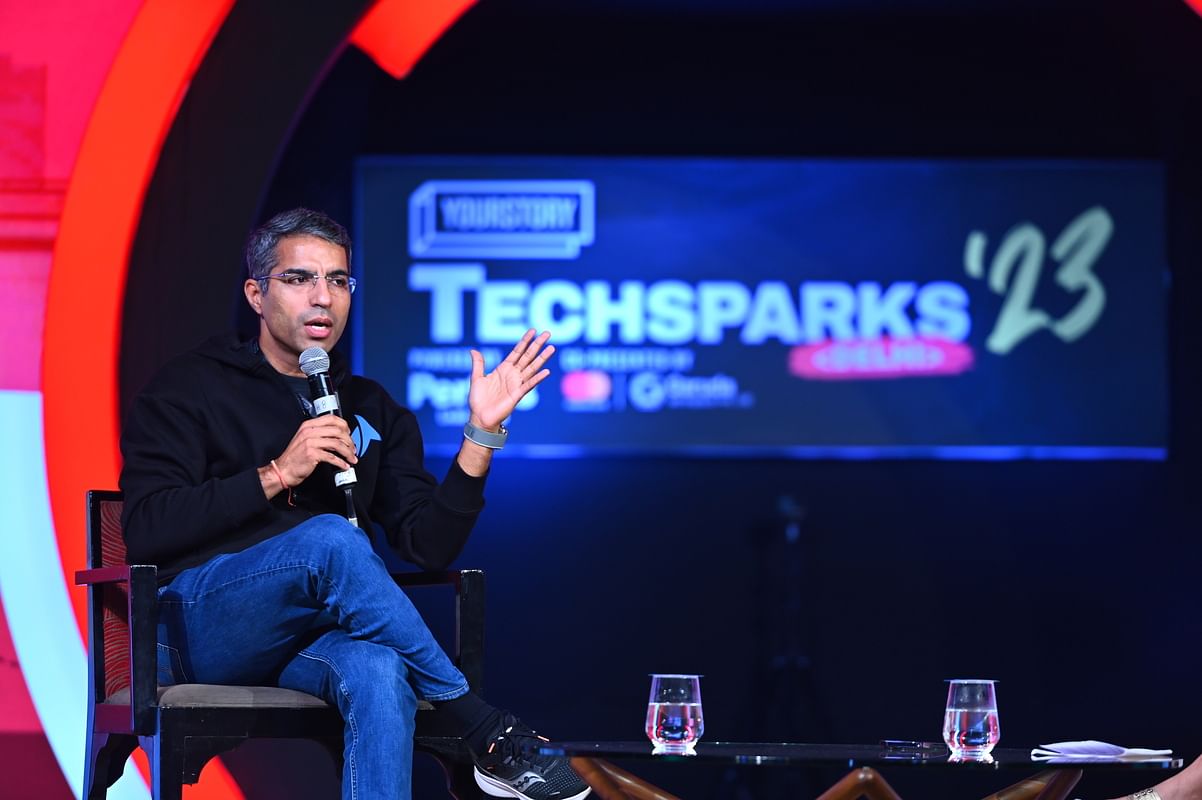

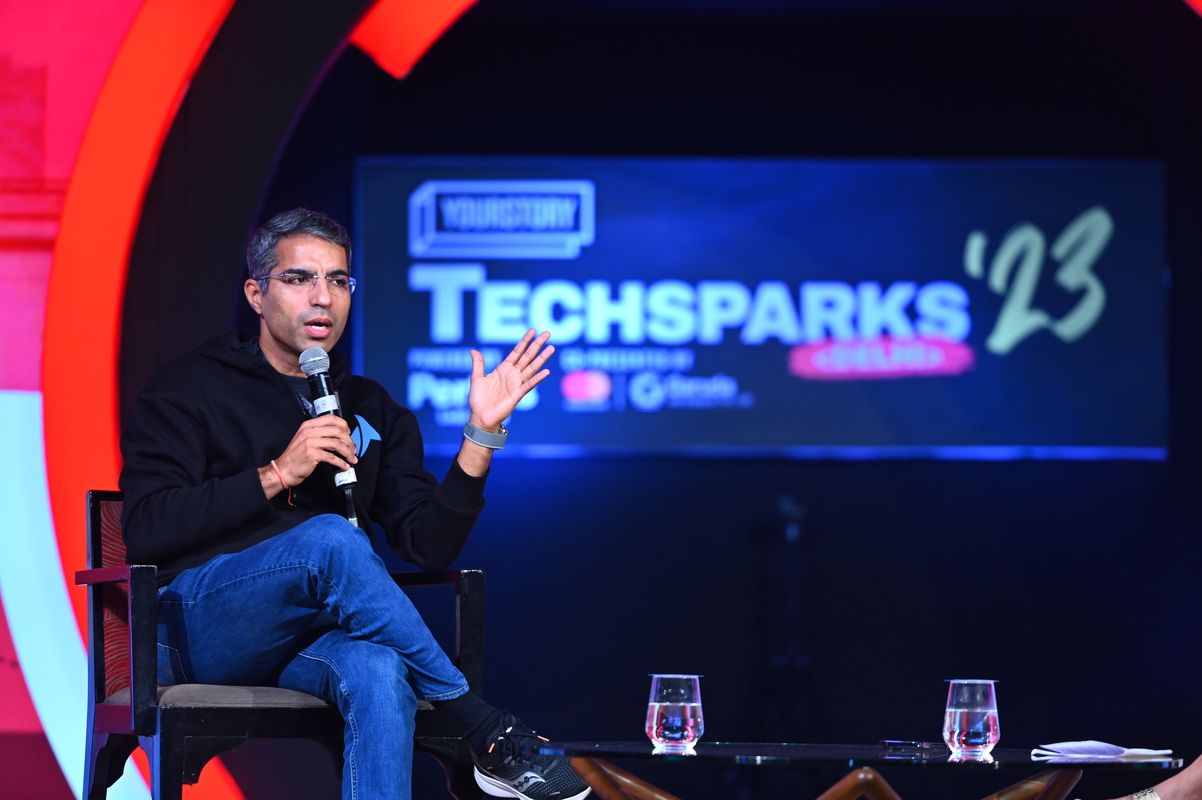

Founders should look at capital as a tool to run the business rather than a way to arrive at valuation outcomes, said Mukul Arora, Co-managing Partner at Elevation Capital, at TechSparks 2023, in Delhi on Wednesday.

Arora said funding today is seen as a mark of valuation, whether it’s in the media or in the founder circles.

“It’s always seen as a big achievement to say we have raised so many million dollars at such and such valuations. But the final valuation is to see whether the customers are rooting for that company or not. If they are rooting, funding will come, valuation will come. If they are not rooting, even if you are valued at over a billion dollars, it will disappear in no time,” he said.

Capital is important, but founders must look at it as fuel and not as an end outcome, said Arora, advising startups raising funds in the current challenging environment.

“The end outcome is whether your customers like (your product) or not. If that (customer liking) is happening, long-term valuation will happen,” he added.

Arora’s comments come at a time when Indian startups are facing challenges in securing funds, especially at the lofty valuations established in 2021, when funding was more accessible.

However, Arora calls the current period a “blessing in disguise” for founders, as it offers them time to develop a distinctive product with a more concentrated and refined focus.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

“Compared to 2021, capital available is obviously much lesser. But I believe that is a big blessing in disguise for the founders. With times like 2021, when capital is easily available, the focus (of founders) is always on how to raise the next round, and I have seen founders lose sight of product-market fit as the focus is on the metric that will help them in raising the next round,” he said.

“Whereas, in times like these, it is a little harder to raise capital but that lets you be razor-focused on building something differentiated, going towards a product market fit,” he added.

To elaborate, Arora quoted the examples of some of the biggest companies in Elevation Capital’s portfolio—food tech platform Swiggy, marketplace unicorn Meesho, and used cars retail platform Spinny.

He explained how Spinny, which started as a classifieds platform for used cars in 2015, raised its Series A funding only in 2018, after several pivots and failures as a retailer for used cars. He also said that Spinny today is by far the largest used cars retailing platform in India.

Arora, an IIM Lucknow alumnus, has been with Elevation Capital for over a decade now and has led investments in the consumer tech and software-as-a-service (SaaS) sectors in companies such as , , Spinny, Swiggy, Unacademy, and XpressBees. He said he looks at investments as a partnership wherein investors and founders are transparent with each other.

“A founder should not look at VCs as someone who needs to be updated and in front of whom you have to be accountable. They need to understand that we are in this journey together, and the more transparent the two partners are with each other the more fruitful that relationship becomes,” he said.

Elevation Capital is one of India’s most active early- and mid-stage investors. It has backed more than 150 companies in India, including some of the biggest unicorns such as Swiggy, Paytm, and Meesho.

Edited by Swetha Kannan