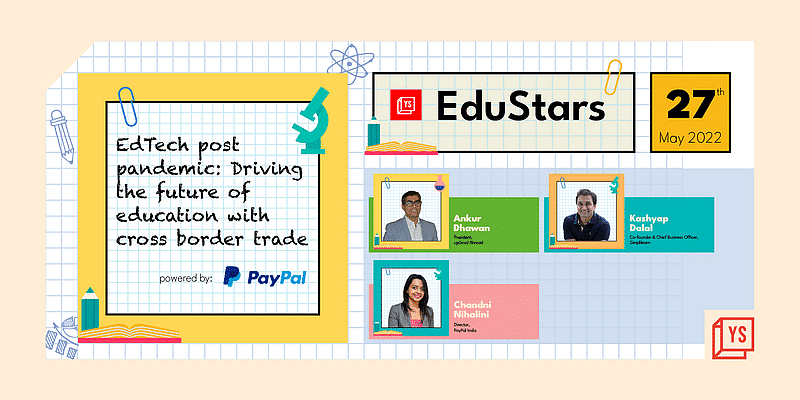

Since the onset of the pandemic, technology has played a key role in enabling growth in the edtech sector. To understand the role that fintechs are playing in accelerating the growth of edtech companies, YourStory in association with PayPal is hosting a webinar featuring Chandni Nihalani, Director, PayPal India; Kashyap Dalal, Co-founder and Chief Business Officer, Simplilearn; and Ankur Dhawan, President, upGrad Abroad.

This webinar is a part of YourStory’s EduStars 2022 — An effort to throw light on revolutionary edtech solutions by engaging top policymakers and industry experts in impactful conversations.

As digital technologies are starting to transform classrooms, students and educators are collaborating from different corners of the world. Edtech companies are poised to become the most profitable sector and payment solution providers are coming up with diverse options that are contributing to this growth.

The pressure to collaborate and develop faster, more efficient, innovative and transparent cross-border payment solutions is on the rise.

Defining the future of edtech

The edtech sector experienced an unprecedented boom since the pandemic as students were forced to adopt digital methods of learning during the lockdown. As schools reopen after a two-year hiatus, the growth of edtech companies might get hampered and staying relevant has become more important than ever.

To understand the edtech ecosystem post pandemic, the webinar will involve a discussion regarding the growth of edtech players in the international market — the challenges they face while scaling up, consumer mindset and demands, overall future of the sector, and how established payment partners can help such platforms grow.

For edtech companies to grow and scale up, they need to reach students across nationalities. By making cross-border payments faster, cheaper, more transparent and inclusive, countries can reap benefits that aid in economic growth, global trade, development, and financial inclusion. Change is a slow process, but edtech and established fintech organisations have to work hand in hand to cater to this unprecedented demand.

![Read more about the article [Funding alert] True Balance raises $30M in debt from India, South Korea investors for financial arm](https://blog.digitalsevaa.com/wp-content/uploads/2021/11/Imageqrfg-1637661918959-300x150.jpg)