Pure play BNPL startups such as ZestMoney, Simpl, LazyPay and ePayLater are betting big on the rise of this short-term credit model, expected to surpass $40 Bn by 2025

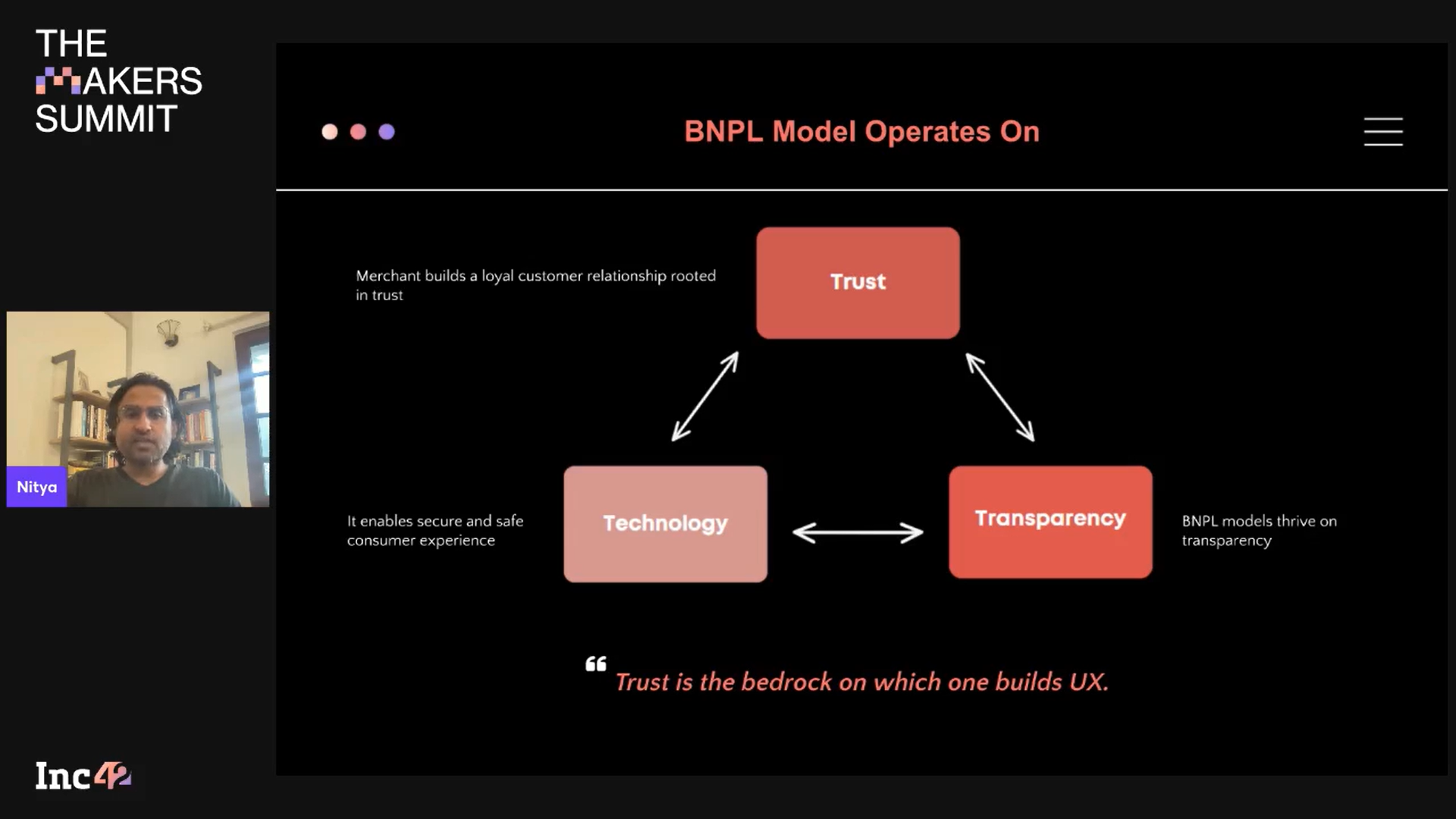

Speaking at the second edition of Inc42’s Makers Summit, Simpl’s Nitya Sharma underlined how BNPL creates a seamless user experience and solves trust and

transparency issues

According to Sharma, the secret of building the right product for the digital world lies in finding the balance between data, design and engineering

The internet economy has fundamentally changed over the past two years. While businesses and organisations opted for rapid digital adoption driven by the Covid crisis, consumer behaviour witnessed a quantum leap of faith as people migrated to online commerce for safety and convenience during multiple-phase lockdowns and beyond that.

Digital payments skyrocketed, too, thanks to an uptick in online shopping, the government’s push for UPI-based payments and the rise of the Indian fintech industry. In fact, the fintech ecosystem has evolved fast to meet the requirements of Indian consumers looking for instant, small-ticket loans for various purposes, from health emergencies to aspirational purchases. This availability of easy credit has further increased the buying capacity of urban consumers and those hailing from Tier 2 and Tier 3 locations, which have emerged as the latest ecommerce hotspots.

According to Inc42’s ‘State of Indian Fintech’ report, lending tech is one of the fastest-growing fintech segments in India. It is expected to grow from $270 Bn in 2022 to $616 Bn in 2025, accounting for 47% of fintech’s trillion-dollar market opportunity.

With the growing adoption of ecommerce platforms in India, the rise of the BNPL (buy now pay later) model has emerged as one of the most interesting trends. This cashless financing option enables retail shoppers to leverage short-term credit for online purchases and defer payments between 15 and 30 days while paying little or no interest. The model has gained immense popularity among the country’s large youth demographic, so much so that Inc42’s recent report on India’s fintech ecosystem predicts that the BNPL market opportunity is likely to exceed $40 Bn by 2025. Incidentally, as per Inc42’s data, the share of BNPL-triggered payments in the digital commerce and PoS space is expected to rise from 3-4% in 2021 to 21-22% in 2025.

Unsurprisingly, pure play BNPL startups like ZestMoney, Simpl, LazyPay and ePayLater are betting big on the rise of this segment. Speaking at the second edition of The Makers Summit hosted by Inc42 in April this year, Simpl’s cofounder and CEO Nitya Sharma said, “The ‘pay later’ model is our gateway to the internet-first way of buying and selling. That is what we are building at Simpl.”

Watch Sharma decode the scalability of BNPL in the Indian market, debunk the myths and address its challenges.

Building A Seamless Payment Experience

Although the volume of digital payments has gone up significantly, with a 33% YoY rise between FY21 and FY22, nearly 70% of ecommerce transactions still fall under the COD category, according to Sharma. He cited the credit to two major reasons for this trend – lack of trust and a dissatisfactory user experience.

“People want to receive the items first and have an equally satisfactory post-purchase experience before they make a payment,” said Sharma. “Companies need to adopt a payment method that not only creates a seamless user experience but also solves the problems of trust and transparency.”

As emphasised by Sharma, it is crucial for businesses to mitigate COD transactions as these can lead to RTOs due to many reasons. For instance, a customer may refuse to accept the order, refuse to pay at the time of delivery or cannot be reached due to incorrect contact details. In all such cases, ecommerce companies incur heavy losses.

What’s more, the Baymard Institute points out that the average rate of shopping cart abandonment is 69.82%. Therefore, long and confusing checkout processes can add to the risk of losing customers at the last leg.

Apart from the BNPL model, Simpl has also developed a one-tap checkout solution to counter shopping cart abandonment. It allows customers to choose BNPL, and the amount is forwarded to their Simpl accounts, which can be settled as a single transaction after 15 days.

A Digital Khata For Everyone

“Our offerings are similar to the khata system (an accounting tab) that has been around for centuries. From the biggest of towns to the smallest of cities, everyone is familiar with it,” said Sharma.

Consider what happens when people regularly shop at neighbourhood stores. They have the option to open a khata with a retailer, and based on mutual trust, the retailer allows them to pay for the goods at the end of the month. This is a win-win situation for both. Customers can conveniently settle their dues at one go instead of paying everyday, and retailers earn customer loyalty that translates into good business and long-term retention.

A ‘convenience’ play of similar nature happens on the BNPL platforms as far as consumers are concerned. Sharma further explained how the BNPL model (or the online khata) could benefit online retailers even though they did not know their customers like the neighbourhood store owners. “Businesses today deal with varied consumer personas. Building relationships through trust and convenience leads to growth and scale.”

Challenges And Concerns Around Regulation

The BNPL market seems promising, given its rising demand and large-scale inclusivity. This short-term lending model is similar to credit cards in terms of convenience, but in India, credit card penetration is as low as 5.5% due to stringent compliance. According to a report by Benori Knowledge, India currently has around 22-25 Mn BNPL users but the number is likely to reach 100 Mn by 2026.

Nevertheless, BNPL players in India have their own challenges due to regulatory concerns, much like other digital lending companies. One key issue is that quite a few digital lenders have jumped on the short-term credit bandwagon without the NBFC licence, although RBI is coming up with stricter frameworks.

In fact, the RBI has proposed to set up a nodal agency called Digital India Trust Agency (DIGITA) to iron out the irregularities and discrepancies in the e-lending segment. The agency will supervise all e-lending apps, check and validate software updates and issue guidelines that all lendingtech companies must follow.

Speaking about the feasibility of the BNPL model in the long run, Sharma said, “The secret of building the right product lies in finding the balance between data, design and engineering.” Calling it the “perfect trifecta”, he added that digital players need to think systematically to achieve this balance and build products that can bypass these challenges.

Catch all the sessions and the insightful conversations from The Makers Summit 2022. The takeaways from some of the startup community’s most prominent product minds, makers, leaders and founders can be found right here at The Makers Academy.