Any new business needs capital and funding to grow. Similarly, startup companies look for funding right form the ideation stage to the time they start generating income.

To create an effortless bridge between acquiring funds and reaching the pinnacle of startup success, many alternative sources of funding have surfaced in the recent years. This can make entrepreneurs feel overwhelmed and confused as they try to choose the best source for their business.

To give you a deeper understanding of startup financing, we bring to you the different stages of startup funding in this article.

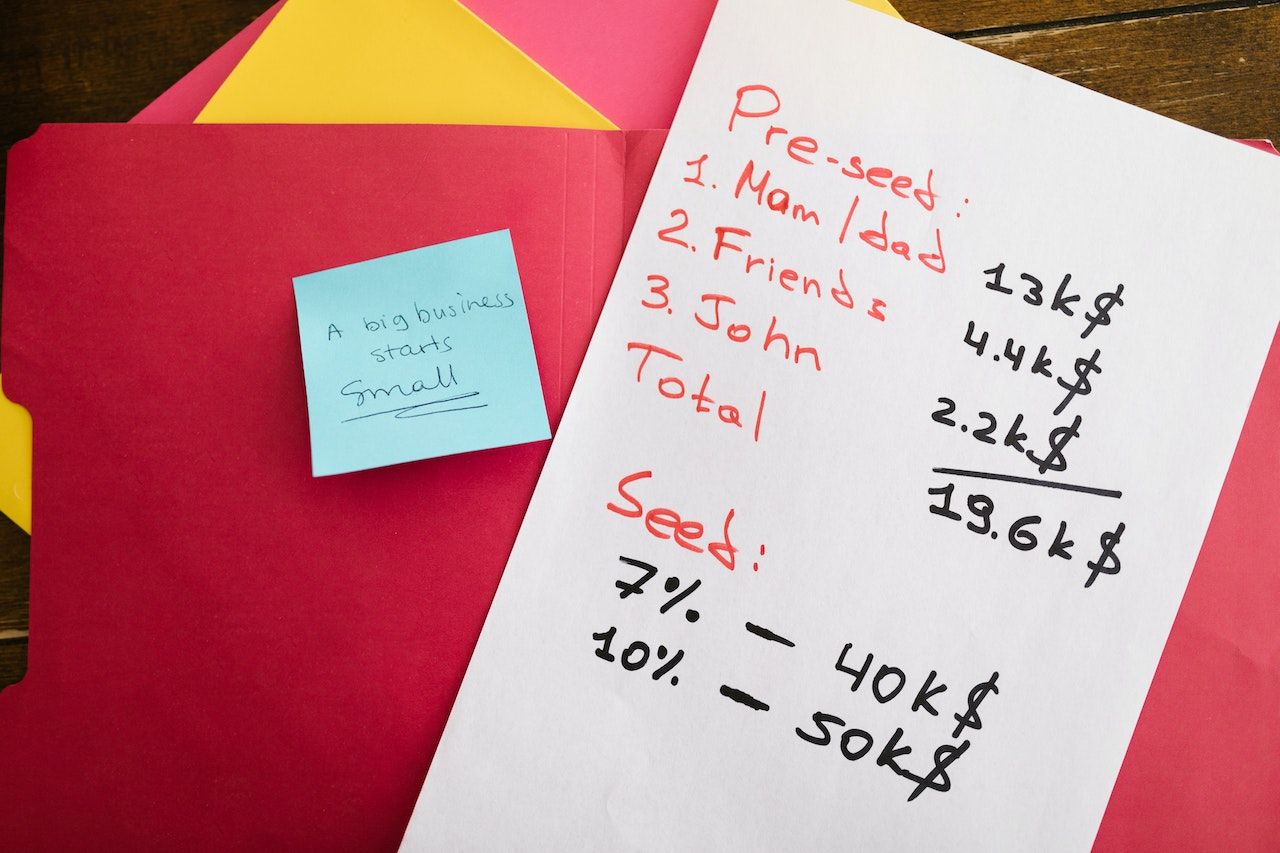

Pre-seed funding: ideation

The planning and background research required to launch a business is typically covered by pre-seed funding. Be careful to assess if your idea is a good one, if the idea already exists in the market, how much does setting up your business cost, which business model are you going to employ, and how do you intend to begin.

Since investors are highly unlikely to contribute at this point in exchange for stock, founders frequently inject their funds. Pre-seed investment may also come from family and friends who want to see you succeed.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Seed funding: confirmation

Pre-seed funding may have felt less than official, but seed funding marks a change in that. Your idea is already a functioning company in this phase with some clientele. Prospective investors can perceive your company as a seed and enquire about certain aspects.

A few of the criteria on which startups are assessed for seed capital include the expansion capacity of your company, Total Available Market (TAM), favourable circumstances for success, alignment of product and market, presence of revenue traction, and so on.

Entrepreneurs, close friends and family, incubators, venture capital firms (VC), angel investors, etc. may all be potential investors in a seed round of funding. The costs associated with seed capital involve team expansion, market research, and product development. With the seed money, the firm can receive support in identifying its ultimate goods and target market.

You must pitch yourself flawlessly and put a lot of emphasis on revenue estimates and their returns if you want to attract a reputable investor. Companies with valuations between $100,000,000,000 and $6,000,000 are eligible for this stage of fundraising.

Series A funding: early traction

<figure class="image embed" contenteditable="false" data-id="521300" data-url="https://images.yourstory.com/cs/2/f3638ff0dcc111ec93bca187955479ef/FeaureImages-06-1688567062556.jpg" data-alt="venture capital, investor, early stage, funding, money, startup idea" data-caption="

Credit: Shutterstock

” align=”center”> Credit: Shutterstock

Series A fundraising, which is the post-market debut stage, signifies the beginning of venture capitalist (VC) investment, where the company offers shares to investors for money. At this stage of funding, investors place a high value on key performance measures including customer base, app downloads, and revenue, among others.

The firm uses the raised money to grow its geographic reach, develop new products, and attract new clients. VC firms and super angel investors are the most prevalent investment sources. VCs oversee expert investment portfolios, invest only in high-growth firms, accept equity as payment for their capital, and actively engage in the mentoring, planning, and management of the startup. In contrast to venture capitalists, angel investors have less influence.

You can now start laying the groundwork for future business growth. Important aspects to be considered are:

- optimising your company

- balancing financial shortages or losses

- increasing the quality of your product

- designing a scalable growth strategy

The average amount of funding in Series A is reportedly $10.5 million.

Series B funding

Series B funding lays the path for your company or brand to reach new heights. As you’ve demonstrated you can scale your idea, startups at this stage have loyal user bases and consistent cash streams. In this phase, investors can assist you to:

- use cutting-edge marketing techniques

- boost share growth

- establish operating groups for marketing and business development

The businesses that falls in Series B are well-established with worth estimating between $30 and $60 million.

Series C funding

The last and the most important stage of funding in venture capital, Series C capital is given to businesses that are already growing and are frequently looking to expand beyond the borders. Finding investors may be simpler at this point if they believe the firm will prosper. In this stage, money is used for the following aspects:

- product innovation

- market expansion (internationally or nationally)

- acquisitions or mergers involving rivals

Even though there are more investment rounds like Series D or E to pursue unaccomplished objectives, the qualifying companies are no longer startups in the literal sense. These kinds of rounds of fundraising, which are often in the hundreds of millions of dollars, are used for international expansion, a final valuation boost before an IPO or market takeover.

Initial Public Offering (IPO)

An IPO represents the pinnacle of achievement when a startup’s shares are first made available for public purchase. Companies must fulfil specific regulatory standards in order to be listed as an IPO.

Fundraising might seem strange, puzzling, and even overwhelming to ambitious founders who simply want to actualize their vision into action. With a profound understanding of the stages of startup funding, you can surely climb the ladder of success.

![Read more about the article [Funding alert] Digital identity and authentication platform Bureau raises $12M in Series A led by Quona](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/WhatsAppImage2021-12-16at6-1639659953801-300x150.jpeg)

![Read more about the article [100 Emerging Women Leaders] How Lavanya Ashok went from working at Goldman Sachs at Wall Street to leading Trifecta Capital’s growth fund](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/100emergingwomen-LavanyaAshok-1631090373683-300x150.png)