As the Indian language user base grows, ‘Bharat’ users – those who favour Indic languages on social media – are at par with ‘India’ users (English language users on social media) across various segments of online engagement, revealed a recent report curated by social media platform ShareChat in association with Group M.

While the report titled ‘Bharat – The Neo India’ analyses the social media behaviour, lifestyle and spending choices, and content preferences of ‘Bharat’ and ‘India’ users, it also debunked some common myths associated with the persona of the language-first internet user.

Understanding India’s next billion internet users

Located uniformly across several big cities and smaller towns and across different economic strata, the Indic-first internet users have an appetite for experimenting with technology and lifestyle products. They are influenced by several touchpoints on the internet while evaluating and making choices for different categories. In fact, the report suggests that non-metros are quickly overtaking metros as centres of fast growth. Rising income levels, a younger population, higher crop prices, consistently favourable monsoons, and increasing internet penetration are collectively fuelling this accelerated growth.

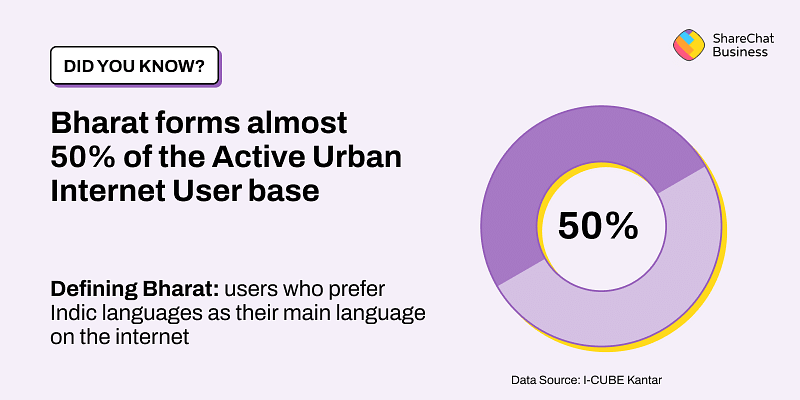

To begin with, 49 percent or 167 million of the urban active internet users prefer Indic languages. This obviously translates to the preference for Indic languages, which is higher in non-metros at 53 percent compared to metros at 39 percent.

The findings in the report are based on a survey conducted by YouGov among 3,432 social media users across 17 Indian states and with inputs from Kantar on Indic language urban active internet users. The report highlights the potential of Bharat, which will enable marketers to make informed decisions to drive business growth.

“Bharat audience is no longer just about being labelled as ‘potential audience’ or ‘untapped potential’. It is the current growth frontier and can be tapped in many different ways. Moreover, given its affluence and aspirations, it would be a missed opportunity for brands to overlook this prolific market,” said Ajit Varghese, Chief Commercial Officer, ShareChat and Moj.

Debunking myths about Bharat users

The report puts to rest several misconceptions around Bharat among marketers. There is a general perception that users from non-metros have lower spending power, a lesser inclination to purchase gadgets or make big-ticket travel purchases, and an aversion to using modern payment techniques. However, the survey proves otherwise. In reality, the lifestyle and aspirations of ‘Bharat’ users significantly overlap with those of ‘India’ users.

Interestingly, the survey reveals that ‘Bharat’ users spend heavily on gadgets, clothing and accessories. In fact, they are increasingly buying gadgets online, with this percentage growing year-on-year to 46 percent in 2021 as against 37 percent in 2020. ‘Bharat’ users have also been splurging online on categories such as travel bookings, beauty and skincare, and food. What’s more, like India, the majority of Bharat users prefer streaming free videos over watching TV. Daily, 50 percent of Bharat users stream free video online and about 47 percent watch TV. They are also catching up with ‘India’ users in terms of paid subscriptions. 27 per cent of Bharat consumers use paid streaming services daily compared to 29 per cent of India. Furthermore, about 29 percent of Bharat users post content daily, compared to 22 percent of India users. Also, 39 percent of Bharat users use social media as their primary source of news consumption, which is significantly higher than the combined usage of print and television.

When it comes to their preference for payment modes, Bharat users are adept at using UPI for online transactions and have a lead over India users in terms of net-banking and credit cards transactions online, the report said. Among Bharat users, 56 percent use UPI and 49 percent use mobile wallets multiple times per week. Another interesting finding was that Bharat users are increasingly diversifying their financial portfolio in stocks, mutual funds, e-gold and even dynamic investments like cryptocurrency.

Checklist for marketers

As this market segment is key for the growth of many brands, the report sheds light on how businesses need to change their strategies while addressing this emerging crop of audience. Here are a few pointers, the report suggests, that can drive tangible business outcomes for brands trying to connect with Bharat.

Create campaigns that connect with Bharat

The fact that Bharat is language-heavy with respect to its media and internet consumption, it is critical for marketers to create inclusive and impactful assets that create relatable experiences so users can interact with the brand in a way that is natural and familiar. Brands must also weave each region’s peculiarities and cultural uniqueness into their communication.

Choose the right platform

Broadcasting campaigns must not be the end game for brands; rather they should be customised to suit the preferences of the audiences. Therefore, it is important to choose the right platform, tap into regional insights, target parameters, user journey, and end actions customised for the region, which can drive result-oriented outcomes.

Measure what matters

The continuous growth of language-enabled environments and programmatic buying has spurred brands to look at all objectives, ranging from reach and frequency through transactions on social commerce. Therefore, the right KPIs must be chosen to get the best measure of attainment.

“It is India and Bharat both that are seeing enormous development in various walks of life. India and Bharat today are highly influenced by the world on the internet and are continuing to see a great appetite for the online world. This report is a great treasure to understand where and how India and Bharat are progressing and how brands and marketers can see an opportunity to reach out to Bharat,” said Prasanth Kumar, CEO, GroupM South Asia.

Given the diversity of the Indic language-heavy, fragmented consumer, Prasanth added that brands and media planners eyeing to connect with the target audience across the country should focus on a customised approach.

To view the entire report, Click here