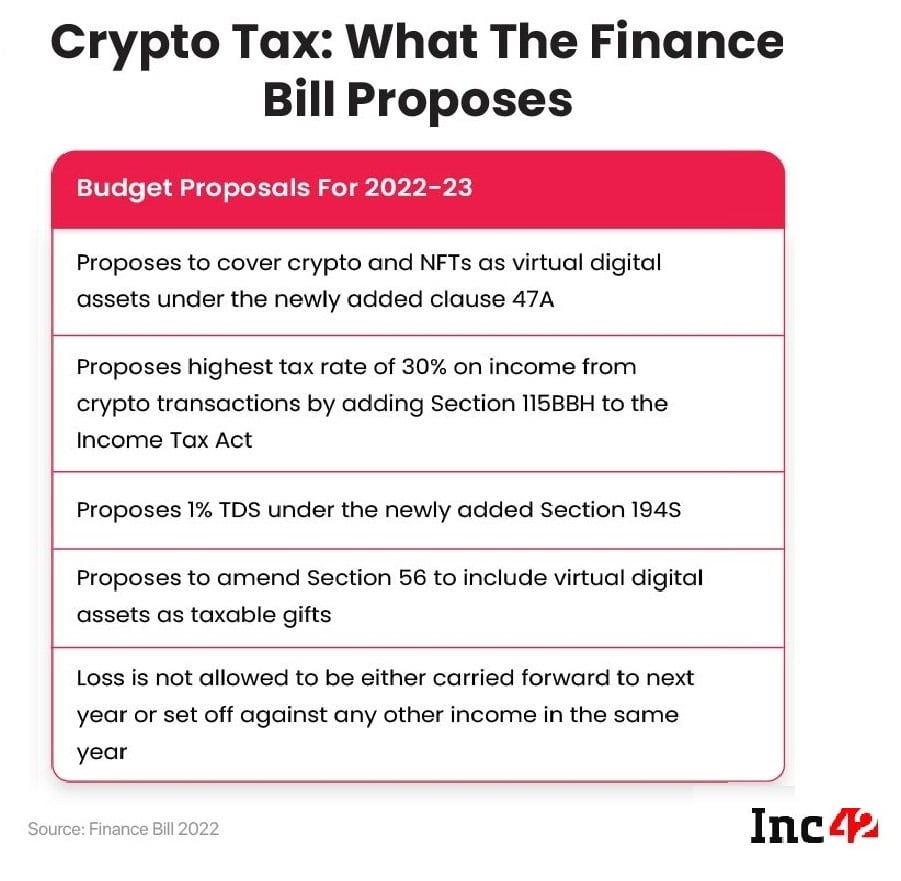

In her Budget speech on February 1, finance minister Nirmala Sitharaman brought clarity to crypto taxation in India, but not everything is hunky-dory. She also proposed a host of amendments to the Income Tax Act, 1961, to incorporate these measures. These include inserting various sections and clauses such as Section 115BBH, 194S and Clause 47A.

But before delving into their implications, let us look at what the FM said regarding cryptocurrencies.

Introducing the taxation scheme for virtual digital assets, the minister said that there had been a phenomenal increase in transactions in this space. The magnitude and frequency of these transactions made it imperative to come up with a specific tax regime.

“Accordingly, for the taxation of virtual digital assets, I propose to provide that any income from the transfer of any virtual digital asset shall be taxed at the rate of 30%. Further, in order to capture the transaction details, I also propose to provide for TDS on payment made in relation to transfer of the virtual digital asset at the rate of 1% of such consideration above a monetary threshold,” she added.

The move has created clarity, confusion and chaos among the crypto community members. And this article will explore all three, one after the other.

According to the Finance Bill, these crypto taxation rules will be applicable from Assessment Year 2023-24, which means FY 2022-23, next financial year.

Let us look at each of these and understand how it may impact the crypto industry.

For Starters, What Is A Virtual Digital Asset?

The ministry of finance has proposed a new clause 47A under Section 2 of the Income Tax Act that defines the virtual digital asset as:

- Any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account, including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically

- A non-fungible token or any other token of similar nature, by whatever name called

This is the first time the Indian government has defined a broader digital asset that includes crypto unless otherwise specified by Executive order.

“The government has come a long way in its stance towards crypto from last February to now, and we are confident that this will herald a new era of growth and innovation for India in a Web 3.0 world,” said Avinash Shekhar, CEO of ZebPay, a leading crypto exchange operating in India.

Slapping A 30% Tax On Income From Crypto-Assets And NFTs

As stated in Sitharaman’s Budget speech, the Finance Bill, 2022, has proposed the insertion of Section 115BBH, according to which any income from the transfer of any virtual digital asset will be taxed at the rate of 30%.

The rest of the income will be taxed as per the existing slabs.

Here is an example to clarify it. Suppose you invest INR 1,000 in a crypto asset, say bitcoin, and sell it for INR 1,200 after some time. According to the latest tax proposal, you will have to pay a tax of INR 60 on INR 200 you have gained from the transaction. The same tax rule will apply to NFTs.

To understand how it would reflect on the annual earnings, let’s take the example of a crypto user Mukesh Kumar who earns INR 10 Lakhs annually. Out of INR 10 Lakhs, Kumar earned INR 1 Lakhs from crypto investments. In such a case Kumar’s income will be divided into two parts and taxed accordingly.

- Income from other sources: INR 9 Lakhs to be taxed at 15% or 20%, depending on the tax regime

- Income from crypto/NFT investments: INR 1 Lakhs taxed at 30% tax

Kumar will thus have to pay INR 30,000 tax solely on crypto income and 15% or 20% tax on the rest INR 9 Lakhs of income, depending on the new or old tax regime, he chooses.

How This Will Impact India’s Crypto Ecosystem

Meyyappan Nagappan, a leader in international tax practices at the law firm Nishith Desai Associates, said that earlier there was a complete lack of guidelines as to whether it would be trading income, investment or capital gains. And there used to be a bit of arbitrage. Even for trading income, one could claim expenses, carry forward losses and so on. It was also part of capital gains, and hence, was treated accordingly.

“Now it brings in more certainty, in a way, but it also brings in the highest tax regime. So, what is likely to happen is that if you want to make profits at the highest tax outflow, your investment strategy has to change. You cannot do the high-volume, low-margin part of trading anymore. The risk will be too high. My anticipation is that the trading pattern will shift more towards investment-style processing instead of arbitrage trading,” said Nagappan.

If the trading pattern changes, it may not augur well for crypto exchanges. In recent years, exchanges like CoinDCX and Coinswitch Kuber spent a lot of money to acquire customers. Their promotion essentially tried to lure the millennials to invest as low as INR 100. But the latest taxation means people will hesitate to trade or invest for the short term. In contrast, holders will continue to invest.

“I think that’s what the government wants,” said Rashmi Deshpande, partner, indirect taxes, at Khaitan and Co.

The government was expected to introduce the Crypto Bill. But it hasn’t done that. However, the authorities have realised that crypto transactions, especially by millennials from Tier 2 and Tier 3 cities, have gone up in the past two years. So they have introduced this, basically to safeguard people’s interests, she added.

According to her, “There is a good possibility that only those who are extremely serious about investing in this space will go ahead. Those who are not serious players and doing it for fun won’t invest anymore.”

TDS At The Rate Of 1%

The government has further proposed to add Section 194S to the Income Tax Act to provide for tax deductions on payments made for crypto transactions at the rate of 1%. This is being done to keep track of crypto transactions in the country.

The finance ministry has proposed a threshold for TDS applicable to crypto transactions. According to Clause 194S, no tax will be deducted if the payer is a ‘specified person’ and the value/aggregate value of such consideration paid to a resident is less than INR 50,000 during a financial year. In all other cases, the said limit is proposed to be INR 10,000 during a financial year.

Here, a ‘specified person’ has been defined as an individual or a HUF (Hindu undivided family) whose total sales, gross receipts or turnover from the business carried on by him or the profession exercised by him does not exceed INR 1 Cr in case of business or INR 50 Lakh in case of a profession, during the financial year immediately preceding the financial year when a virtual digital asset is transferred.

The Confusion: Budget Keeps Mum On Crypto Mining, Staking

Interestingly, the Budget has not mentioned the mining and staking of cryptocurrencies or how crypto miners are supposed to be taxed. According to Deshpande of Khaitan and Co, the current 30% taxation only applies to crypto buying and selling and does not encompass mining.

Hence, miners are not required to pay any crypto tax until they sell or convert these crypto-assets into INR or other virtual digital assets.

No Clarity For Crypto Startups

Until now, crypto exchanges have been charging 1-2% commission for facilitating crypto-to-crypto, crypto-to-INR and crypto-to-foreign currency transactions. These businesses currently pay 18% GST on the commissions earned from their services. But at times, income tax officials have asked them to pay 18% GST on transactions instead of commissions. The Union Budget has provided no further clarity in this regard.

Besides, not all crypto startups run crypto exchanges. Many of them are brokerage firms that buy, sell and hold crypto as part of their service bouquet. Further, some exchanges charge in crypto for providing crypto-to-crypto transactions. At some point in time, if these exchanges convert these cryptos into fiat currencies, the 30% tax will be applicable. However, it will not be a viable option if these platforms have to pay 30% tax on the profits made on these crypto transactions.

The Chaos: Stakeholders Unhappy With Super-Hike In Crypto Tax

“Thirty per cent tax is levied on gambling. Is investing in crypto equal to gambling?” asked Priyanshu Jain, a Delhi-based trader.

Badri Narayanan, executive partner at the law firm Lakshmikumaran and Sridharan, said, “The entire scheme appears to remove ambiguity, but at the same time, discourages people from investing in crypto assets.”

In the beginning, crypto entities welcomed the government’s move. But it soon turned into a chaotic situation when Aditya Singh, the founder of Crypto India, started a petition demanding a reduction in TDS to 0.05% and a lowered tax slab in line with the tax charged on the gains from bonds and equities. The petition has been endorsed by 58K users so far.

“If the TDS is not reduced, it may be an industry killer,” said Nagappan.

The step has not been taken to promote crypto or crypto technology but to impede crypto, feel most crypto enthusiasts.

Meanwhile, Nischal Shetty, founder and CEO of Binance-owned crypto exchange WazirX, has moved on to set up a new blockchain venture called Shardeum. And the Twitter campaign #IndiaWantsCrypto, once started by him, is now changing to #ReduceCryptoTax.

So, what is the overall outcome of India’s crypto journey? From chaos to clarity to confusion to chaos again, we seem to have come full circle since the RBI announced its stringent stand against crypto in 2018.