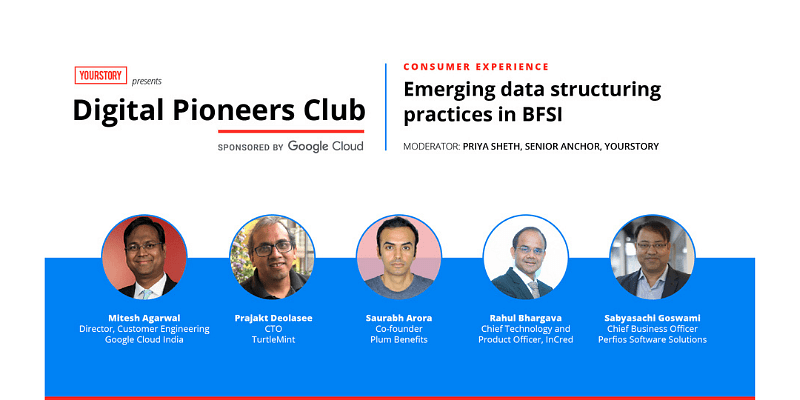

India is growing into a data-rich digital economy in financial services and insurance. And, this has opened tremendous opportunities for fast-growing ventures in the sector to build data models that translate into a strong foundation for growth. Discussing the emerging data structuring best practices in the Banking, Financial Services, and Insurance (BFSI) sector were leaders from fintech and insurtech companies at the Digital Pioneers Club CTO Roundtable series, hosted in association with Google Cloud. Present at the discussion were Sabyasachi Goswami, Chief Business Officer, Perfios Software Solutions; Rahul Bhargava, Chief Technology and Product Officer, InCred; Prajakt Deolasee, CTO, TurtleMint; Saurabh Arora, Co-founder, Plum Benefits and Mitesh Agarwal, Director, Customer Engineering, Google Cloud India.

A sector-wide digital transformation

The fact that Indians have shifted to carrying the mobile instead of the wallet or a debit or credit card is a strong indication of the transformation in consumer behaviour and digitisation of the sector, shared Perfios’ Sabyasachi. He noted that financial transactions and payments have undergone a massive transformation and that solutions like digilocker and Unified Payments Interface (UPI) have had a positive impact on the sector. The National Payments Corporation of India (NPCI) data showed that UPI transactions stood at Rs 3.29 lakh crore in September with the number of transactions at 1.8 billion. Sabyasachi added that the sector is now moving towards a paperless economy and is in the right direction.

Echoing similar sentiments, but in the medical insurance space, Plum Benefits’s Saurabh highlighted the high acceptability of digital procurement of health insurance worth thousands of crores. “In the last one and a half years, about 1,000 corporates purchased health insurance with Plum and not even a single sale has taken place via in-person meeting. So this is the extent of digital transformation we are witnessing” he said.

Talking further about the transformation in the lending space, InCred’s Rahul added, “Money has become a digital product in India.” From a lending perspective, the digital acceleration has been more in digital documentation and consumer acceptance of the process. He explained, “The backend processes in lending, where you would have to get documents from a customer such as bank statements or proof of identity, have been simplified with different layers available on digital platforms such as IndiaStack. Now there is really no excuse for us to not have end-to-end digital lending practice.”

Prajakt shed light on how building foundational technologies has enabled expansion across two directions – one on enabling new ways to distribute insurance, two on enabling deeper penetration across insurance categories by cross selling or upselling insurance products or selling small ticket insurance products. Talking about the former, he shared, “We are in the business of distributing insurance; not manufacturing them. So for us the expansion is not just about what we distribute but how we distribute. And, today, the platform that is used by our network of insurance agents to sell insurance products is the same technology that is being used by other large distributors like banks who traditionally have had no technology solutions.”

Role of tech in processing complex data sets

Google’s Mitesh highlighted that be it banking, securities, capital markets or insurance, all have a fundamental data layer but each of the respective regulators looks at this data very differently. He added, the power of data comes in when you look at data processing at scale and getting data insights in real-time. “So, whether you have instant insights from your internal data or the external data that lives anywhere, is really where I think Google has innovated a lot,” he said. He shared that while historically ML models in the financial services were used to capture customer intent, it’s interesting to see how you can marry this intent with the actual sale in the digital world to eventually help create personalised experience.

Gaps in data structuring in lending and insurance

Perfios estimates that 40 percent of Indian customers are new to credit. Talking about the kind of data structuring banks need today to be able to lend, Sabyasachi shared that for credit bureaus like Open Credit Enablement Network (OCEN), GST have played an instrumental role in enabling access to largely structured and sanitised data, however there are significant gaps that needs to be addressed. One, he noted that most fintech players are trying to structure only the customer data. The biggest missing link is the structuring of data pertaining to the internal systems itself such as that related to processes and workflows.

“If a financial institute actually has to look into data structure, it can be bucketed into multiple things. One, what are the data structures that are required in a particular process. Two, what are the data sets required in a workflow? Three, what is the data structure required from a customer experience standpoint and the product itself? Unless we address all these four buckets, I think it is going to be futile because you’re just trying to address only one bucket which is about customers,” he explained.

Rahul too iterated the need for data structuring with respect to lending. He opined that a good set of APIs, microservices or primitives should be made available as part of open banking, which would allow fintech companies to pull out data from hundreds of sources and put them together in an easy-to-use consumer-friendly workflow.

Giving insights into the challenges in the insurtech space, Saurabh shared that while the pandemic accelerated digital adoption in the health insurance space, it could create an impact only to a small extent due to the lack of proper systems in place. He shared how lack of data structuring in processes followed by each insurer has taken a toll on hospitals itself. He added that the lack of codification of the diagnosis or treatments in the current healthcare industry has led to a gap in fraud analytics. “There is no international coding standard for the diagnosis or treatment and what the payments are for those treatments,” said Saurabh. He also shared that the insurance regulators don’t get real-time data and that there is limited analytics capability across the ecosystem because of uncoded data. All of this not only negatively impacts the insurance companies and hospitals but also the users.

“How can we have holistic health insurance policies if we don’t have efficient systems?” he said, raising a very pertinent question.

Summing up, he shared, “The COVID-19 pandemic forcefully digitised the health insurance sector but we are in a state where our systems are yet to mature. We have a few more years before the systems come together and bring to the fore a very efficient health insurance ecosystem.”

In his concluding address, Mitesh further deep-dived into the opportunities in data structuring and how solutions with Google Cloud marry search trends and intent with an API ecosystem and the whole AI portfolio around vision, voice and vernacular to provide that data rich customer experience.

![Read more about the article [Jobs Roundup] Work for rural vehicle marketplace Tractor Junction with these openings](https://blog.digitalsevaa.com/wp-content/uploads/2022/04/TractorJunctionfinal-1651216412194-300x150.png)