Furniture rental company RentoMojo made a profit of Rs 6.2 crore in the financial year ended March 2023, up from a loss of Rs 13 crore in the year-ago period.

The Bengaluru-based firm’s revenue from operations grew 22% to Rs 121 crore in FY23 against Rs 98.6 crore in the same period last year. Total expenditure increased only marginally to Rs 117 crore from Rs 112.5 crore in FY22.

Employee benefits (Rs 22.58 crore) and finance costs (Rs 11.20 crore) accounted for the majority of the total expenses incurred.

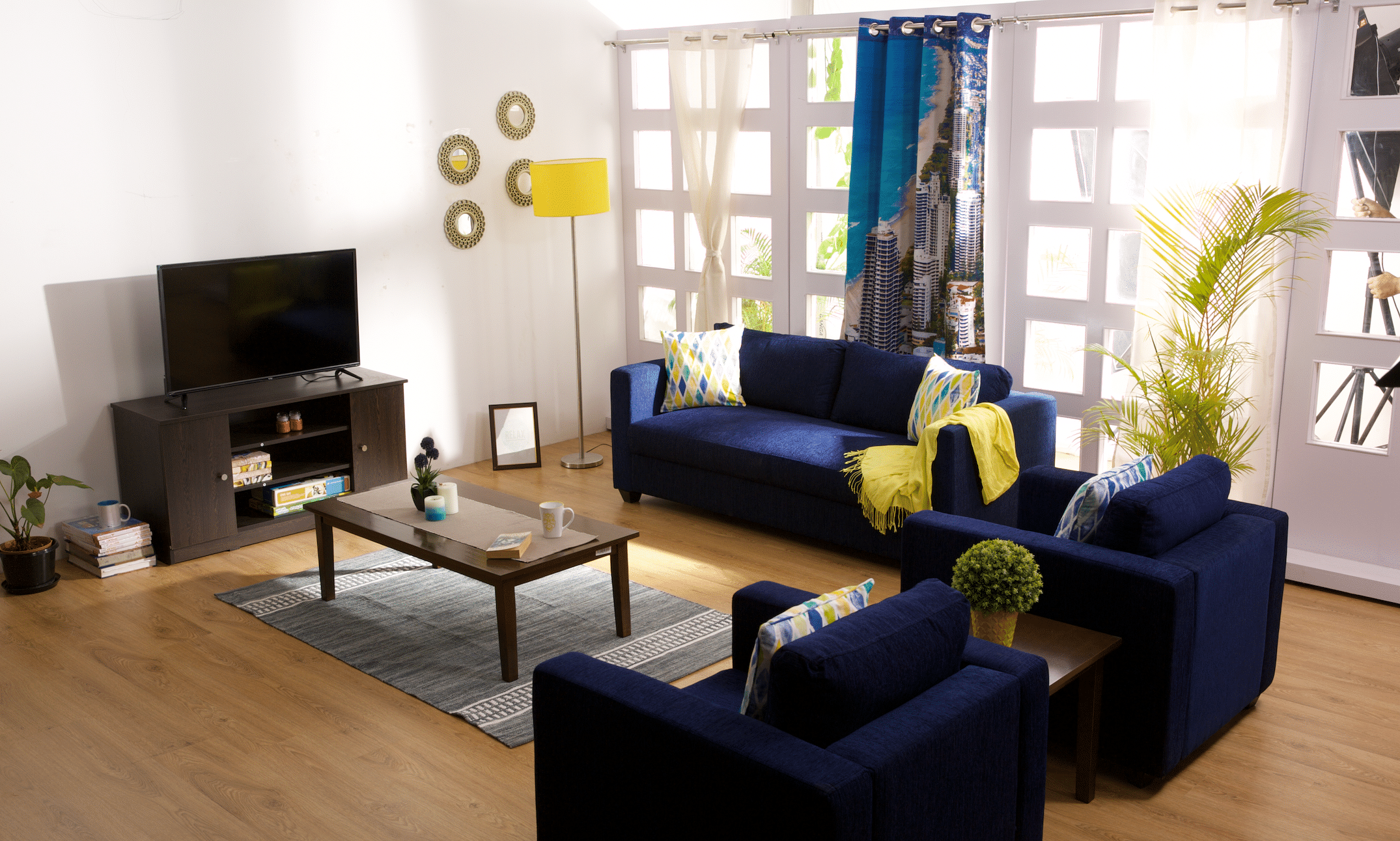

Founded in 2014, RentoMojo is a rental platform for furniture, appliances, and electronics. The startup has seen a 5X rise in demand in FY23, with core categories of furniture and appliances driving this growth, Geetansh Bamania, Founder and CEO of RentoMojo, told YourStory in an interview last year. Bamania said the company has been profitable since October 2021.

“We are not seeing any major shift in the category mix on the demand side. However, the ecosystem did not scale as fast as demand did. The speed of availability of debt and the production bandwidth continues to be our focus towards making this ecosystem ready to meet the ever-increasing demand for rental products,” Bamania had said.

RentoMojo has raised Rs 70 crore in multiple rounds in the past five months and has an additional debt line of over Rs 40 crore on the table for this fiscal year. Since its inception, the company has raised over Rs 620 crore through debt and equity funding.

In April, the firm suffered a data breach through which hackers gained unauthorised access to its customer database.

The hackers were able to access a few cases of personally identifiable information by exploiting the cloud misconfiguration through extremely sophisticated attacks, RentoMojo had told users in an email.

Edited by Affirunisa Kankudti

![Read more about the article [Funding alert] Tech-based mentorship platform MentorKart raises $150K led by Startup Buddy’s founders](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Imagei6p2-1623300103953-300x150.jpg)

![Read more about the article [Funding alert] Lavado raises undisclosed sum from Pepperfry founders](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Funding-1587044486257-300x150.png)