Frendy dons many hats: it is a convenience store manager, grocery retailer, dark store operator and also makes private labels of daily essentials.

However, unlike other retail tech companies, Frendy isn’t targeting metros or Tier I cities. Instead, its focus is on smaller cities and villages.

Frendy operates in small rural catchment centres, specialising in serving towns where the population is below 10,000. These towns come with their own geographical and economic limits making it difficult for traditional players like D-mart or Reliance to operate. Moreover, these towns are also unattractive for new-age quick commerce companies which cannot justify sheer costs with low volumes and sporadic orders.

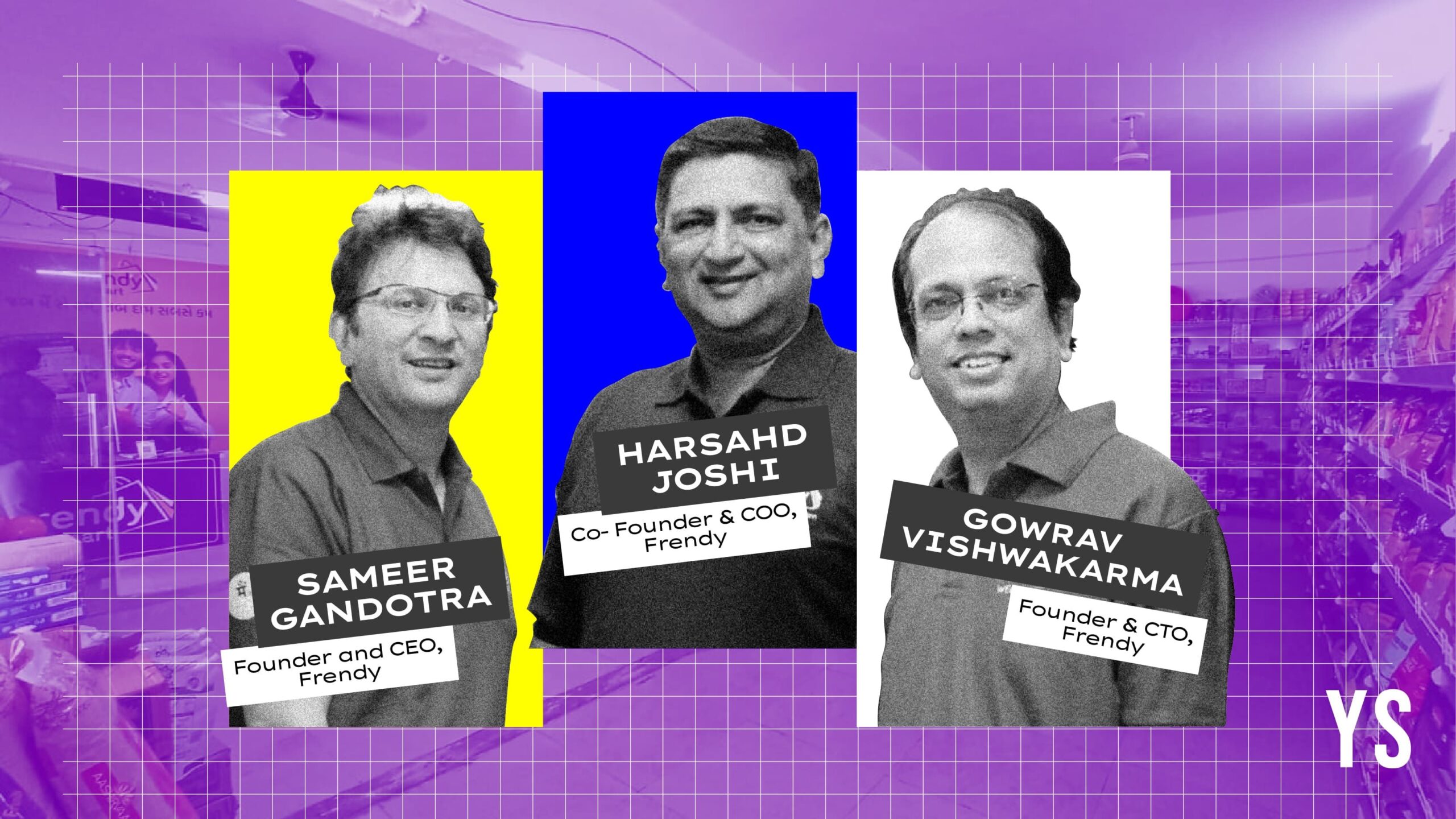

Founded in 2019 by Sameer Gandotra, Gowrav Vishwakarma, and Harshad Joshi, the assisted commerce and convenience store startup is headquartered in Ahmedabad.

Frendy operates nearly 25 mini-marts—neighborhood convenience stores—in towns like Chaala, Kalavad, Gondal, and Chithroda among others in Gujarat.

“We also believe that the small format store is what will eventually win in India. especially in small towns & rural India, where car penetration is extremely low, and public transport is practically non-existent,” Gandotra, Frendy Co-founder, tells Yourstory.

Frendy operates on both B2B and B2C models. It operates mini-marts, which are run-of-the-mill grocery stores with daily essentials, checkout counters, and uniformed staff. These marts have 1,500 SKUs (Stock keeping units).

“There are a lot of opportunities, in Tier III and IV towns which can grow because aspiration levels are high,” noted Brijesh Damodaran, Managing Partner at Auxano Capital, an investor in the company.

These marts also have a partner app that runs a digital loyalty programme and also allows customers in a radius ranging from 500 meters to one kilometre, see available items, place an order, check prices and even get home delivery. These mini marts bring 30% of revenue for the company, of which nearly 15% of sales are contributed by Frendy’s private label products that cover staples, cleaning supplies and home basics.

Micro kiranas: Neighborhood store goes digital

Along with being a retail store, these mini-marts also act as dark stores for the company’s B2B operations where they supply to micro kirana stores in a radius of 10-30 km. These micro kiranas stores do less than 2 lakh of business a year and provide service to Tier III towns or in rural catchment areas.

More than 2,000 of these micro kiranas are digitally connected to Frendy, which allows them to buy the assortment that they would ideally store and also provides them with access to larger assortments that are available at the mini-mart and central warehouses.

These micro kiranas can also provide their customers with a digital app that allows them to see what is available at micro kirana, with a price that displays the best price available at the kirana. The customers also have access to Frendy’s larger assortment which is available through hop, skip and jump delivery via micro kiranas and mini-marts.

Through its micro kirana distribution, Frendy manages to reach rural markets which either place an order through the app and collect it from the micro kiranas or just ask micro kirana to source it for them.

Such distribution essentially turns micro kiranas as an extension of Frendy marts through assisted commerce which gives the customer the assurance and trust of local mart along with the assortment of larger towns.

Nearly 25% of its affiliated micro kiranas are supplied through Frendy mini-marts and the rest are directly supplied through the company. This distribution allows the micro kiranas to hold smaller inventories and shorter cash cycles and they have access to larger assortment.

All these transactions both from mini-mart and micro kiranas just are partly digital with customers checking the product catalog digitally but the billing is done manually by micro kiranas. The burden of last-mile delivery is on the micro kirana owner, who if required, can also get it home delivered. These dynamics are a lot more flexible in this region.

“What we realised is that the largest retailer in the Town is also the wholesaler for the micro kiranas in the villages. This B2B business is precisely what we have institutionalised,” says Gandotra.

Where is the cash cow?

Frendy makes its money through a private label, which contributes 8% to the revenue, exclusive of marts. Another stream is retail distribution through mini-marts and its expanded network of micro kiranas. It earns money through its B2B network as well by using the marts as a micro hub for kiranas in that radius.

Frendy co-owns all the mini-marts and runs them under a franchise model. It provides the deck, backend infrastructure, and private label entities. The franchisee invests half in the mini-mart and runs it like a store operator.

Damodaran, whose firm also has an observer seat on the company Frendy Board, believes Frendy needs to continue being cognizant of its working capital and has to watch out for its margins, inventory and procurement as it expands and grows.

Apna Mart, a franchise-driven offline grocery chain that has a similar target group, clocked hefty expenses as it pushed to pad up its topline. The company which has stores in states like Jharkhand, Chhattisgarh and West Bengal posted eight-fold rise in its operating revenue to Rs 32.2 crore during FY23 in comparison to Rs 3.7 crore in FY22. Its loss during the period was Rs 21.8 crore against a profit of Rs 8 lakh a year ago, data from RoC filings showed.

Frendy currently operates on a 6-6.5% gross margins and expects hit operational profitability in the next two years. It clocked Rs 70 crore in sales under banner, which refers to goods sold from company owned marts. By the end of this financial year, it plans to log Rs 100 crore in book revenue. Currently, it is focusing on establishing itself in Gujrat, and plans to foray in other states after it is a lot closer to PAT profitability.

In July, it raised Rs 2 crore debt funding from UC Inclusive Credit. In November 2023, it raised Rs 16 crore in bridge round from Auxano Capital, AT Capital Singapore. This round also witnessed participation from Metara Ventures, Rohan Jain and Rishabh Jain, Apurva Salarpuria family office and existing investor Desai Ventures. Cumulatively the company has raised nearly Rs 40 crore in funding.

India’s fast-moving consumer goods (FMCG) sector grew 7.5% by volume in the April-June 2023 quarter, the highest in the last eight quarters, led by a revival in rural India and higher growth in modern trade, according to the Indian Brand Equity Foundation. Based on a Nielsen report, the FMCG sector in rural and semi-urban India is estimated to cross $100 billion by 2025. This market, which was previously unorganised, holds vast potential and Frendy is trying to capture a slice of it through an organised and vertically integrated venture.

![Read more about the article [Funding alert] Proptech startup BricSpaces raises $350K in pre-seed round from angel investors](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imagev1bh-1621492973929-300x150.jpg)

![Read more about the article [Funding alert] GoKwik raises $35M in Series B round led by Think Investments](https://blog.digitalsevaa.com/wp-content/uploads/2022/05/ImageTaggingPooja30-1651839634401-300x150.jpg)

![Read more about the article [Funding alert] Chingari raises $13M in a round led by OnMobile](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/chnagri-1597040973748-300x150.jpg)