Cred Avenue, which raised $150 Mn and $130 Mn, respectively. In May, the neobanking platform Open emerged as India’s 100th unicorn after raising $50 Mn in funding led by IIFL.

With the rise of fintech in India, many trends (and startups) are coming up to meet the growing demand of underserved Indian consumers. Take, for example, the rising popularity of the BNPL (buy now pay later) model, often considered a credit card disruptor. According to an analysis by Inc42, the BNPL market is expected to surpass $40 Bn by 2025.

Meanwhile, lending tech is likely to account for 47% of fintech’s trillion-dollar market opportunity, followed by insurtech at 26% and digital payment at 16%.

But the question is: How will these sub-sectors shape India’s fast-growing digitally charged economy? And how will fintech redefine India’s financial services sector in the coming years?

After a spectacular second edition of The Makers Summit in April, we are setting the stage for India’s premier fintech conference. Inc42 Fintech Summit 2022 will bring together India’s top fintech leaders, financial institutions and tech firms under one virtual roof.

Supported by Slack, Akamai, and Beams Fintech Fund, the conference will decode fintech’s trillion-dollar market opportunity.

Meet The Speakers At Inc42 Fintech Summit 2022

Inc42 Fintech Summit 2022, to be hosted on July 1 and 2, will feature a mix of keynotes, breakout sessions, fireside chats, panel discussions and hands-on masterclasses. It will bring together more than 50 startup founders, fintech experts and professionals across 25+ sessions.

Gear up to meet dignitaries like TV Mohandas Pai, chairman of Aarin Capital Partners, Dr Amar Patnaik, a Rajya Sabha MP (BJD) and member of the Parliamentary Standing Committee on Finance, former SEBI chairman UK Sinha, Rajnish Kumar, Chairman of the board, BharatPe.

The speaker lineup also includes founders and senior executives of fintech unicorns such as Mabel Chacko, cofounder and COO of Open, Oxyzo Financial’s CEO Ruchi Kalra and Nithin Kamath, founder and CEO of Zerodha. Besides, there will be many soonicorn leaders, including Jupiter’s Jitendra Gupta, Harshvardhan Lunia of Lendingkart, INDmoney’s Ashish Kashyap and Nitin Gupta of Uni Cards.

In addition, participants can attend investor-led sessions featuring the likes of 3one4 Capital’s founding partner Siddarth Pai; Sanjay Swamy, managing partner at Prime Venture Partners; B Capital’s partner Karan Mohla and more.

Insightful Themes

Our prominent speakers and panellists will deep dive into the market challenges posed by regulatory and policy frameworks. For instance, in May this year, the RBI called for legislation to regulate areas like neobanking and digital lending. What does it mean for players in these sub-sectors? Find out at the Inc42 Fintech Summit.

It is evident that Indian startups are in for a lacklustre funding season. Funding fell from $4.6 Bn in March to $1.7 Bn in May, the lowest in 2022, due to the global economic slowdown. According to Inc42, growth stage startups are hit the hardest due to a 37.5% MoM funding decline in May. Our speakers will decode the future outlook for fintech startups looking to raise funds or list this year.

Our sessions will further address the hottest trends in the fintech sector, from lending to open banking and help participants understand how they can scale and grow sustainably, the future of the internet.

What To Expect At Inc42 Fintech Summit 2022

As we can easily perceive, the Inc42 summit will be a one-stop destination for all things fintech, from hottest trends to key growth drivers to the challenges ahead and their solutions.

Get an unprecedented opportunity to connect and interact with the crème de la crème of the community under a single roof. The conference will have the right ingredients to help you figure out the secret sauce to lift your startup.

We invite founders, entrepreneurs, investors, policymakers and fintech enthusiasts from India’s fintech ecosystem to be a part of the revolution with the Inc42 Fintech Summit 2022.

![Read more about the article [Funding alert] Upstox turns unicorn! Raises $25M from Tiger Global as part of ongoing round: Source](https://blog.digitalsevaa.com/wp-content/uploads/2021/11/YourStoryRKSVFunding1568981823026png-300x150.png)