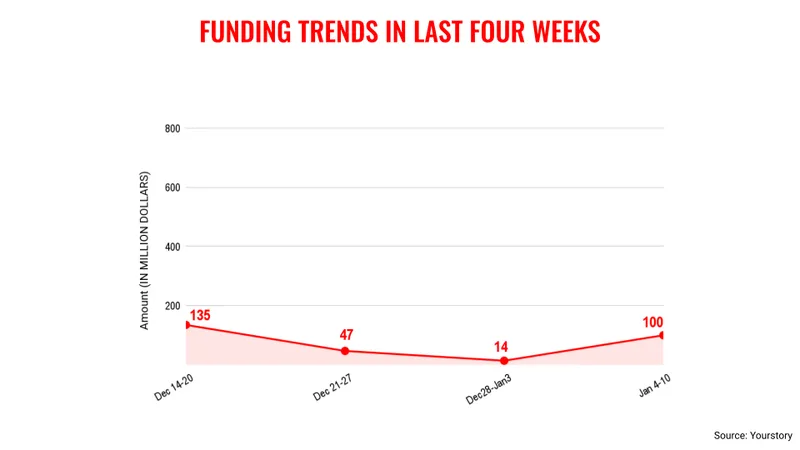

Venture capital funding saw a steady growth in the second week of January shrugging off the previous week’s inertia and setting the stage for better prospects in the near future.

The total funding for the second week of January came in at $100 million spread over 19 deals. In contrast, the previous week saw VC funding at just $14 million.

The steady increase in VC funding is a good sign for the Indian startup ecosystem as this signals there is optimism about a further increase in capital inflow in the near term. This can be corroborated by the latest fundraise of premier VC firm Accel, which garnered $650 million.

This week also saw healthcare-focused SaaS unicorn Innovaccer raising $275 million. Though headquartered in the US, the origins of this startup are in India where it has the majority of its employees.

However, challenges remain for the Indian startup ecosystem in terms of raising money as the macroeconomic environment remains subdued with a slowdown in the domestic economy and uncertainty over what would be policy measures from the new President of the United States.

On the other hand, there is a lot of activity for the ecosystem from the quick commerce segment as Zepto, Swiggy and Zomato continue to introduce new products keeping the excitement in the market.

While the ecosystem is optimistic, it is also cautious.

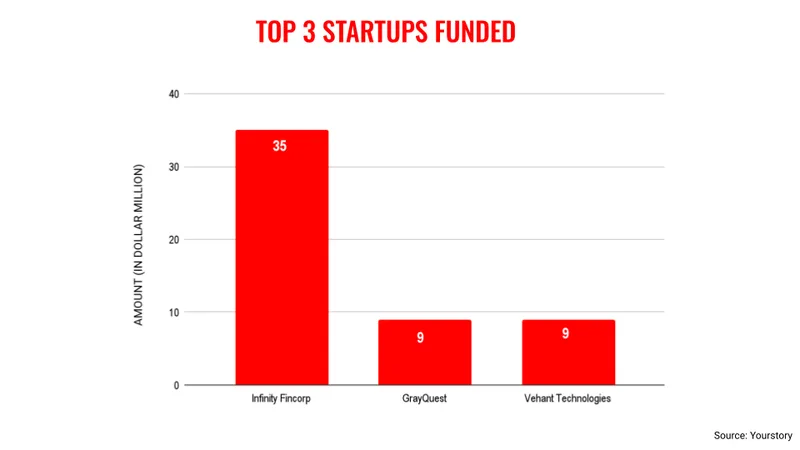

Key transactions

Infinity Fincorp Solutions raised $35 million from Jungle Ventures, Archerman Capital and Magnifico.

Fintech startup GrayQuest raised Rs 80 crore ($9.3 million approx.) from IIFL Fintech Fund, Claypond Capital and Pravega Ventures.

Tech startup Vehant Technologies raised $9 million from True North.

Banana chips brand Beyond Snack raised $8.3 million from 12 Flags Group, Enrission India Capital, NAB Ventures and Faad Network.

SaaS startup Mintoak raised Rs 71 crore ($8.2 million approx.) from Z3Partners.

EMO Energy raised $6.2 million from Subhkam Ventures and Transition VC.

EV startup Oben Electric raised Rs 50 crore ($5.8 million approx.) from Ambis Holding US, Kuberan Ventures, Karimjee Group, Mission Vertical and family offices.

Neuroscience startup BrainSight AI raised $5 million from IAN Alpha Fund, IvyCap Ventures, and Silver Needle.

![You are currently viewing [Weekly funding roundup Jan 4-10] VC inflow shows steady rise](https://blog.digitalsevaa.com/wp-content/uploads/2024/04/funding-lead-image-1669386008401-scaled.jpg)

![Read more about the article [Funding alert] Neobank Rewire raises Series B funding of $20M to expand its financial services](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Imageym69-1614840668644-300x150.jpg)

![Read more about the article [Funding alert] Flexmoney raises $4.8M in Series A round from Pravega Ventures, others](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Imaged3fu-15985072374461-1623748521168-300x150.jpg)