Mumbai and New-York based AI and data analytics firm Private Limited is set to turn itself into a public limited company as it prepares for an initial public offer (IPO).

The company will complete the process by “mid-April 2024” according to an email communication from Fractal to its employees, reviewed by YourStory.

“The company has initiated the process to convert its status from a private limited company to an unlisted public limited company for which necessary approval was availed from the shareholders at their extraordinary general meeting held on March 28, 2024,” the email informed the employees.

Fractal Analytics declined to comment on the development.

Companies usually change their status to a public limited firm from a private limited company before going public. Swiggy, which is also aiming for a domestic listing, transformed into a public limited company last week, on April 9, as per documents filed with the Registrar of Companies.

Founded in 2000, Fractal Analytics is an analytics and AI company which helps firms make better decisions on sales, marketing, supply chain, and other business operations. Its clients include the likes of Axis Bank, Wells Fargo, and Proctor and Gamble. The company has about 5,000 employees across India, the United States, and the United Kingdom.

Fractal’s bouquet of AI tools and platforms include Eugine AI, an emissions analytics platform, and Asper AI for commercial decision-making. It recently launched Flyfish, a generative AI tool for sales.

The firm has also incubated Qure.ai, which provides automated interpretation of radiology exams such as X-rays, CTs and ultrasounds scans. In January 2022, it acquired Neal Analytics to scale its AI offerings on Microsoft’s multi-cloud ecosystem.

<figure class="image embed" contenteditable="false" data-id="542730" data-url="https://images.yourstory.com/cs/2/bc14afb0357911eca2270b39b804102d/Untitled-1-02-1655396342456.png" data-alt="Path to unicorn club" data-caption="

” align=”center”>

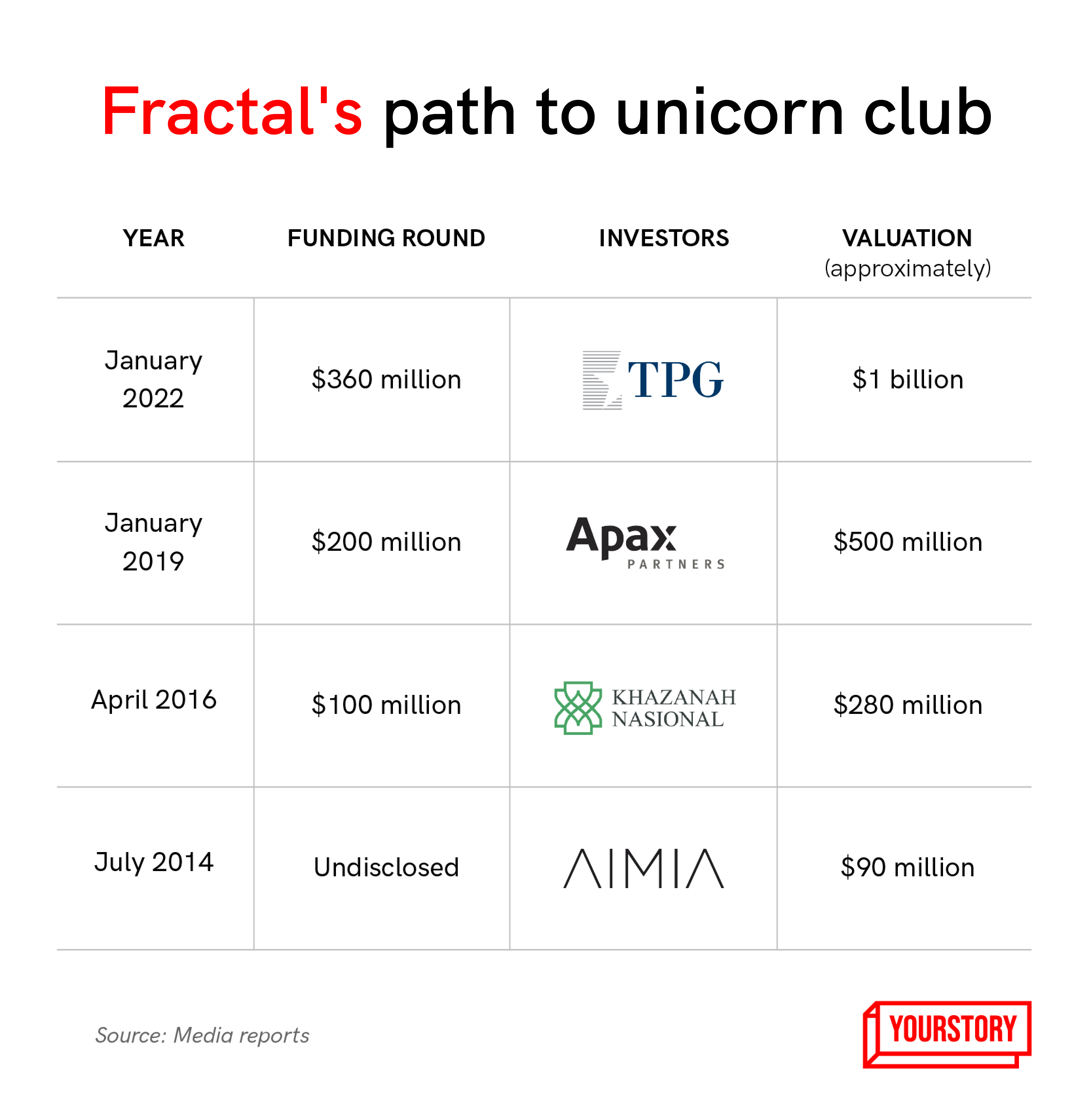

Fractal Analytics entered the unicorn club in 2022 with a funding of $360 million from private equity firm TPG Capital Asia. Prior to this, in January 2019, it raised $200 million from British private equity firm Apax Partners LLP. It is now preparing for a public listing on Indian bourses, as per reports.

The company aims to raise over $500 million in its IPO, targeting a valuation of $3 billion to $3.5 billion. It will provide partial exits to Apax Partners and TPG, Moneycontrol had reported, citing a source.

Investment banks Kotak Mahindra Bank and Morgan Stanley have been appointed the advisors for the proposed public listing, the report said. Fractal had previously tried listing on the public markets at a valuation of $2.5 billion in 2022, but had to defer to market sentiments.

In FY23, Fractal Analytics posted a revenue of $255 million and a profit of $24.2 million, as per data research platform Tracxn.

Edited by Swetha Kannan