In an article for London Business School, the former CEO of global learning company Pearson, John Fallon, recalls being asked the same question at company town halls. The question centred around Pearson’s ‘transformation’ and if it was done with it.

“I would regularly be asked a variation of the same question: Are we finished transforming yet?” writes Fallon.

Digital transformation, which is frequently talked about in various organisations, is a journey. And it’s certainly not an overnight one–especially for an organisation with 177 years of legacy.

“Digital transformations take longer than the tenure of most CEOs,” Fallon writes.

“The pace of digital shift can be uneven, uncertain, sometimes unmanageable,” he reflects, capturing the challenges in driving a monumental shift in a large organisation spread across the world.

Founded in 1844, UK-headquartered Pearson is a multinational corporation focused on educational publishing and services.

Fallon led Pearson from 2013 to 2020, steering the company through a complex journey—from being a traditional educational publisher to a digital-first organisation. Following his retirement, Fallon was succeeded by Andy Bird, who was followed by Omar Abbosh, the current CEO of the company.

Pearson’s transformation journey continues till date, under the new leadership–as it leverages cutting-edge technologies to personalise education and forges partnerships to expand its offerings and global reach.

The company is keen to drive the shift and keep the momentum going across all key markets, including India.

The opportunity in India

As its digital transformation journey gets underway in India, Pearson is recognising the distinct demands and challenges of the market.

The company is sharply focused on the needs of students and educators in the country and the tenets of the revamped National Education Policy and seeks to leverage the power of partnerships to support its efforts.

India may not currently be among Pearson’s top-three markets globally, but it views the country as a strategic market primed for future growth.

Vinay Kumar Swamy, Country Head of Pearson India, asserts that India is a focus area for Pearson and “serious investment plans” are in the pipeline.

With 420 million young people, representing 29% of the country’s population, India’s youth market is a goldmine for education innovation. And Pearson is eager to seize the opportunities in digital education in the world’s largest population.

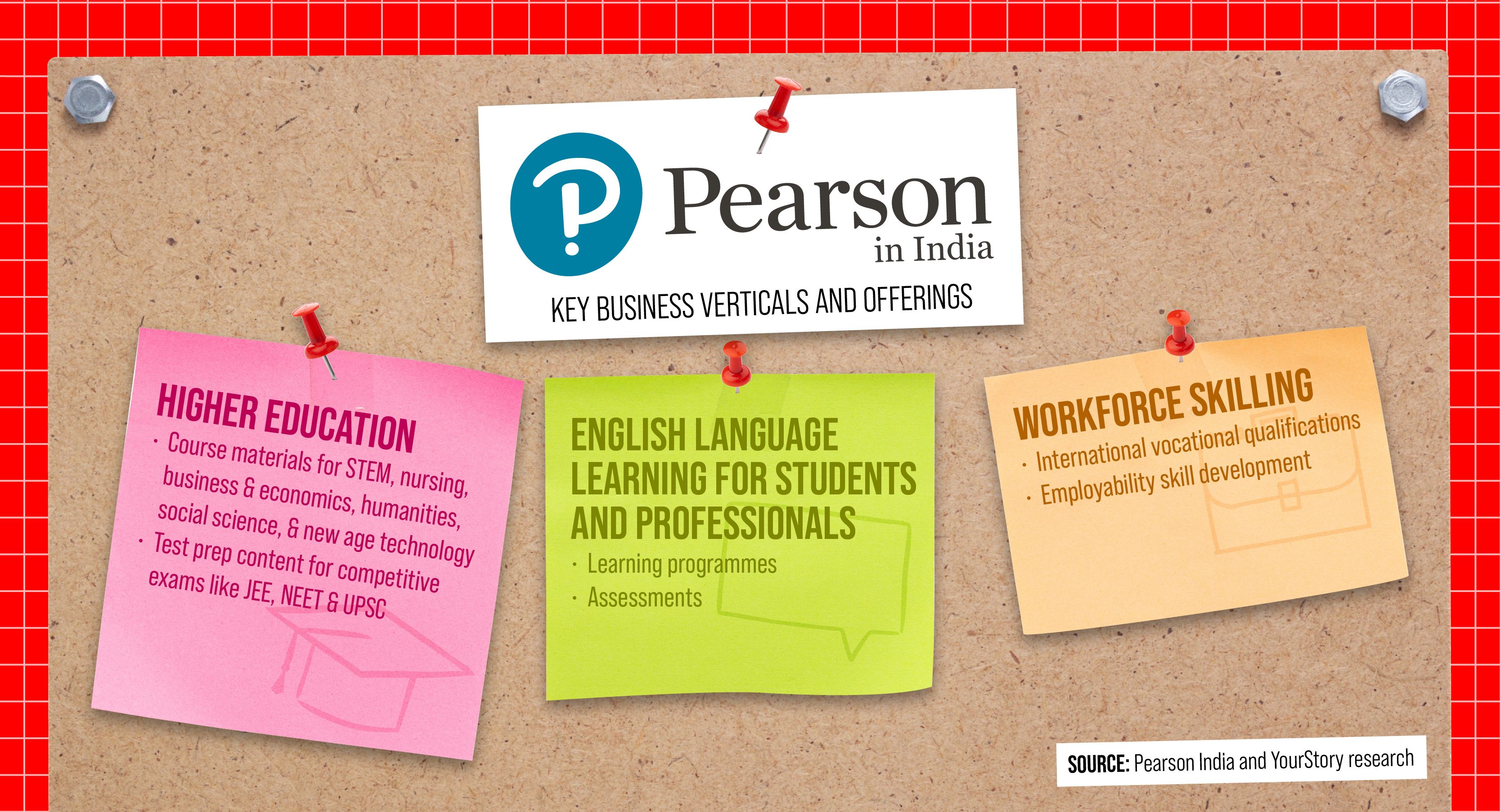

Pearson ventured into India over 25 years ago offering textbooks and printed course materials. Over time, it expanded its offerings to comprehensive curriculum support for schools and higher education institutions and digital learning solutions. It also offers test preparation content for competitive exams like JEE (engineering), NEET (medicine), and UPSC (civil services).

The company’s content is available in both the printed and digital formats, including online resources and mobile apps.

<figure class="image embed" contenteditable="false" data-id="546746" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/PearsonInIndiaGraphic2-1718280456379.jpg" data-alt="Pearson India" data-caption="

Design: Nihar Apte

” align=”center”> Design: Nihar Apte

Power of partnerships

Collaborations drive the efforts in all the areas that Pearson is present in, reiterates Swamy.

Pearson has partnered with stakeholders across the spectrum, including government bodies, trade organisations, higher education institutions, industry leaders, and other education firms.

Through collaborations, Pearson has been able to leverage diverse expertise and resources and ensure that content is accessible to a large base of learners. Collaborations have also enabled the company to deliver relevant high-quality education and targeted skills training, thus enhancing employability among learners, says Swamy.

While Pearson has collaborated with many partners over the years, the intensity and scope of these partnerships have increased in recent years.

Earlier this year, Pearson partnered with Hyderabad-based Solitaire Business School to offer its BTEC Higher Nationals programmes in business management and courses in sport, fitness instructing and personal training, marketing and business.

Pearson has also partnered with Udaipur-based Buddha Group of Institutions to offer BTEC Higher Nationals courses in art and design and business management.

Pearson BTEC (Business Technology and Education Council) is a career-oriented vocational qualification designed to provide learners with practical skills and knowledge relevant to specific industries.

In February, Pearson joined hands with global student housing marketplace University Living to facilitate foreign accommodation, financial services, and logistics support for aspirants from India.

When choosing a partner, Pearson considers alignment with its goals and values and synergy in content creation, technology integration, and marketing. It also prioritises partners with a strong track record and expertise, innovation, growth potential, and a commitment to quality education and employability.

Test prep market

In the higher education segment, test preparation is a rapidly growing market that the company is keen to cash in on.

According to Technavio, the test prep market in India is projected to increase by $9.07 billion from 2021 to 2026, at a CAGR of 15.02%.

Last year, Pearson opened one of its largest company-owned Virtual University Enterprises in Chandigarh. The test centre has the capacity to conduct more than 14,000 tests per month.

Pearson recently entered into a partnership with Chennai-based education firm Veranda Learning, part of Kalpathi AGS Group, to enhance its competitive test preparation and IT education content and resources.

Through this partnership, Pearson hopes to offer comprehensive preparatory content for bank exams and hybrid products in test prep.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Content is key

Pearson has digitised every single piece of content that’s available with it—not just in India, but globally as well. It has established technology development centres in Bengaluru and Chennai towards this endeavour.

A lot of the digital content created in India caters to other geographies as well, points out Swamy.

Pearson’s digital learning solutions offer diverse resources such as e-texts, synopses, interactive courses, assessments, and virtual platforms to enable student engagement and self-paced learning.

Over the years, the company has been steadily leveraging the power of artificial intelligence to enhance its products.

Swamy singles out the ‘Pearson Test of English’ as a key product featuring AI-powered computer-based English language tests for study, work, and visa applications.

But AI is not something Pearson has been dabbling with in the recent past, following the advent of ChatGPT, insists Swamy.

“We have been integrating AI into our products for the last eight, nine, or even ten years,” he says.

Pearson has also integrated GenAI study tools into its products and content. The initial rollout in the US focused on maths, science, and business titles. Now the company plans to extend these tools to global editions of its higher education titles, including those in India, by August this year.

Swamy sees AI as a crucial component of personalised learning and adaptive assessments–in line with what other edtech companies, including PhysicsWallah, upGrad, Allen, and Sri Chaitanya’s Infinity Learn, are focused on.

Even as Pearson ramps up digital content, it hasn’t neglected the market for physical books, which are still in demand.

To meet this demand, Pearson has launched a book vending machine for direct sale of books in Bengaluru.

Swamy notes a strong interest in these machines from universities, coaching centres, and distributors, and there are plans to install book vending machines in the test prep hubs of Delhi and Kota soon.

Meanwhile, Pearson is also working to address the issue of lack of quality content in regional languages through impactful partnerships.

While it has a body of content in Hindi, the firm plans to offer digital content in other regional languages such as Tamil, Kannada, Telugu, Bengali, and Marathi for test preparation and higher education.

<figure class="image embed" contenteditable="false" data-id="546747" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/PearsonInIndiaGraphic1-1718280559981.jpg" data-alt="Pearson India" data-caption="

Design: Nihar Apte

” align=”center”> Design: Nihar Apte

Affordability and accessibility

While quality content is crucial, it is equally important to ensure it’s affordable and accessible.

One of the ways in which Pearson is trying to accomplish this is by using AI to translate content into regional languages, thereby reducing the cost of content.

Pearson offers higher education content and test preparation catalogues through ecommerce websites such as Amazon. It has also partnered with Snapdeal to serve Tier II and III cities. Besides this, it has tied up with quick commerce platform Blinkit for fast delivery of books.

All these partnerships are enabling the company to reach a broader audience nationwide, says Swamy.

Business growth and competition

As Pearson’s business encompasses a large gamut—from content and courseware to curriculum and assessments—it has to contend with various competitors.

Pearson competes with publishers including S. Chand, Saraswati House, and McGraw Hill in the course materials space, while Coursera and Udemy are its competitors in digital learning. It also competes with homegrown startups such as Unacademy, PW, and upGrad in innovative learning solutions and companies like PSI Services, Prometric, and ETS compete in test delivery and proctoring services.

Commenting on Pearson’s strategy in the Indian market, the founder of an edtech firm notes, “Compared to startups, Pearson may be slower in fully embracing digital learning and is playing catch-up in the online learning space.”

While its digital development needs to accelerate, the company’s presence in both physical and digital resources is a huge advantage, catering to the current demand for flexibility, he says, adding that Pearson’s global presence is another plus.

In 2023, Pearson posted a profit of £380 million globally, up 55.7% year over year. However, in 2023, its sales dropped 4.3% year on year to £3674 million.

Pearson’s market share is improving in India, according to the Pearson India chief.

The company delivers content to over 5,000 higher education institutions in India and has reached 6 lakh learners across the country through its digital products and services.

In India, Pearson is inching closer to three decades—thus bringing to the table “credibility” and “financial stability”, says Swamy.

“We are meeting the planned numbers for this year … We might be slightly exceeding the planned profitability for Pearson India,” he says.

“Profitability through optimisation is what we are looking at in Pearson at this point.”

As part of its optimisation strategy, Pearson, in 2022, sold a majority of its K-12 publishing business in international markets, so that it could focus on fewer but bigger opportunities that contribute to growth and digital transformation.

Mumbai-based edtech unicorn LEAD completed the acquisition of Pearson’s K-12 learning business in India last year.

Investing in the right talent is another priority for the firm, which has over 1,200 employees in India. It plans to hire professionals skilled in content creation, educational technology, data science, AI, and skills training over the year.

Moving forward, Pearson must invest heavily in developing engaging and interactive digital content with GenAI integration across various disciplines, advises an industry leader.

This combined with flexible pricing models and relevant partnerships can help Pearson make its resources accessible to a broader student base, he adds.

According to industry experts, higher education and skill development—segments in which Pearson operates—offer opportunities for career advancement and income generation and will never go out of favour.

“Amidst the struggles, the education sector stands poised for expansion, fuelled by learners’ escalating demand for digital learning, irrespective of the channel,” notes the industry leader quoted earlier.

If Pearson is able to capitalise on these tailwinds, it can make considerable progress in its transformation journey in India.

The pace might be ‘uneven’ and ‘uncertain’ at times, but it all boils down to – to quote Fallon again – “sticking with it, however hard it gets”.

(Cover image designed by Mayank Dahiya and infographics designed by Nihar Apte)

Edited by Swetha Kannan