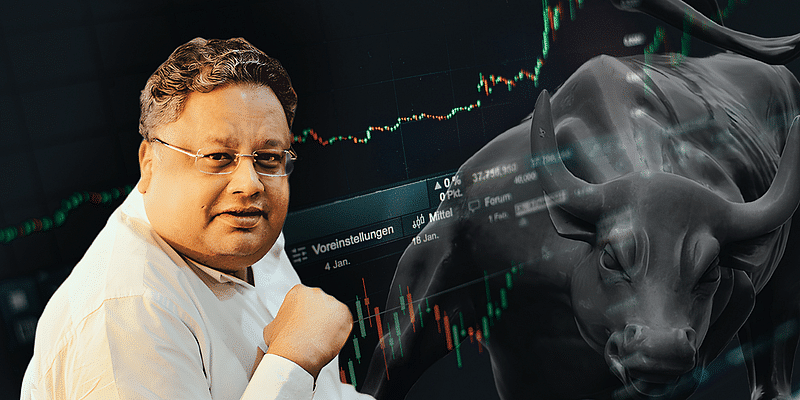

Today, the skies are set for a celestial celebration as we remember the birth anniversary of the late Mr. Rakesh Jhunjhunwala, the Indian titan of investments, who touched the heavens of financial success. Known as India’s Warren Buffet, Jhunjhunwala’s legacy still impacts the landscape of Indian finance. Even in his absence, his spirit seems to guide the Sensex, now inching towards the 1 lakh mark, symbolizing his eternal impact on the Indian financial scene.

Jhunjhunwala’s life provided a wealth of wisdom, especially his enduring respect for his father, who he called his Superman, his fearless approach towards identifying winning investments and riding them to success, his unflinching faith in India’s economic potential, and his generous contributions to charitable causes. He lived life king-size and left behind an indelible legacy.

The Investor with a Midas Touch

Born into a middle-class Marwari family in Mumbai, Rakesh Jhunjhunwala was introduced to trading at an early age by his father, an Income Tax officer. His journey began modestly, with a starting capital of Rs 5,000 in 1985, yet his keen intuition and strategic investment decisions propelled him to become one of the country’s largest investors.

His audacious bets on Tata Group companies, from Tata Tea to Tata Motors, stand testament to his faith in the potential of Indian enterprises. His first-ever investment, a purchase of 5,000 shares of Tata Tea, yielded him almost Rs 25 lakh over three years, setting the foundation for his future investment success.

Jhunjhunwala’s portfolio is a vivid example of the diversity and breadth of his investment philosophy. Over his illustrious career, he invested in companies across various sectors such as pharmaceuticals, finance, private sector banks, and real estate entities. His flagship portfolio at the time of his demise held shares worth $4 billion, including $1.4 billion in Titan stocks, $884 million in Star Health & Allied Insurance Co., and $281 million in Metro Brands Ltd.

An Advocate of Long-Term Investments

Jhunjhunwala’s investing philosophies stood out for their simplicity yet profound wisdom. He believed in buying when others sold and selling when others bought. He insisted on investing in financially sound companies with strong management and held his positions for long-term gains.

His long-term philosophy also extended to his philanthropic activities. Jhunjhunwala pledged to give away 25% of his wealth to charity, focusing on improving India’s education sector, especially in finance and economics. His commitment to philanthropy is enshrined in the Rakesh Jhunjhunwala School of Economics and Finance at Ashoka University, a testament to his enduring legacy.

A Legacy Outperforming the Market

Even in his absence, the late Rakesh Jhunjhunwala’s investment legacy continues to outperform the market. In the financial year 2023-2024, his equity portfolio, managed by his wife, Rekha Jhunjhunwala, recorded an impressive 11% rise compared to the S&P BSE Sensex and Nifty 50’s gain of around 6% and 6.7%, respectively. The portfolio, valued at Rs 32,445 crore as of March 31, 2023, is now worth Rs 35,979 crore.

The outperformance was led by a sharp rise in the Aptech stock price , which surged nearly 65% in FY24. The company’s strong earnings and the declaration of an interim dividend of Rs 6 per share for FY23 played a significant role in this achievement.

Despite the volatile market environment, Jhunjhunwala’s portfolio has demonstrated robust resilience, supported by a diverse set of stocks, including Tata Motors, Metro Brands, Indian Hotels Company, and Crisil, that have pushed the portfolio value higher.

Lessons from the Legend

Jhunjhunwala’s investment journey offers valuable insights for both novice and seasoned investors. His strategies reveal the importance of understanding the financial market and being able to spot and bet on new opportunities. His legacy teaches us that investing isn’t just about profits; it’s about faith in the future, understanding opportunities, recognizing the right people, and evaluating competitive abilities.

As we remember Rakesh Jhunjhunwala today, his life and success are a reminder that the journey of investment is one of conviction, patience, and an unwavering belief in the potential of the markets. His legend will continue to inspire generations of investors who dare to dream big and strive for success, just as he did.

![Read more about the article [App Friday] Only allowing one post per day, BeReal helps avoid social media FOMO](https://blog.digitalsevaa.com/wp-content/uploads/2022/06/Imagecalf-1654790205381-300x150.jpg)

![Read more about the article [Funding alert] B2B cross-border tech platform Geniemode raises $2.25M led by Info Edge Ventures](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/Image0lm1-1630922827931-300x150.jpg)