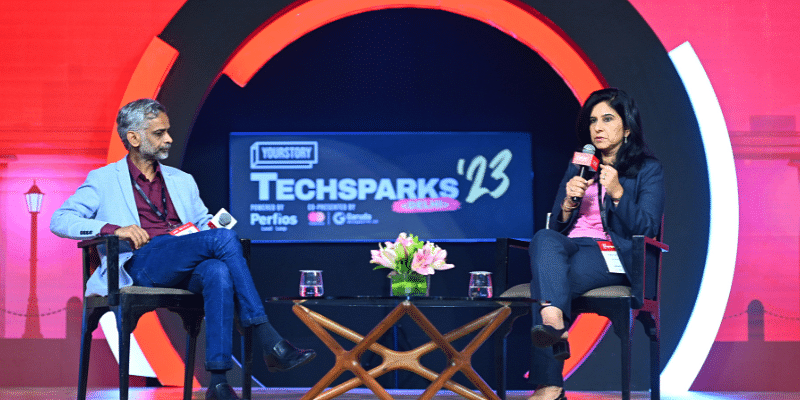

In a recent fireside chat at TechSparks 2023 Delhi edition on bridging the fintech divide, Sonia Gupta, Chief Business Officer, True Credits, discussed product innovation, sustainability, and the regulatory landscape with Ramgopal Subramani, Chief Strategy Officer, Perfios. The conversation delved into various aspects of fintech’s impact on traditional banking.

A pioneer in the fintech industry, Gupta shared valuable insights into the evolution of fintech and its key contributions to financial inclusion.

Both speakers began by acknowledging technology’s role in addressing the challenges of reaching customers in remote areas and meeting the needs of individuals whose requirements deviate from traditional banking norms. Gupta highlighted the significance of technology in overcoming barriers, especially in assessing the creditworthiness of individuals in underserved regions.

“Whether it’s a small kirana store owner, a ride-share driver for Ola or Uber, or even salaried individuals seeking a short-term loan until the next month’s salary, the demand for financial products is varied and dynamic. This necessitates a shift in the way financial products are conceptualised and delivered.

Fintech emerges as a key player, offering innovative solutions and reshaping the economics of financial products. The focus is not just on serving the urban elite but extending financial services to the underserved, creating a more inclusive and dynamic financial landscape,” Subramani shared.

<div class="externalHtml embed" contenteditable="false" data-val="

“>

Product innovations and financial inclusion

One of the focal points of the discussion was the revolutionary shift in product offerings. Traditionally, financial institutions imposed minimum loan limits, making it challenging for small businesses and individuals to access credit.

Gupta explained how fintech companies have transformed this landscape by offering tailored products, including microloans, ‘buy now pay later’ options, payday loans, and supply chain financing. The advent of innovative financial products has empowered individuals and small businesses, allowing them to access funds more flexibly.

Data-driven risk assessment

The conversation then shifted to the core of lending — risk assessment. Gupta emphasised how fintech organisations, driven by a greater risk appetite, have effectively leveraged technology to assess creditworthiness. Advanced image processing, image recognition, and data analytics have played pivotal roles in evaluating a borrower’s ability and intent to repay.

These organisations utilise unstructured data from various sources, including traditional documents, SMS data, and public databases, to build comprehensive risk profiles.

Evolution of sustainable finance

Gupta shed light on the financial aspects of lending, addressing the cost structures involved in running a fintech lending business. The cost of acquisition, processing, and servicing loans has been significantly reduced by eliminating physical interventions and adopting digital solutions. Collections have also become digital, with AI-powered tools facilitating invoice-based processes.

“Financial inclusion stands as a critical pillar for sustainable economic growth and expansion, a fact recognised by regulators, industry leaders, and the government. In India, a land of innovators, the genesis of this imperative was met with a further impetus through our robust digital public infrastructure and cutting-edge technology. The regulatory bodies, especially in recent years, have been proactive and supportive, setting the stage for greater financial inclusion.

“Global trends emphasise that accessible financial services for the majority of the population are vital for sustainable growth. In this landscape, fintechs and new-age organisations have emerged as key players, leveraging technology and digital infrastructure to expand credit access to previously untapped segments and geographies,” she added.

The future of embedded finance and collaborations

Looking ahead, Gupta highlighted the emergence of ‘Invisible Finance’ or embedded finance as a key trend. With an estimated 70% of lending expected to come from outside traditional financial institutions, embedded finance is poised for accelerated growth. The development of digital public infrastructure, including credit on UPI, health stack, logistics stack, and agri stack, opens up new avenues for fintech to drive financial inclusion in sectors beyond traditional banking.

She also discussed the potential of open banking and Open Credit Enablement Network (OCEN) in fostering collaborations between traditional players and fintech platforms. The shift from competition to collaboration among incumbents is expected to unlock more funding opportunities and broaden the customer base.

The evolution of products, data-driven risk assessments, financial sustainability, and collaborative trends point towards a future where fintech continues to play a central role in reshaping the financial landscape for the underserved.

![Read more about the article [Funding alert] Zeta raises $250M from Softbank Vision Fund, attains unicorn status](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imagedcnm-1621866423378-300x150.jpg)

![Read more about the article [Funding alert] Upswing Cognitive Hospitality Solutions raises $150K from Australia’s Framed Venture Capital](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/funding11-1621401209824-300x150.png)