With more than 80 investments in the past eight years, Dr Ritesh Malik is one of the most prolific angels in India and he has also been on the other side of the table as an entrepreneur with Innov8

From setting a decade-long horizon for investments to investing small in many startups, Malik breaks down the rules for angel investments that have worked for him

The Delhi NCR-based investor believes that angels should back startups and founders, no matter whether it is a funding downturn or boom, since building a portfolio is paramount and a constant endeavour

Software will eat the world. That’s the mantra that Dr Ritesh Malik lives by and invests by. And it’s also why he feels strongly about how startups, products and technology are changing our lives every minute.

As someone with more than 80 investments in the past eight years, Malik is one of the most prolific angels in India and he has also been on the other side of the table as an entrepreneur with Innov8. Having seen both sides of the coin, the Delhi NCR-based angel investor brings clarity of thought, and feels that angel investment is largely about patience and understanding people.

Speaking to Inc42 about his journey so far and how he sees angel investments in 2022, Malik said his biggest takeaway over the years has been to continue learning about how products, startups and founders are evolving. “That is my edge and my competitive advantage in this space,” he adds.

From setting long-term horizons to understanding the trajectory of founders and products, Malik took us through his key principles for angel investments.

Edited excerpts

Inc42: The best place to start would be at the beginning. So first, tell us about your journey and how you started investing in startups.

Ritesh Malik: So as you know I’m a doctor and I had no idea about angel investing. But I also had this passion for being an entrepreneur. So I started an augmented reality startup back in 2012, called Adstuck. Then in 2016, I started Innov8 which was acquired by OYO. But in between these two stints, I realised that a small amount of capital invested at the right time in a good mission or a founder can yield tremendous value.

I was fortunate enough to know about the Paytm story at an early stage and knew how its angels made a lot of money, but also I could see what Paytm could become in the long run — what it is today. All this while I thought that to understand the tech industry, I would have had to become an engineer or do some kind of MBA. But here there was another option — so I focussed on investing and being a part of early startups, and learn from them instead.

And seeing that, I told myself to forget about making money, the fact is the world is going to change so in 2013-14 I invested my first cheque. The idea is if you want to make money and if you want to make large amounts of money, you need to focus on learning new skills. You need to become a learning centre yourself.

Inc42: What drew you to angel investing and why should anyone look at this opportunity? What’s so attractive about angel investing?

Ritesh Malik: Firstly, investing in startups makes you young. You’re always connected to new trends and ideas, the things that will change the world and the new habits setting in.

As much as angel investments need gut feeling and instinctive decision making, it is also about numbers. The tech industry is growing at say 300% to 400% year on year. Technology adoption is going to be huge by 2028. We are going to have 105 Cr internet users and their time spent on the internet is going to be many times what it is today. So in just six years, everything will be technology-based and we will see such high demand for technology products which will be catered by startups primarily. And I want to tap this space right now.

And why I say this is because IT companies are not tech companies per se. Tech means companies should be able to scale up without mass hiring. Some of the large IT services giants might call themselves technology companies, but they are basically human resource management companies. Their revenue is directly proportional to the number of employees they hire. Startups are leveraging technology to build the value chain, so this is what will see a huge upside. Of course, startup investing is a very different play altogether — one should start small and you might get lucky in four to five years, if you apply the principles that govern all investments.

Inc42: That’s interesting. When it comes to HNIs, family offices, the familiarity with public markets investing brings some expectations of quick and high returns. Are there any similarities that you see between angel investments and public markets?

Ritesh Malik: When I say principles that govern all investments, I mean there are some parameters that are common across assets. This is not a new sort of investment and nor is it a different kind. Every investment has a single goal i.e buying an asset which will grow.

But now the defining quality of a good asset is changing from income-yielding asset to a value-laden asset. It’s this value that is making angel investing so attractive, because any other asset might give you the income, but only startups have that long-term value and a huge upside. This changes your thinking, how you approach the world today and shows you that technology is a great enabler.

Put simply, think about angel investing like any other form of investment, so think long term, and don’t be bound by expectations of quick exits. Any investment done for the short term can be a gamble. But if you apply science towards it and take a portfolio approach and have long horizons, you are bound to make money in this.

When it comes to startup investments, one of the core things is that your motive should be very clear. Many startup investors today in the market, who have actually destroyed much of the work of the past, are the ones who want quick exits. These investors are going for pre-IPO rounds and hoping to exit quickly. There’s a lot of FOMO (fear of missing out) in terms of IPO and investing in get-rich-quick schemes. It’s very risky.

Inc42: That would seem obvious, but it’s not easy to avoid the temptation of making quick returns. How did you get into this long-term mindset? And what is the horizon you have set for yourself.

Ritesh Malik: I started out with a horizon of 4-5 years and slowly I have learnt that one must have a horizon of one decade minimum, or ideally five decades. If you want to truly build wealth as an angel investor and add value to the ecosystem, you have to have a decade-long horizon. This will bring two things — once you have set this long horizon, you will only invest spare change because no one wants to blow up their corpus in the first year.

But in the long run, you will make, in my opinion, at least 7x-8x of what you will make in a mutual fund.

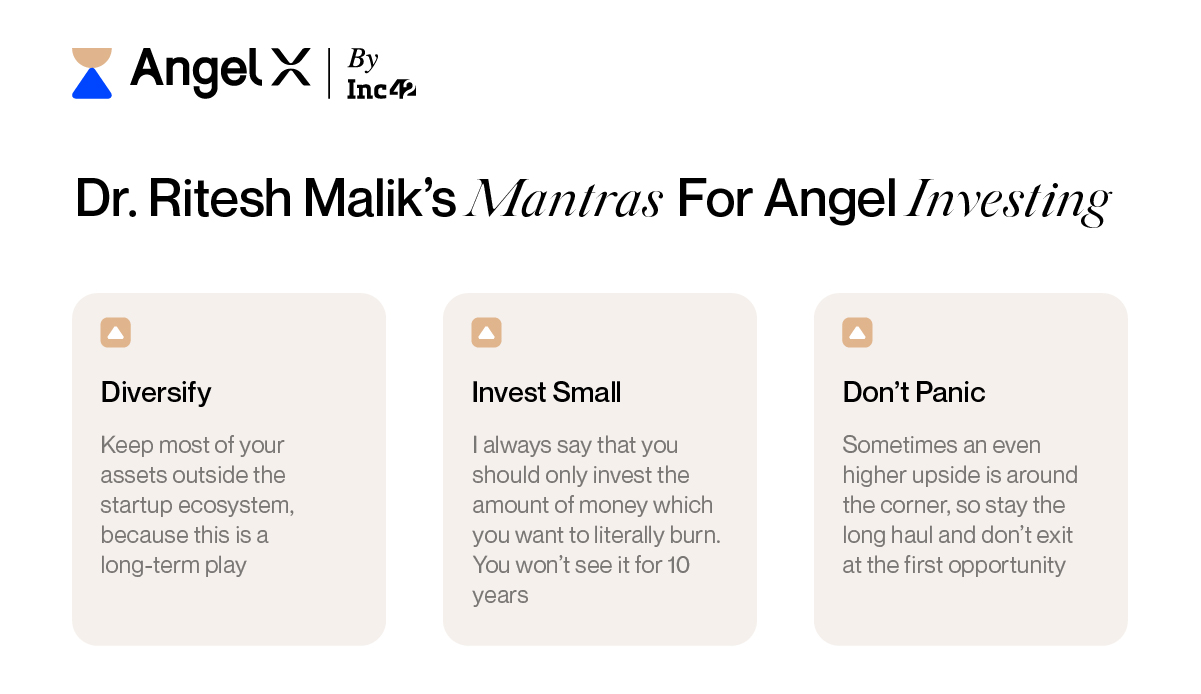

Like in all investments, follow some basic rules:

- Diversify — keep most of your assets outside the startup ecosystem, because this is a long-term play.

- Invest Small – I always say that you should only invest the amount of money which you want to literally burn. You won’t see it for 10 years or what I call burnt capital.

- Don’t Panic — a lot of angels might be tempted to take a full exit if the opportunity comes, but sometimes an even higher upside is around the corner. Stay the long haul.

I will give you an example to illustrate this. For instance, if you have a corpus of INR 2 Cr. You should firstly look to allocate half of this for new deals, and the rest for follow-on rounds for your portfolio. And the half that you will invest in new startups has to be broken up, which gives you the ticket size.

My ticket size ranges from INR 15 Lakh to INR 25 Lakh, and we invest in a lot of startups, because portfolio building is critical. I also believe in building the community and supporting the right founders.

Inc42: How did you bring this shift in your mindset to learn and imbibe new ideas? Did it require some kind of rules or parameters?

Ritesh Malik: I think if anyone is not learning, that means that they are actively perishing on a daily basis. My biggest concern Is how do I learn new things? A person who does not learn daily is going to eventually lose a lot of wealth

There are four ways to do it, in my opinion.

- Read the right things. Understand the evolution of the tech industry over the years

- Meet people that are higher up the chain in terms of the value or their expertise

- Invest in dynamic sectors that have challenges that can be learning experiences. When founders discuss their problems, you learn so much more.

- Be open and start teaching. Teaching is the best form of learning because you can claim to be teaching something that you have fully understood.

For me investing into a startup is not about making money. It’s about learning. And like there’s a cost of doing business, there’s a learning cost also, which is mostly your time. And when you build a community of founders, when they share things with each other, it is the most amazing validation for your investments.

If your only goal is to maximise your ROI, then it is better you don’t angel invest yourself, but invest in a fund, because the amount of capital is so high in the startup ecosystem today, that it will take anyone a lot of time to gain traction. I entered in 2014 when there was nothing. I made a small name at that time, so startups want my cheques. And now entrepreneurs are turning angels, and other founders want their cheques rather than some businessman or family office who has no idea about tech.

Inc42: That is an interesting concept. As an angel investor, do you focus on building a brand for yourself? In a way that’s a competitive edge.

Ritesh Malik: That’s true. But in angel investments, the notion is flipped on its head. In angel investing, the brand is not built by your successes and investing, but by backing the founders till they fail, if they fail.

My money is made by heroes in the founder ecosystem, but my brand is made by the ones who are not able to become heroes, because they are the ones who say that I stuck with them when no one did.

Secondly, I take a product-driven approach to my thesis and this is what I have realised that backing the right founders and the founding team is key — everything else can be changed, but the people will fundamentally determine the success of any business.

Inc42: Since you brought up the concept of an investment thesis. Tell us about how you went about building it?

Ritesh Malik: When it comes to a thesis, there’s no single answer or a magic bullet. It’s about backing your skillset and as you learn more, your skills grow and you can truly build a portfolio. The thesis is something like a product-market fit and it will have to keep evolving.

The first step of course is understanding startups. This will answer the question of why you should invest in any company. What value is the startup bringing to the table? How will it change the lives and habits of people?

So first learn about startups and investments through courses — there are many angel investor courses in the market today that have the right approach. And this will help you in the initial run, before you are ready to jump in. While you are learning, you can always earn interest on the amount you wish to invest through a FD or something like that.

And when you are ready and have the knowledge of how startups and products are built, it’s important to follow the three core rules I have mentioned — invest small, invest in a lot of startups and back founders for the long haul.

You should also incorporate your strengths in thesis-building. For example, if a potential angel investor is a marketing head of any large company, that means he’s an expert in marketing. They should make their brand around marketing and tell founders that along with money, the startups get their time and expertise free of cost. And this can be more valuable than the money they are investing in times of crisis.

Inc42: When it comes to angel investments, there will be some duds and some huge successes. You had hinted at the role of a portfolio to get the right balance. Tell us a little more about how you view this.

Ritesh Malik: I will tell you one thing. I have a lot of sour grapes or what they call anti-portfolio. Unacademy was one such miss. But my point is you will miss some good chances and you will invest in some startups that fail. The goal should not be to hit a home run in every investment — that will never happen — but it should be about the average return across the portfolio.

And this is why I will say again. Invest small and invest in a lot of startups because that is how you can hedge the risk of angel investments. One should aim to have a portfolio of at least 20 companies in the first two years and that’s when you can expect to see some magic. Of course, it takes time and patience to get there and you have to leverage all avenues.

For instance, you can back some founders and give them your time and money in exchange for lower equity and a chance to learn. When you ‘give’ something, you get something — in this case, referrals, word-of-mouth among the founder ecosystem. These things can be priceless. Leverage your network to build a portfolio.

In my opinion, a portfolio is only possible with a long-term horizon and for a long-term horizon, you will have to invest in a lot of companies. It’s this cyclical logic that has worked very well for me.

Inc42: Speaking of crisis, let’s talk about the so-called funding winter. How are you approaching this period and what’s your advice to those who are just stepping into angel investment territory?

Ritesh Malik: See, today, the ecosystem might be facing a winter, but these are cycles. It happens all the time and as an angel you should not pay attention to this. At least if you have your principles right. Follow the rules of investing small and investing in many startups and having a long-term horizon.

Just imagine in 2032, you will not be talking about the funding winter in 2022. You will not be talking about one cycle, but about the past ten years and that is the power of the horizon. It gives you perspective. And anyway, this is the best time to invest because technology always wins in a slowdown.

So I always believe that you should invest, no matter whether it is a funding downturn or boom. As far as I am concerned, angels should never go by these cycles.

Learn from the fall and rise of tech giants such as Amazon, Apple and Google. But even now the earliest investors in the company continue to hold on to their shares. They saw the long-term value and continue to back the company.

In my opinion, this is the time where there will again be a lot of FOMO in early stage investments. But the key is to support startups even in a drought. The idea is that when these kinds of things happen, most investors just move away. But my personal goal is to be a source of solace and support in stressful times.

![Read more about the article [Startup Bharat] How these IAS aspirants from Allahabad launched an exam road map platform for UPSC candidates](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Nishant1-1620224804469-300x150.jpg)