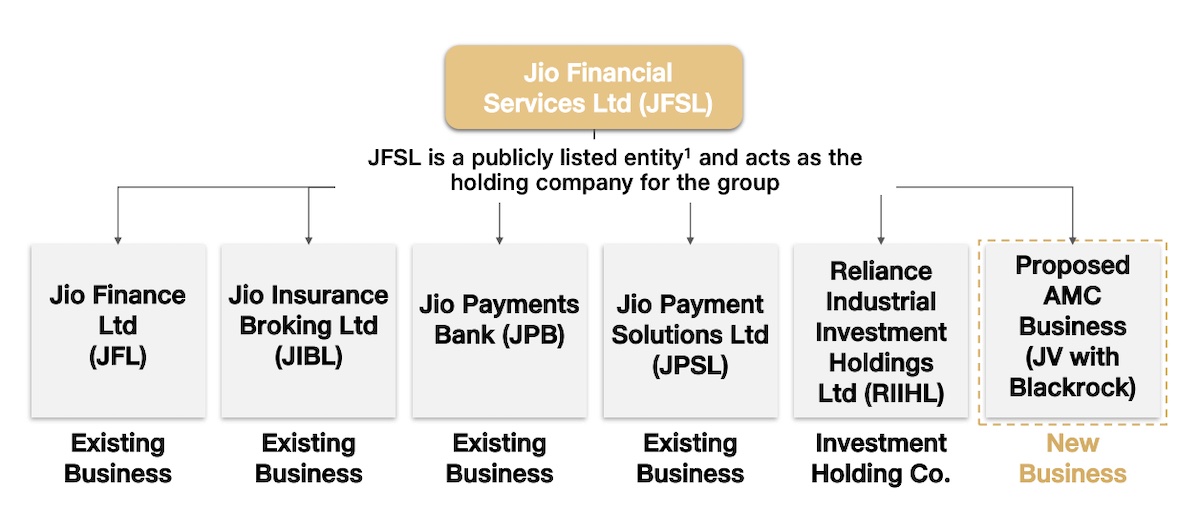

Jio Financial Services, the Indian conglomerate Reliance Industries’ financial services unit, has started its lending and insurance businesses and is rapidly scaling up its offerings as billionaire Mukesh Ambani expands the ever-so-wide tentacles of his oil-to-telecom empire.

In an annual presentation this week, the recently publicly listed firm said it has started to offer personal loan to salaried and self-employed individuals through its MyJio app and through 300 stores across India. It has also partnered with 24 insurance firms to offer a wide-range of coverage across auto, health, and corporate categories, the firm said.

The market has been closely paying attention to Reliance’s financial services ambitions for years. It wasn’t until last year that Ambani, Asia’s richest man, made it clear that the firm plans to enter into the sector, though it has largely remained guarded about what all it plans to do.

Different arms of Jio Financial Services. (Image: JFS)

Jio Financial Services said it’s taking a direct-to-customer approach with its offerings to drive cost efficiencies and enabling personalized customer interactions. The firm is incorporating “alternate data models for 360-degree customer view and tailored offerings,” and is developing a unified app for the “diverse financial needs of customers.”

In the annual report, Jio Financial Services said it’s also testing a sound box, the fast-omnipresent portable device that alerts merchants when a transaction has completed, the firm said, confirming an August TC report. The company is “generating substantial data footprint and enhancing our customer engagement across digital channels, and in turn enriching and facilitating other businesses,” it said.

On lending, Jio Financial Services plans to extend loans to businesses and merchants as well as offer loans to facilitate vehicle and home purchases, it said. It also plans to give loans by using shares as collateral.

More to follow.