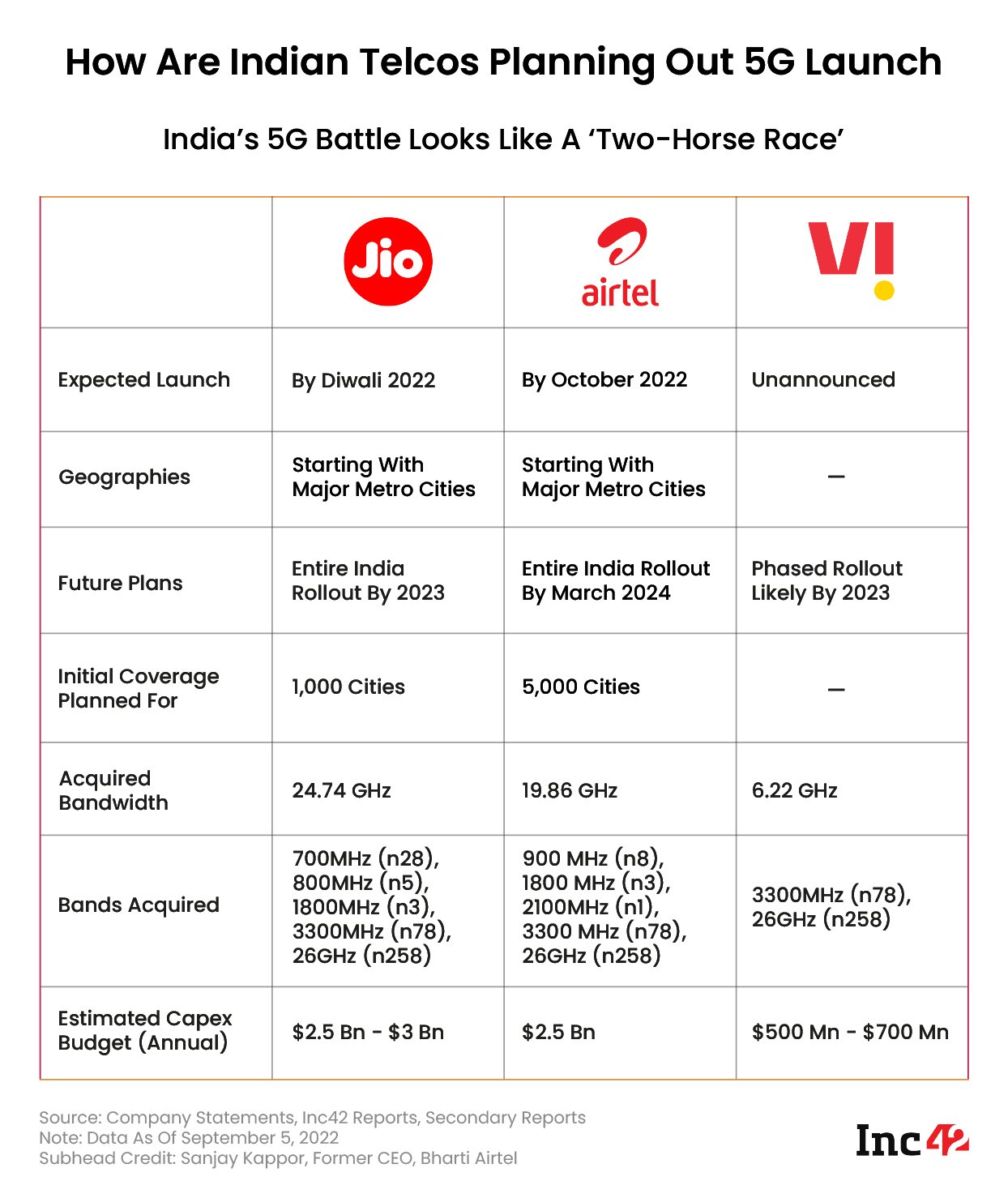

While Jio will launch 5G services in key cities by Diwali, Bharti Airtel is also expected to start services in few cities in October

Both Airtel and Jio are looking at a timeline of 2023 to start 5G services to the majority of users in the country, while Vi has not shared rollout plans yet

Jio aims to cover 1,000 cities by 2023, while Airtel is banking on its 4G infrastructure to start providing 5G to 5,000 cities by 2024

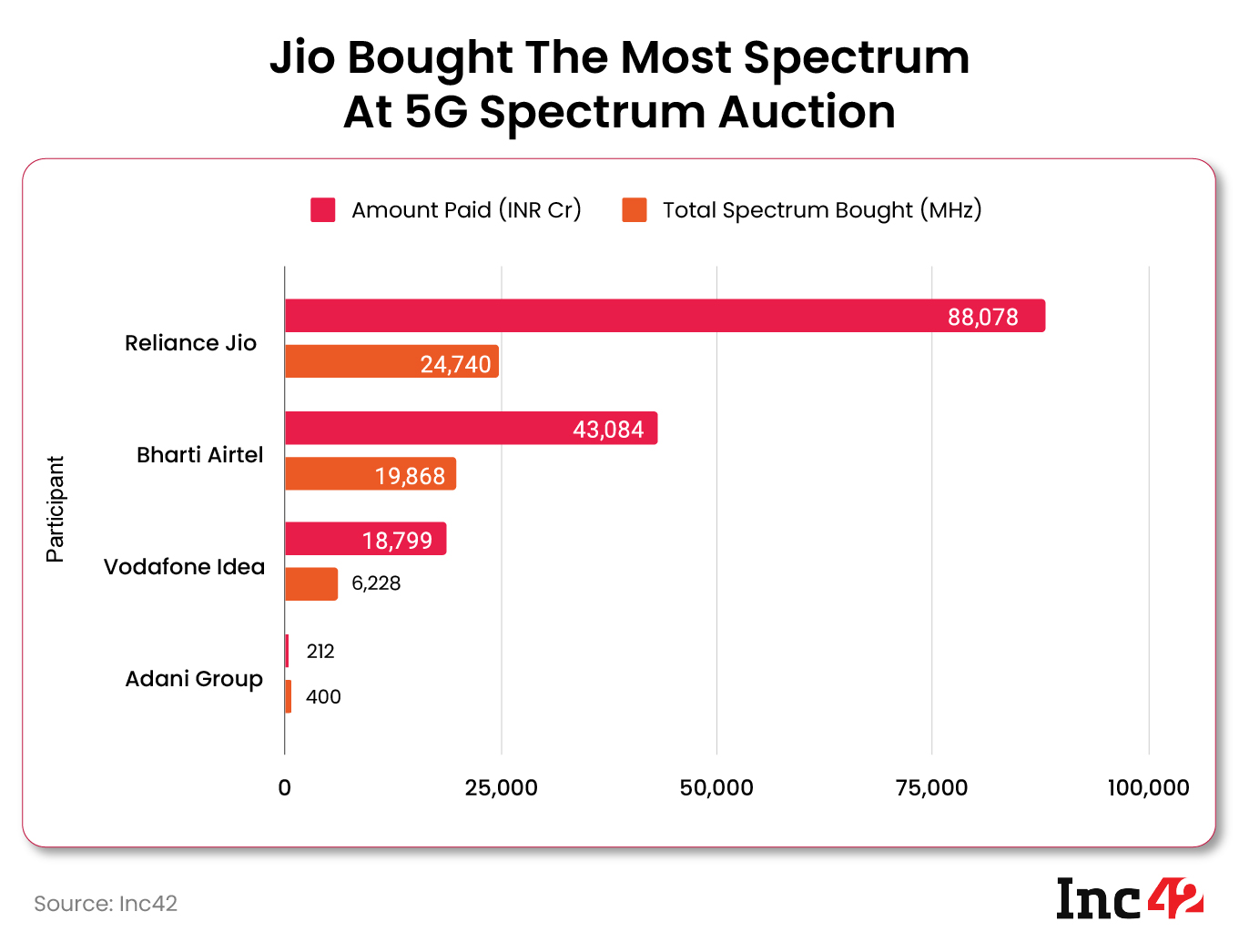

In August 2022, the Department of Telecommunications (DoT) concluded the 5G spectrum auction in which Reliance Jio, Bharti Airtel, Vodafone Idea (Vi) and Adani Data Networks bid for spectrum worth INR 1.50 Lakh Cr. Soon after, the telecom department allotted the spectrum to the companies, and since then, all eyes are on the rollout of 5G services in the country.

It is noteworthy that Jio was the biggest spender at the spectrum auction at INR 88,078 Cr, followed by Bharti Airtel (INR 43,084 Cr). Vi purchased 5G spectrum for INR 18,799 Cr. Jio, Bharti Airtel and Vi bought 24.74 GHz, 19.86 GHz and 6.22 GHz spectrum, respectively. Adani Data acquired the spectrum for private networks.

As far as the rollout of 5G services is concerned, the DoT announced that 5G internet will be available in 13 Indian cities first – Ahmedabad, Bengaluru, Chandigarh, Chennai, Delhi, Gandhinagar, Gurugram, Hyderabad, Jamnagar, Kolkata, Lucknow, Mumbai, and Pune.

As the telcos gear up to roll out the fifth generation of internet services, IT Minister Ashwini Vaishnaw hinted that the services will be available in most parts of the country in 2-3 years and the rollout in major circles will begin as early as October 12. “Requesting TSPs to prepare for 5G launch,” he said on micro-blogging platform Koo.

The anticipated launch has also raised questions about the price of 5G network in a country where 4G data packs cost less than $3 per month, and if consumers will be willing to pay more for the new plans.

A Comparative Analysis Between Jio, Airtel & Vi’s 5G Rollout Plans

During Reliance Industries’ annual general meeting last month, Jio announced plans to launch 5G networks in key cities including Delhi, Mumbai, Chennai and Kolkata by Diwali (October-end 2022). The telecom giant has set INR 2 Lakh Cr for 5G deployment in the country. Further, reports suggest that the telecom giant will spend $2.5 Bn to $3 Bn every year for the next couple of years as capital expenditure (capex) for 5G services.

Dubbed True 5G, the internet speed of the company’s public networks will reportedly be up to 1 GBPS. Jio aims to provide low-latency services, Voice over New Radio (VoNR) and other IoT use cases via its True 5G initiative. It will first open an experience centre in Mumbai and plans to have a nationwide presence (starting with 1,000 cities) by March 2023.

Airtel, on the other hand, intended to launch 5G services in August 2022, but that has been pushed back to October 2022. By March 2024, Airtel intends to have a presence in over 5,000 towns and cities. Further, since Airtel has primarily acquired mid-band spectrums, the telco claims that its CAPEX will remain around the existing levels of $2.5 Bn.

Airtel’s enterprise cloud solutions will also have private network deployments as the company has 12 large data centres and 120 edge data centres that are likely to facilitate 5G-enabled cloud solutions, especially for content delivery networks.

The above scenario, as former Airtel CEO and presently an independent analyst Sanjay Kapoor puts it, is a big maze and a two-horse race between Airtel and Jio.

The comment assumes significance largely because debt-ridden Vi has not yet announced any 5G deployment plans, nor its strategy of rolling out the network for its users anytime soon. Further, reports suggest that Vi’s strategy will be largely dependent on customer demand and competitive dynamics.

Vi has reportedly started sending text messages to its users in various locations, such as Delhi-NCR, about its fifth gen services, indicating that a launch is imminent. However, in the absence of any clear timeline, the delay in the launch of 5G services can further push its customers to Jio and Airtel.