Indian agritech startups faced a funding crunch in 2023 much like their counterparts across other sectors. Startups that had raised a considerable amount of equity funding to build a platform-play have had to go back to the drawing board to figure out sustainable growth while product-led agritech startups have had to focus on profitability to tide over the trying times.

“Over the last 18 months there has been a lot of capital constraint and funding rounds have been slow, especially in the late stage,” Subhadeep Sanyal, Partner at agritech and food sector-focused venture capital firm tells YourStory.

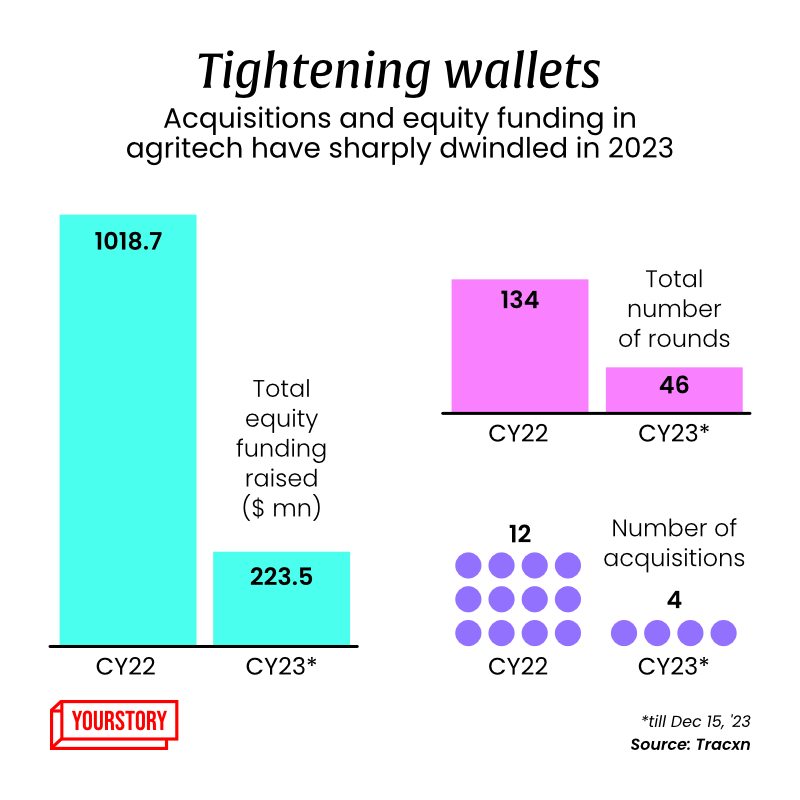

Overall, deal activity fell by nearly a third for the agritech sector with only 46 equity-based funding rounds recorded in calendar year 2023 (till December 5, 2023), as compared to 134 in 2022, according to market research and data platform Tracxn. The total equity funding came down to $223.5 million this year, down from $1.08 billion in 2022.

“Technology-first startups which had raised between $20 million to $30 million in their overall life cycle have reached maturity over the last two years, finding Product Market Fit (PMF) and have moved to the next level,” Sanyal adds.

<figure class="image embed" contenteditable="false" data-id="533714" data-url="https://images.yourstory.com/cs/2/bc14afb0357911eca2270b39b804102d/PayalAgritech-1703232253503.png" data-alt="Agritech funding 2023" data-caption="

Agritech funding snapshot 2023

” align=”center”> Agritech funding snapshot 2023

Even as startups, including those in agritech redraw their strategy, the agritech sector in India is on track to be a $34 billion market opportunity by 2027, according to a year-old report by Avendus Capital. The report estimates that the sector is estimated to grow at a CAGR (compound annual growth rate) of 50%, driven by increasing digital penetration, supply-chain disruption and customer demand for quality produce.

Trends

While a majority of equity capital has been directed at full-stack platform play for farm inputs, supply chain, and marketplaces, there has been continued interest in data-driven startups offering analytics and information-as-a-service for farmers, said Pankaj Raina, Managing Director of Investments and Research at New York based private equity firm, .

“On the sidelines of supply chain-based investments, we have seen some credit and financial services startups come up,” Raina tells YourStory, “Investors want to back innovation in the agritech sector. In the year-ahead, demand for IP-led play will go up, as we see new global and local investors enter the sector.”

The overlap of climate and technology focus in agriculture will partly drive investments in new sectors.

Sanyal of Omnivore says that the firm will evaluate bets on agri and rural SME financing, sustainability in agriculture as well as agri and food-focused biosciences, livestock nutrition as well as farm-sourced food from its Fund III which announced its first close earlier this year at $150 million.

The fund has backed companies such as sustainable packaging company , biomaterials startup , insurance broking startup for rural and underserved customers, , among others.

Building for the rural customer

Startups in the sector will have to strategise their playbook to ensure that they stay top-of-the-mind for their customers which are largely rural and are adapting quickly to the on-demand revolution through penetration of smartphones.

“A lot of companies in the sector start out with a B2C (business-to-consumer) proposition, in this case, targeting farmers. However reaching farmers is not as easy as reaching urban users and we have seen many of these companies pivot to B2B (business-to-business) in 2020-21 by selling to local retailers or distributors,” said Siddharth Dialani, Founder at advisory-led ecommerce platform for farm inputs, .

He adds that the rural milieu is changing behaviourally and it is relatively easier to build B2C businesses now.

However, services and businesses in agritech will do well with an omnichannel approach as the rural customer continues to rely on “touch and feel” for certain categories.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

“For example, a farmer applying for a loan might not be comfortable uploading Aadhaar and PAN Card details over the phone. In our case, we started conducting our advisory camps periodically with Western Maharashtra and have seen tremendous success. Farmers prefer the ‘Crop Doctor’ to inspect their field in person, rather than communicating through videos online,” he says.

In the case of product and technology-led companies, affordability for the end-consumer is key, says Devendra Gupta, Co-founder and CEO of solar power backed-cold storage solution provider, . The startup closed the second tranche of its Series C funding of $25 million earlier this year.

“For companies that are focused on the low-income market segment, what we have learned at Ecozen is to build products that are aligned with the usage capability and affordability of the segment. Building low-ticket products can help here, as they can speed up the pace of technology adoption,” says Gupta.

He adds that focus on climate tech solutions and the societal shift to clean, smart, and efficient technology has helped the company scale profitably, growing at 100%-plus CAGR.

Road ahead

In line with the slowdown in equity capital, merger and acquisitions in the sector have slowed down as larger companies and strategics have tightened their purse strings. The year’s M&A activity fell to a third of that of 2022, even as funds of earlier vintage come to the end of their life cycles – which will likely lead to secondaries in the sector.

“Innovative business models will always be attractive for M&A-related plays. In select cases we will also witness companies and start-ups with a larger equity base consolidate in the space to acquire talent, revenue, customers, contracts etc,” says Raina of Zephyr Peacock.

This year, Omnivore exited its investment in Agro Sciences to Sumitomo Chemicals, marking its third exit to a strategic buyer, after selling precision agri equipment maker MITRA to Mahindra & Mahindra’s Farm Equipment Sector (FES) and aquatech company to animal nutrition and aquafeed company, Nutreco. Sanyal of Omnivore believes that there are companies in the agritech space with strong potential to be IPO-ready over the next three to four years.

“Agriculture as a sector is not unheard of in the Indian retail markets and is a very stable asset class. We have seen large poultry companies, aquafeed companies, agri-machinery companies going public,” said Sanyal.

He adds that for the sector, patient capital is key. “Agriculture is a seasonal business and there are bound to be some shocks. Instead of comparing month-on-month growth, our request to investors is to look at it from a seasonal growth perspective.”

Edited by Affirunisa Kankudti

![Read more about the article [Tech50] How Noida-based startup Uznaka Solutions is building complete in-house EV chargers with proprietary tech](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/uznaka-1640752732223-300x150.jpg)