The resolution professional of debt-ridden Future Enterprises Ltd (FEL) has invited Expression of Interest for the company’s assets, including stakes in the insurance business and apparel manufacturing units.

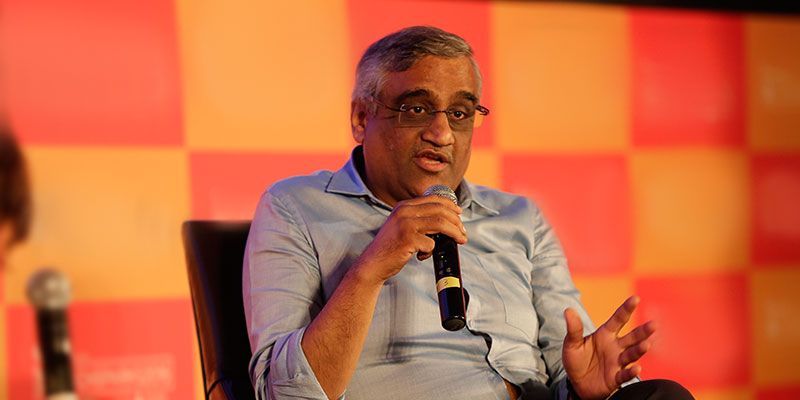

FEL, a flagship firm of Kishore Biyani-led Future Group, is going through the Corporate Insolvency Resolution Process (CIRP).

The EoI, which has invited prospective buyers to submit interests, has divided the FEL assets into three clusters and the deadline for submission is February 27, 2024.

The first cluster has FEL’s 25.18% stake in Future Generali India Life Insurance Company (FGILIC) and 0.51% stake in Future Generali India Insurance Company (FGIIC).

The cluster also includes FEL’s 49.81% stake in Sprint Advisory Services and Shendra Advisory Services, both a special purpose vehicle previously holding 44.88% of the issued and paid-up share capital of FGILIC and FGIIC.

The second cluster has FEL’s 39% stake in two firms—Apollo Design and Apparels and Goldmohur Design and Apparels.

The company holds investments in Apollo Mills and Goldmohur Mills in Mumbai and has entered into a joint venture with National Textile Corporation (NTC) for the restructuring and development of these two mills.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

The third cluster is a residual entity of the Corporate Debtor FEL, without the assets mentioned in Cluster 1 and 2. It also has two manufacturing units located at Tarapur-Palghar in Maharashtra and Mahadevapura-Bengaluru in Karnataka.

For the first cluster, the prospective resolution applicant should have a minimum tangible net worth of Rs 100 crore, while for the second and third, this criterion is Rs 20 crore.

CIRP was initiated against FEL by the Mumbai bench of NCLT on February 27, 2023 after admitting a petition from one of its operational creditors.

According to reports, FEL has admitted claims of around Rs 13,500 crore from financial creditors as of November 2023.

FEL is engaged in the business of manufacturing, trading, leasing of assets and logistics services. It used to develop, own and lease the retail infrastructure for Future Group.

It also holds the group’s investments in subsidiaries and joint ventures, including in sectors like insurance, textile manufacturing, supply chain and logistics.

It was part of the 19 group companies operating in the retail, wholesale, logistics and warehousing segments, which were supposed to be transferred to Reliance Retail as part of a Rs 24,713-crore deal announced in August 2020.

The deal was called off by Reliance Industries after it failed to get lenders’ support.

Edited by Kanishk Singh