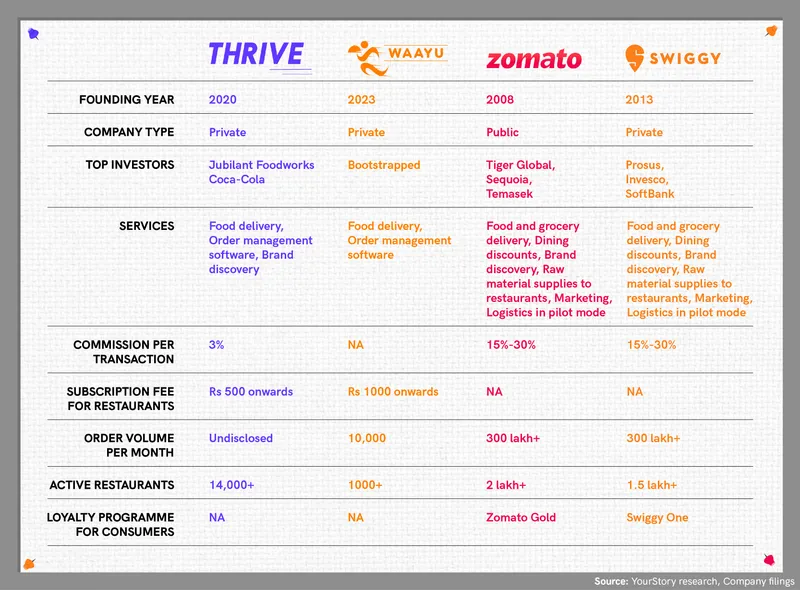

On May 8, a small homegrown food delivery app named Waayu was launched in Mumbai. Founded by hospitality veterans Anirudha Kotgire and Mandar Lande, Waayu is enabling over 1,000 restaurants in Mumbai to take food orders online. Its entry has provided some relief to several eateries that are eagerly looking for options beyond Swiggy and Zomato.

Waayu joins another Mumbai-based online food delivery platform Thrive, which was founded in 2020 by Dhruv Dewan, Karan Chechani, and Krishi Fagwani. Thrive encourages users to order directly from restaurants, and recently raised funding from Coca-Cola India.

Interestingly, both Thrive and Waayu are attempting to break through the intense competition posed by Swiggy and Zomato with a different approach–by enabling more than just food delivery. Both firms have introduced software-as-a-service (SaaS) products, including order management dashboards and marketing tools, to enable deeper integrations between restaurants and end consumers.

According to several industry observers, including investors and restaurant owners, this is a strategic move. They feel the two companies are following Info Edge-backed DotPe’s footsteps by offering full-stack software to restaurants over and above enabling food ordering. This is expected to help the platform retain brands and generate consistent revenue.

The recognition of Waayu and Thrive assumes importance at a time when restaurants are growing increasingly unhappy with market leaders Swiggy and Zomato, with rising commissions and marketing spends, reduction of delivery radius, and unavailability of delivery partners becoming top concerns.

Moreover, over the last few weeks, the growing popularity of the government-backed Open Network of Digital Commerce (ONDC) has also triggered important conversations among restaurateurs about cutting dependency on the duopoly. ONDC, which began its pilot in October last year, charges lesser commission with the aim of democratising ecommerce and food delivery. This has resulted in food orders costing at least 30%-40% cheaper than Swiggy and Zomato.

Ultimately, restaurants seem pleased to have more than two options to choose from, according to three owners YourStory spoke with.

DotPe was one of the first firms to venture into the food order management proposition. Founded by former PayU executives Shailaz Nag, Gyanesh Sharma, and Anurag Gupta in 2019, it offers similar software services to the food and beverage industry. After having raised more than $90 million from Info Edge and Prosus (incidentally one of Swiggy’s top investors), the company has over 60,000 merchants on board.

Infographic by Nihar Apte

Monetisation strategies

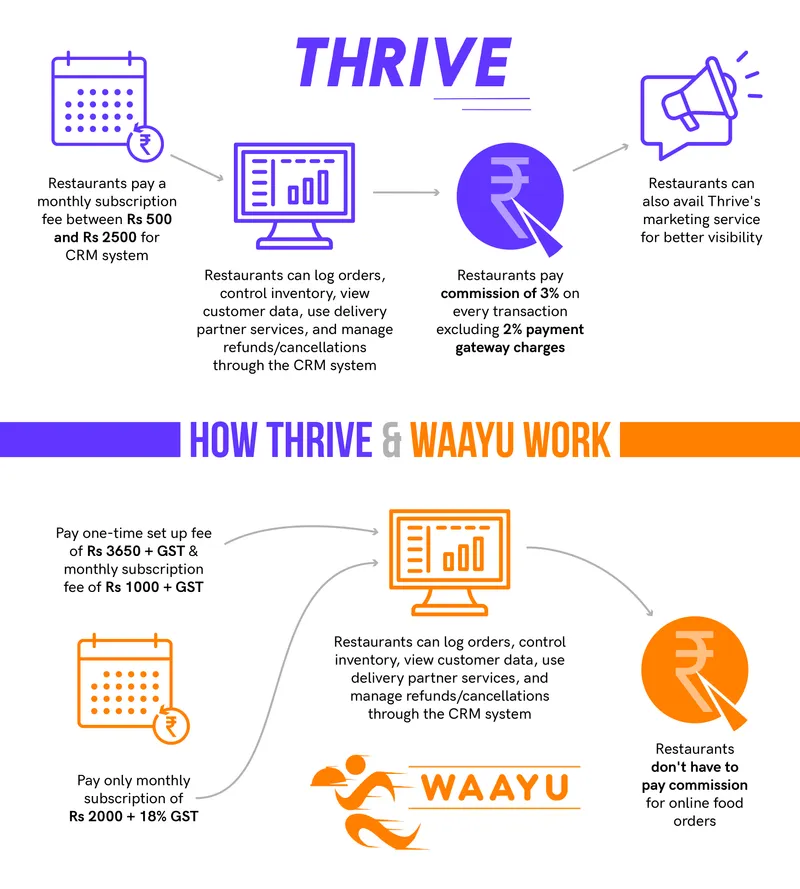

Both platforms charge a subscription fee to restaurants for multi-faceted software products.

Thrive’s software segment has two main offerings–an order management dashboard to help with WhatsApp, POS integrations, track order status and delivery partner assignment, and a marketing software to help restaurants enhance visibility on social media through Facebook and Instagram advertisements. Subscriptions range from Rs 500 to Rs 2,500 per month depending on the offering.

Dhruv Dewan, Co-founder of Mumbai-based Thrive, tells YourStory that the idea is to help restaurants with discovery and that commerce is a byproduct of visibility. “We are okay if a consumer discovers a restaurant on Thrive and ends up ordering on another platform. If brands are recognised on the platform and the word is spread, it’s a win for us,” he adds.

However, Thrive’s revenue is dependent on the commission earned through every order made through the platform. It takes a 3% cut on every transaction, excluding a 2% payment gateway charge compared to Zomato and Swiggy, who charge between 15% and 30% per order, excluding gateway and delivery fees.

Waayu, on the other hand, offers two options to restaurants–one with a set-up fee and a monthly subscription charge and another with a slightly higher monthly fee without a set-up charge. It lauds itself for being a zero-commission platform.

“The thought of Waayu came around to provide restaurants with more control over order processes,” Anirudha and Mandar, co-founders of Waayu, tell YourStory.

Waayu’s software allows restaurants to track orders and delivery status with access to customer data, including profiles of customers, ordering frequency, and eatery preferences. “This will help restaurants personalise orders for regular customers and tweak menus to focus on high-selling items,” Anirudha adds.

Waayu’s business is fully dependent on the software subscriptions, unlike Thrive that also charges a commission on conversions.

“It’s a sure-shot way to ensure restaurants stick around since they can manage everything from order confirmation to cancellation on a single platform,” says an executive who has been working in the hospitality industry for over two decades, on the condition of anonymity.

Moreover, restaurants would prefer to pay a one-time or monthly subscription fee rather than pay hefty commissions on every transaction, this person adds. There’s also the problem of losing control of the process if restaurants are heavily dependent on aggregators for customer data, revenue, and discovery, which is the case with Zomato and Swiggy.

However, an investor tracking the foodtech space closely throws a word of caution saying that scaling a commission-free system can be tough. “Thrive seems slightly better off given that it banks on order conversions. Waayu will have to reach a certain scale to be able to profit from selling software to restaurants,” this person adds.

A Mumbai-based restaurateur active on all four platforms–Thrive, Waayu, Zomato, and Swiggy–says he enjoys the availability of options. “Since Waayu and Thrive are relatively new, we are open to trying the platforms for as long as our brands gain traction and we don’t need to pay hefty commissions,” he says.

Infographic by Nihar Apte

Competitive challenges

It will be tricky for any company attempting to break the Swiggy-Zomato duopoly, says the investor quoted above. It took the firms a decade and lots of cash to grab market share and build a relationship with restaurants, this person adds.

Moreover, restaurants were introduced to Zomato and Swiggy at a time when online restaurant discovery was not that popular.

However, Thrive was not built with the intention to break the duopoly, says Co-founder Dewan. He adds that the food delivery space is large enough for more than two players to exist. “We wish to give restaurants the opportunity to be recognised, more than just depending on a platform for business,” he adds.

Waayu’s Anirudha and Mandar too share a similar vision, stating that Waayu attempts to do away with “high commission charges, unfair search rankings, manipulated ratings and reviews, and one-sided policies.”

Thrive is also working on a community engagement platform for restaurants, which will enable customers to post reviews and feedback on restaurants to start a discussion. The feature, which is expected to go live in the next few months, will enhance brand discovery for eateries and offer a single platform for food-related conversations for users, Dewan says.

Waayu is in talks with ONDC to hop on board, say the founders. The integration can be expected to be finalised over the next few months. “Waayu and ONDC’s goals are in sync–to create a democratic ecosystem for both eateries and consumers,” Anirudha says.

It seems like there is a race to become the next Zomato and Swiggy. However, only the fittest will survive.

(Cover image and infographics by Nihar Apte)