Capital, a public equities investment firm, has launched a global tech fund for high net worth individuals (HNIs) and institutional investors.

Airavat Global Technology Fund R will provide Indian HNIs and institutional investors the opportunity to leverage the Indian technology ecosystem insight to capitalise on the growth potential of tech companies worldwide, said the Bengaluru-based company in a statement.

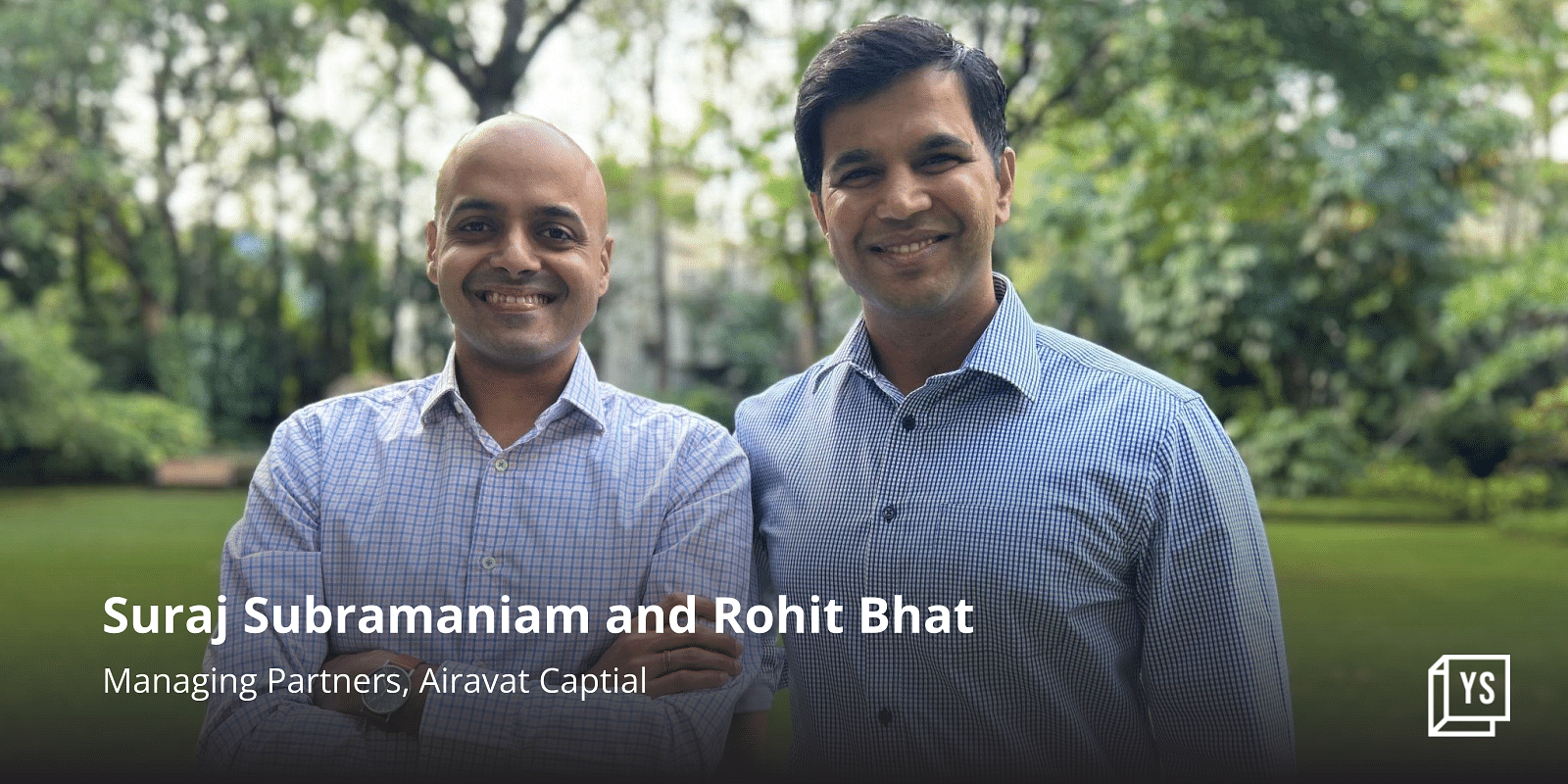

India has the second-largest software developer community globally and could become the largest community in the coming years, according to Rohit Bhat and Suraj Subramaniam, Managing Partners at Airavat Capital.

“With the launch and migration of our funds to GIFT City (Gujarat International Finance Tec-City), we think we are at the beginning of a tectonic shift in the Indian investment landscape… the time is right to build a world-class global technology hedge fund that expresses India’s insight and knowledge advantage globally,” they said.

Trilegal was the legal advisor and PWC was the tax advisor to Airavat in setting up the fund.

HDFC Bank, which is the designated depository participant and custodian of Airavat Capital India Fund, facilitated the relocation of the foreign portfolio investment to GIFT City. MITCON Credentia is the trustee, while Kfin Technologies Limited is the fund administrator of Airavat’s funds in GIFT City.

According to the statement, Airavat Global Technology Fund R is the first global technology fund to be based out of GIFT City.

Airavat Global Technology Fund R has gained significant initial interest, surpassing $40 million, from a diverse range of investors, including existing Airavat stakeholders, VC investors, technology founders/CTOs, and family offices, said the statement.

Notable investors in existing funds managed by Airavat include Sanjeev Bikhchandani and Hitesh Oberoi (Info Edge), Abhay Pandey and VT Bharadwaj (A91 Partners), Shray Chandra (Capitalmind), Jitendra Gupta (Jupiter Money, ex-Citrus Pay), Pankaj Chaddah (Shyft, ex-Zomato), Sidu Ponnappa (ex-Gojek), and Tanay Tayal (Moonfrog).

While Airavat Global Technology Fund R caters to Indian pools of capital, Airavat Capital is also launching GTF NR, a sister fund of the global tech fund, aimed at raising capital from investors in Southeast Asia and the Middle East. GTF NR has already seen strong interest from family offices and HNIs in these regions, said the statement.

The launch of GTF NR will strenghten GIFT City’s status as an emerging international investment hub, paving the way for future investors to take advantage of the enabling regulations, the statement added.

“IFSC Authority (International Financial Services Centres Authority) has created an enabling regulatory and business environment for India-centric funds to onshore the funds at Indian IFSC from offshore locations. We are seeing good traction for both new funds setting up and the re-domiciliation of funds from overseas locations to GIFT IFSC,” said Dipesh Shah, Executive Director, IFSC Authority.

Airavat Capital is an investment management firm focused on technology-enabled businesses across growing sectors such as consumer, financial services, technology, and pharmaceuticals.

With the launch of its global tech fund, the firm strives to expand its technology-focused investment practice onto an international canvas. It aims to cross $100 million in assets under management over the next year.

![Read more about the article [Startup Bharat] Why this boy from Bihar quit a government job to start a coworking startup](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/9de83379-8521-48d6-ac73-1eb37dda86461-1619594214839-300x150.jpg)