With India’s startup ecosystem facing funding slowdown in the past two years, a key debate has emerged among founders and investors—how to strike the right balance between growth and profitability.

The question of how much a startup should cut back on spending and whether it should prioritise profitability over growth has sparked many discussions. If profitability is prioritised, concerns arise about how the company will continue to grow and justify its valuation, creating a dilemma for both companies and investors.

The founders of Homelane and Akshayakalpa, two of India’s emerging ‘soonicorns’—startups poised to achieve unicorn status with valuations exceeding a billion dollars—argued that instead of choosing between growth and profitability, companies should instead focus on sustainable growth, especially as shifting global macroeconomic conditions reshape investor expectations.

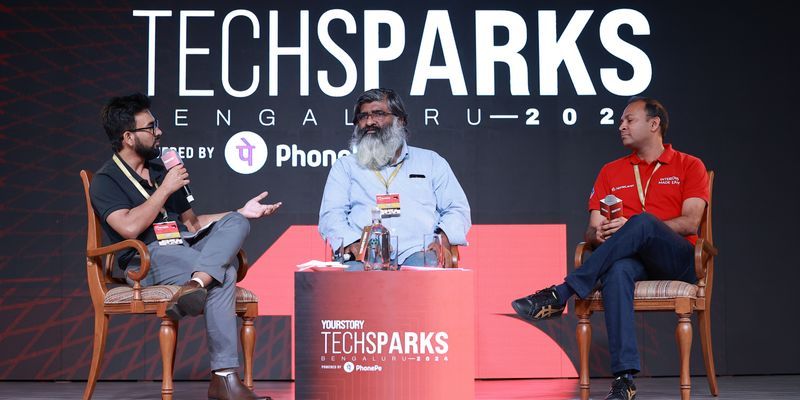

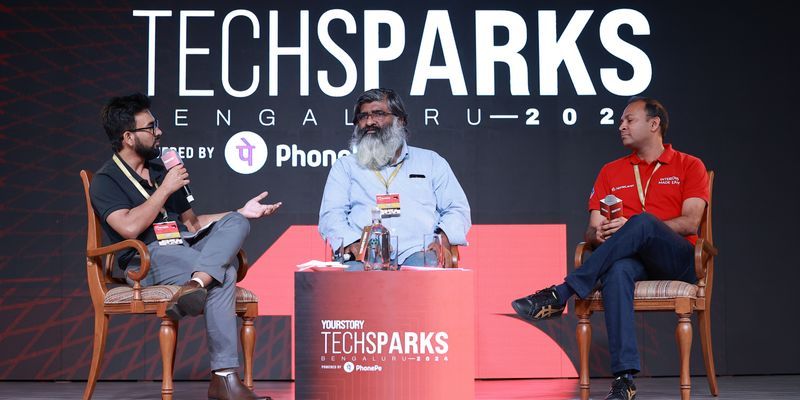

“Investors are deeply considering the sustainability of a business,” said Shashi Kumar, Founder & CEO of Akshayakalpa Organic, during a panel titled ‘Startup to Impact: Building Sustainable Ventures’ at TechSparks 2024 in Bengaluru.

“By spending money, growth won’t accelerate. Often, we get distracted from focusing on growth. But focus on the fundamentals and the core, and the results will come,” he added.

Kumar, who founded Akshayakalpa over a decade ago, has scaled the company from a pre-revenue company to close at Rs 200 crore as of FY23. Akshayakalpa was profitable until FY19, but slipped into losses since then. Earlier this year, the company raised $15 million in funding led by A91 Partners at about $72 million. Last year, YourStory had reported that the company was in talks to raise $25 million in funding.

Tanuj Choudhry, Co-founder and the Chief Operations Officer (COO) of Homelane, an online platform for furniture and home interiors, agreed with Kumar and said, “It’s not about being a maverick founder who’s been able to build a business in two years and raise a billion dollars in funding. There’s a lot of respect for folks who can build a business for three-four-five or 10 years because it takes a lot out of you to build a business like that.”

“60% growth year-on-year but with burning a lot of money versus 30% growth with a clear path to profitability, today, the path is clear,” he added.

Founded over 10 years ago, Homelane has raised funding over the years from a host of institutional investors such as Peak XV, Accel, Stride Ventures, and West Bridge, among others. The Bengaluru-based company recently raised $27 million funding while acquiring a smaller rival named Design Cafe for an undisclosed amount. Media reports suggested that the deal valued the merged entity at around $400 million.

Choudhry and Kumar both highlighted how investor sentiment has shifted. Unlike a few years ago when startups easily attracted capital amid favourable macroeconomic conditions, investors are now asking tougher, more scrutinising questions.

“When we raised funds in 2021, we were still EBITDA negative, we were growing at a fair clip, but I distinctly remember we were asked questions about how we were going to control our fixed costs, how will we get our CAC (customer acquisition costs) down, etc. So these questions were there, but today it has become a lot more brutal,” said Choudhry.

“The questions are now around whether you have runway for two years, if you are planning to go public then there are 10 more questions around what will the multiples be if you go public etc. So companies have their own life cycle and I think the economy has its own life cycle. Profitability, runway, the desire to be able to stay in the race and how much stamina the management has, are some things that are back in the focus,” Choudhry added.

Kumar, on the other hand, shared that Akshayakalpa has raised over Rs 450 crore since 2019 without ever relying on a formal pitch deck. He explained that his approach has always been to demonstrate the company’s work to potential investors and gauge their interest afterward. Kumar added that he doesn’t believe in using formal PowerPoint presentations as pitch decks to secure investment.

“When I came out of the technology industry, I strongly believed that anybody who was writing a powerpoint presentation, was not leading a good life. I continue to believe so,” he added.

Just as Kumar and Choudhry, many entrepreneurs and investors spoke in length about building sustainable, yet growing, businesses.

Kunal Bahl, Co-founder of Snapdeal, one of India’s largest ecommerce companies, and an ace investor with Titan Capital, launched a new term with YourStory called “Indicorns,” at TechSparks and said that the country should celebrate profitable companies over loss-making unicorns.