In the past two years, new-age discount brokerage platforms have taken over the market, courtesy of their sophisticated tech and zero or flat charges. The pandemic also came as a shot in the arm for these platforms that saw a massive surge in first-time users.

So much so, the top five discount brokerages account for almost 59% of overall NSE active clients share today, with , , , and Angel One, among others, commanding top positions.

Having said that, the pandemic boom now seems to wear off amid the growing market volatility, saturating new user addition, and intense competition.

According to rating agency ICRA, after a strong run in the previous two fiscals, revenue growth rate for the brokerage industry will taper in FY23, even as overall performance remains strong.

Tejas Khoday, Co-founder and CEO at Fyers, a fast-growing discount brokerage firm, expects consolidation phase to kick in the near future and an eventual rise in brokerage rates.

“How to grow revenue is a major concern among brokerages. At Rs 20 (flat fee charged by a majority of discount brokerages, per trade), it is difficult to cater to customers. The brokerage rates haven’t gone up with inflation, and the race to zero (rates) won’t benefit anyone,” says Khoday.

“Eventually, if the ecosystem has to improve, they have to go up a fair bit so that customer requirement can be catered as cost of doing business and technology has risen substantially,” he says.

Founded in 2016 by brothers Shreyas, Yashas and Tejas Khoday, Bengaluru-based Fyers is among the fastest-growing online discount brokerages in the last few years, with an active client base of 1,66,077 till January 2023.

Typically, an online discount brokerage platform provides a DIY trading interface to clients and offer them to open Demat and trading account to trade in the share market. In return, they charge a flat rate/trade, which is comparatively much lower as compared to what traditional brokerage firms offer.

Compared to its peers Zerodha and Upstox, Fyers was one of the late entrants in the online discount brokerage space. Nevertheless, this did not take away the headroom for the bootstrapped company and its likes as the industry was itself at a nascent stage while speeding towards a boom along with a strong scope for new players in light of the under-penetration in India.

Positioning itself as a ‘product-first’ company, Fyers has managed to catch up with VC and large brokerage house-backed online platforms, placing itself in the top 10 position (with respect to the number of active traders on exchanges), and has achieved profitability at an early stage.

The company claims to have hit operational breakeven in 2018, and “never had a down quarter”.

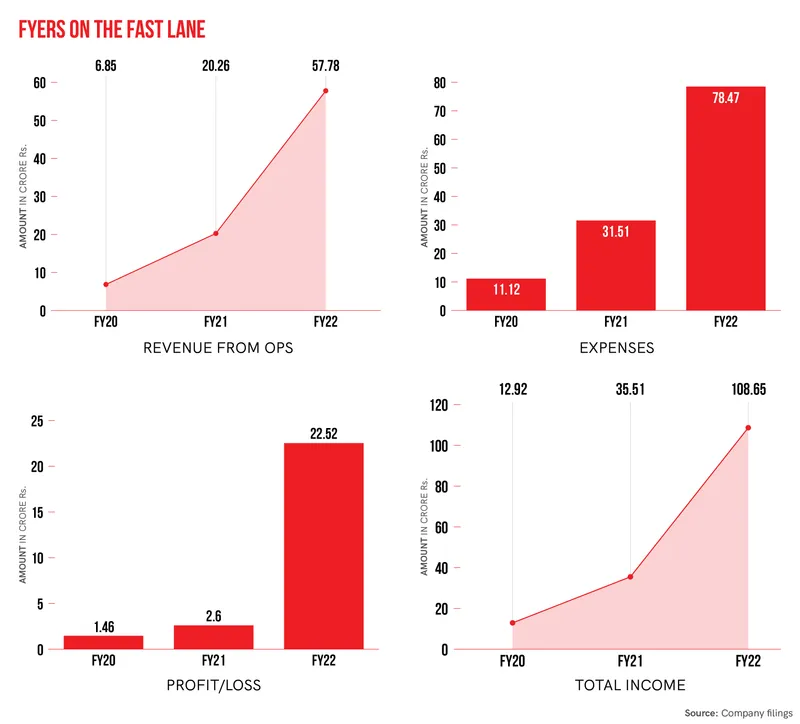

Its revenue growth from operations (majorly broking income) jumped 2.5X to Rs 57.78 crore in FY22, while net profit stood at Rs 22.52 crore, up from Rs 2.6 crore in FY21. Its total income in the said period was Rs 108.65 crore.

At the same time, its expenses stood at Rs 78 crore in FY22, up from Rs 31 crore the previous year.

“In 2022, we were the fastest-growing stock brokers because the markets saturated and went down and so did the number of investors. Most of the large brokers lost users. We had a 70-75% overall growth, which puts us in the fastest-growing category,” says the co-founder.

While recognising the presence and scale of other larger players in the space, Khoday says, Fyers’s moat lies in intricate in-house products, which are usable for active traders in the stock market.

The firm is not looking to go after first-time investors, but the ones who are already active in the space. This, says the co-founder, negates the “detrimental” impact brokerages targeting the GenZ and millennial have once the markets go down as they witness heavy dropouts.

“We don’t believe in playing the aggressive customer acquisition game. Trading is a zero-sum game. Naturally, the majority will lose and few will make money. This is across the board. So, we don’t like to add customers for the heck of it because trading in general is not suitable for everybody,” Khoday adds.

Strong focus on backend tech, scalability

Fyers recently launched a 2.0 version of its app, which claims to be much faster with advanced features, including analytics for traders.

Going back to the genesis of starting Fyers, Khoday picks up on the limited technological innovation by most online platforms back then as they relied on third party-vendors for software.

“Technology is the core aspect of the broking business, and that itself was and continues to be outsourced. A software company would lease out its product to a broker, who would further offer it to customers. Everybody did that for the longest time,” he said.

In order to give itself a leg up, Fyers looked at building everything in-house.

The co-founder claims this to be the platform’s biggest moat and a differentiator as it gave them a “better control to influence user experience,” given the dynamic and complicated nature of the broking sector. This further strengthened their user retention rate, and hence very low customer acquisition cost.

Fyers claims to be the first brokers in India to launch drag-and-drop trading in 2017 and offer free trading APIs for traders. Besides, it also introduced password-less login for traders along with a thematic investing feature.

“We have been solving for the scale and latency of our trading platform, and upgrading our system for the last 18 months. Whatever is visible is marketed, and whatever is invisible goes under the radar. No one pays attention to how scaleable the platform is,” he adds.

The fintech platform recently introduced a feature to verify trader or trade authenticity to tackle trading-related forgery on social media.

Control over expenses, external capital

Fyers continues to remain bootstrapped and is not looking to raise external capital, as of now.

“What’s important while raising capital is to have similar expectation. Generally, an expectation mismatch can kill the company and destroy customer journey in the way. We are profitable right now, so we don’t see raising capital as a need in the near future from VCs,” says Khoday.

The company claims to have low marketing expenses and limited focus on outbound lead generation.

Of its total expense of Rs 78.47 crore, Rs 34 lakh was spent on business promotion, while major expenditure included transaction charges, followed by salaries and wages.

“We don’t worry if we get fewer leads, and rather attract the same by launching new products, streamlining processes or when the markets do well. Word of mouth picks up and pays dividends in the long run,” the co-founder said.

Next stop: Wealth management

The startup is now looking to introduce wealth and portfolio management services, which would place it at par with other full-service brokerage houses.

“Portfolio management companies tend to overcharge the customers, which is the biggest deterrent to industry growth. Pricing has to be fair along with more transparent practices and we think we can make a difference,” the co-founder says.

Fyers currently has a headcount of 300 employees across three offices in Bengaluru, and is looking at 70% topline growth in FY23.

Traditional brokerage VS new-age tech

A lot of players in the segment, particularly traditional broking houses like ICICI Securities, Take Axis Securities, and IIFL Securities, are going beyond pure-play broking activity and have taken up distribution, loans, and advisory services in order to diversify revenue streams as broking charges remain low.

The value-added services include everything related to investing, including equity, debt, mutual funds, bank deposits, insurance, retirement, and loans.

Would this give a leg up to traditional houses as compared to new-age discount brokers, and lead to migration?

Kodhay sees no reason for this, simply because the latter is also upping the game by offering the same services, along with superior tech and better customer experience.

He further adds saying that the traditional brokerages may have caught on the low pricing side, but are yet to catch up on the product offering and ability to cater to the real needs of users.