Venture capital funding into Indian startups declined in the second week of May in the absence of any large deals. The Indian startup ecosystem continues to face turbulence, with leading unicorns witnessing a significant markdown in their valuations.

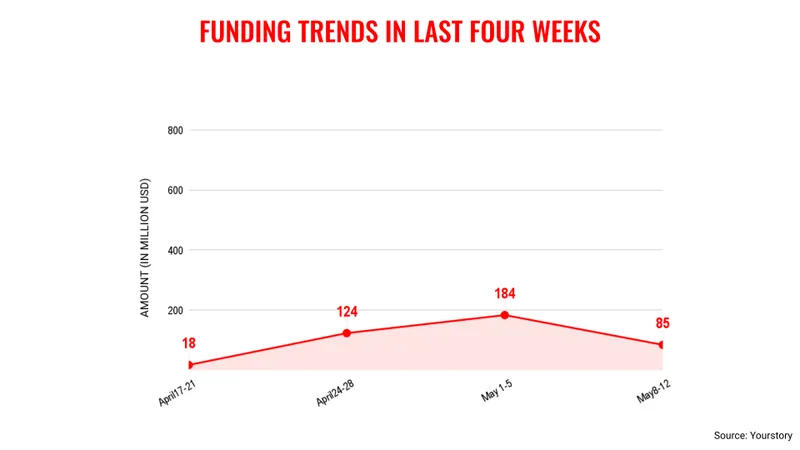

Venture capital funding this week totalled $85 million across 20 deals. This was a $100 million drop as compared to the previous week when $184 million were raised. The macroeconomic uncertainty has resulted in an uneven funding pattern over the last couple of weeks as VC firms continue to hold their purses.

Several billion-dollar valuation companies like Pine Labs, PharmEasy, Ola, Swiggy, BYJU’S, and Oyo have gotten valuation haircuts given the present environment, and it is likely other unicorns will see such corrections as well.

A haircut in valuation is the difference between the current market valuation and how much an investor will recognise that value as collateral.

However, the week also saw a few positives for the startup ecosystem in the medium and long term as venture capital firms continue to raise fresh capital. During this week, 3one4 Capital and Strides Venture announced fresh funding.

The startup ecosystem will continue to face funding challenges right through this year and any pickup in activity is likely only from next year.

Key transactions

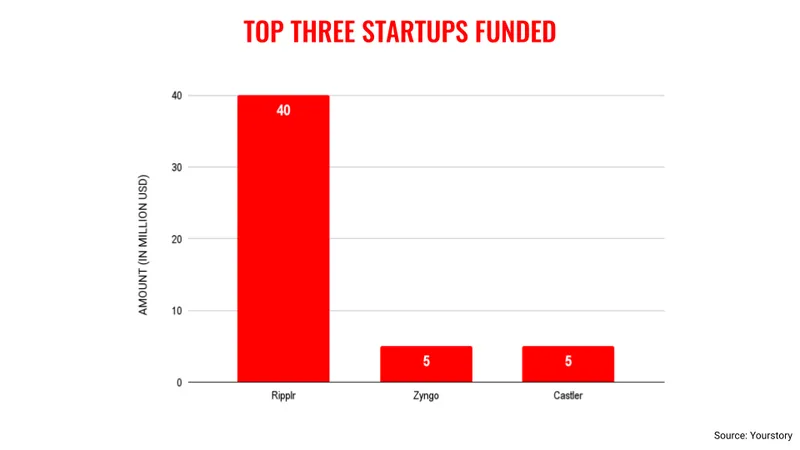

Ripplr, a distribution and logistics platform, raised $40 million from Fireside Ventures, Bikaji and Neo Foods, 3one4 Capital, Zephyr Peacock India, and Sojitz Corporation.

Zyngo Mobility, a logistics startup raised $5 million from Delta Corp Holdings and LC Nueva Investment Partners LLP.

![You are currently viewing [Weekly funding roundup May 8-12] Venture capital inflow declines without large deals](https://blog.digitalsevaa.com/wp-content/uploads/2022/11/funding-lead-image-1669386008401-scaled.jpg)