Byju’s, run by Think & Learn Pvt. Ltd., reported nearly unchanged revenue growth for financial year 2020-21, saying it had to defer recognising significant business growth, but expects to be cash-flow positive by the end of the financial year.

The edtech company, India’s most valuable startup, also said it would have to push its IPO by 9-12 months because of macroeconomic factors. Last valued at $22 billion, Byju’s was planning a public share listing in the US by getting acquired by a blank-cheque company, or the Special Purpose Acquisition Company (SPAC) route.

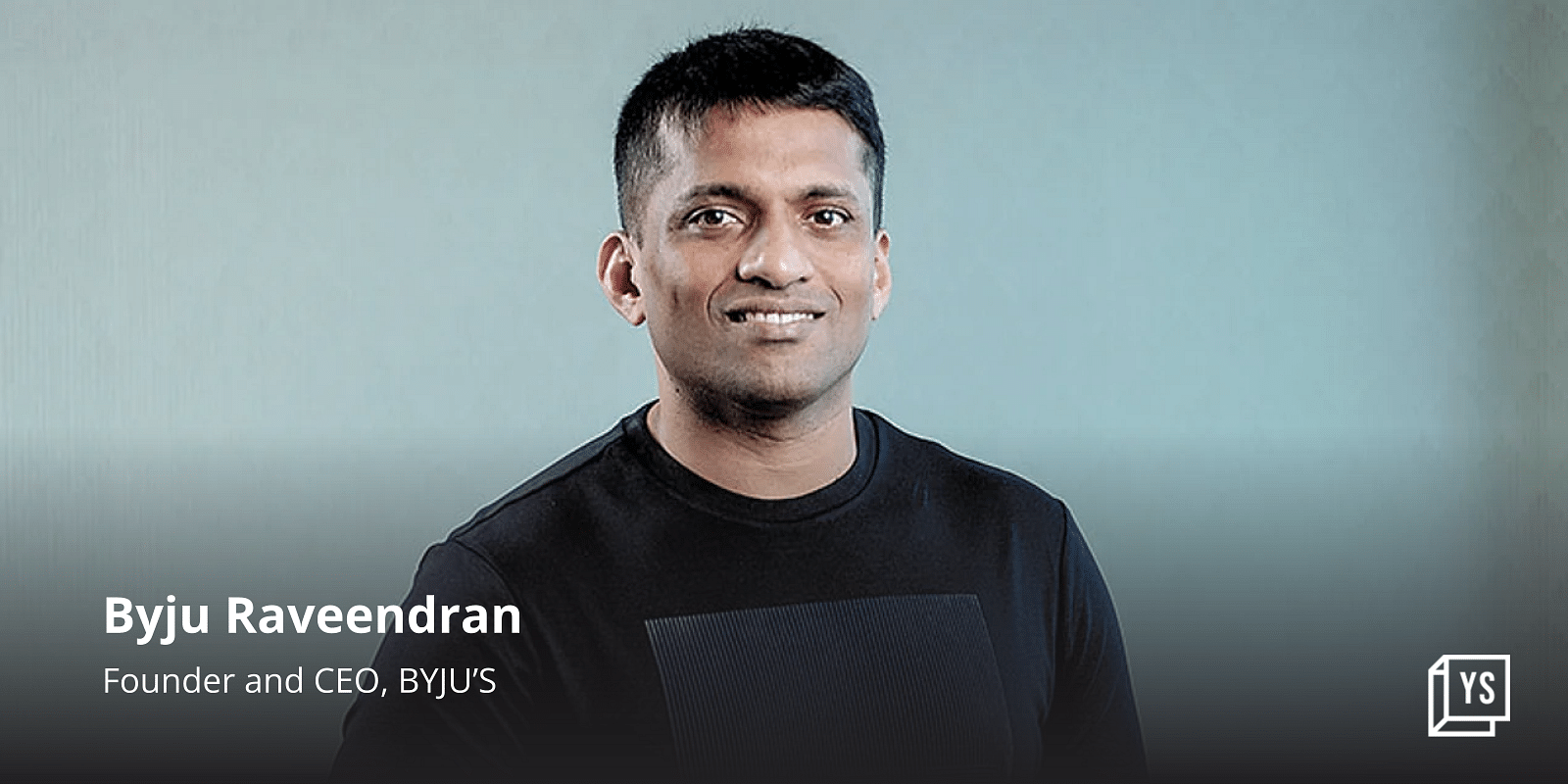

“While the revenue got deferred, the cost wasn’t. That was the reason the loss increased from Rs 300 crore to Rs 4,500 crore at a consolidated level (in FY22),” said Byju Raveendran, Co-founder and CEO. He added that while the company’s loss this year had reduced, cash burn from White Hat Jr, which the company acquired two years ago, continued to cause concern.

The company had registered a loss of Rs 262 crore in FY20.

Byju added that the company was “looking to move our listing by 9-12 months, looking at the overall macro market conditions and scenario… However, we will be cash-flow positive by the end of the (financial) year.”

Byju Raveendran, Founder and CEO, BYJU’S

Byju’s said it registered gross revenue of Rs 10,000 crore in FY22. Between April and July this year, it logged revenue of Rs. 4,530 crore.

The edtech giant, which has been in the eye of a storm over delayed financial reporting and fundraising woes, said it has received an unqualified report for FY21 from its auditor, Deloitte Haskins & Sells.

Byju added that the company is heading towards cash-flow positivity in terms of Byju’s, Aakash Education, and Great Learning. White Hat Jr, however, is still burning significant cash, and will take a few more quarters to break even, he said.

Byju’s registered group revenue for FY21 of Rs 2,428 crore. The CEO said in an interview with YourStory that while the company saw significant business growth in FY21 over FY20, this was the first year where new revenue recognition started because of a COVID-related business model change. This resulted in almost 40% of the revenue being deferred to subsequent years, Byju said.

“It has been a tough and yet positively humbling experience. While we had good revenue growth in FY21, due to revenue recognition policy changes advised by Deloitte you won’t see that in the audited finance report. The revenue of Rs 2,428 crore is similar to FY20.”

The other reason cited for the increased losses, Byju said, was due to some fast-growing and yet loss-making acquisitions.

Byju said the company will be reducing marketing expenses for Whitehat Jr and working towards making it cash-flow positive in the next few quarters.

On fundraising, Byju said the company is “looking to raise a fresh round of funding at a valuation of over $22 billion. We are in final talks with sovereign funds and the conversation looks good.”

On previous funding that is yet to come through, he said Sumeru Ventures and Oxshott Capital faced challenges due to the macro-environment. “But it is just $300 million out of the billions we have raised.”

Byju’s also said its acquisitions across segments over the last year have seen substantial growth. Aakash in the test-prep segment and Great Learning in the higher-education segment have doubled revenues since acquisition, the company said.

![Read more about the article [Weekly funding roundup Dec 9-15] VC funding touches fourth highest level for 2023](https://blog.digitalsevaa.com/wp-content/uploads/2023/09/funding-roundup-LEAD-1667575602969-300x150.png)