On July 12, SEBI (Securities and Exchange Board of India) came out with a circular titled “BRSR Core – Framework for assurance and ESG disclosures for value chain” which has far-reaching consequences beyond the top 1,000 listed companies for which this is directly applicable. This is because SEBI has mandated value chain disclosures for upstream and downstream partners of a listed entity, cumulatively comprising 75% of its purchases/sales (by value) respectively.

But before we dive into the specifics, let’s start with the basics.

ESG stands for environmental, social, and governance. It is a framework for companies to assess and manage their impact on the environment, society, and the way they are governed. Investors, customers, regulators, and other stakeholders are increasingly demanding that companies disclose their ESG performance.

ESG reporting can help companies to attract and retain investors, customers, and employees. Companies are increasingly being rated on ESG performance by ESG rating providers like MSCI, Sustainalytics, and Refinitiv, and these ratings are increasingly impacting their ability to attract investors, and lenders and win business.

BRSR Core and impact on value chain

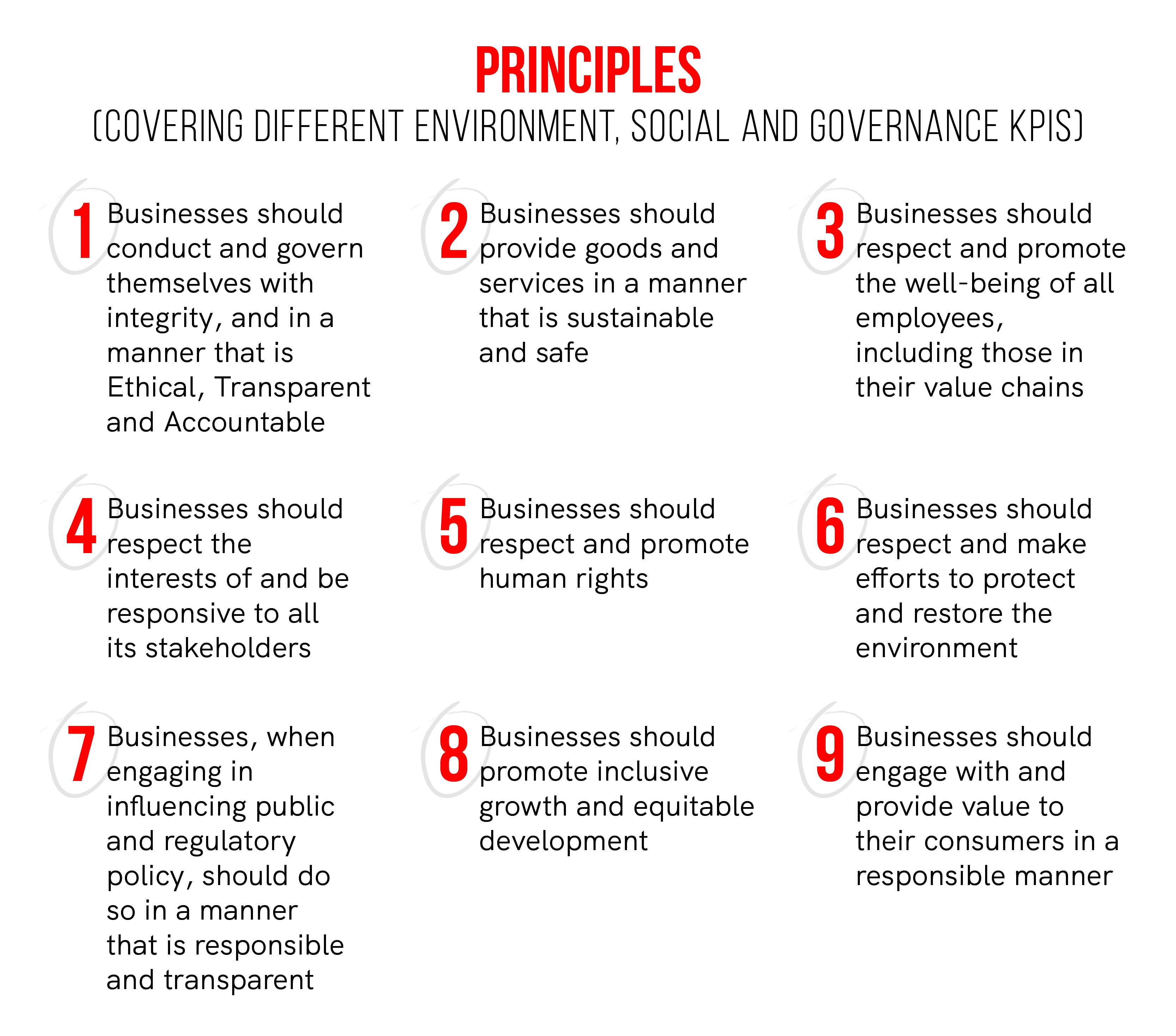

BRSR stands for Business Responsibility and Sustainability Reporting. It is a mandatory ESG reporting framework for listed companies in India. The BRSR framework was introduced by SEBI in 2021. The BRSR framework covers a wide range of ESG topics (approximately 150 questions to be specific) across three sections and nine principles.

The top 1,000 listed companies in India will all be reporting their ESG performance through the BRSR framework for FY 2022-23 over the next few months.

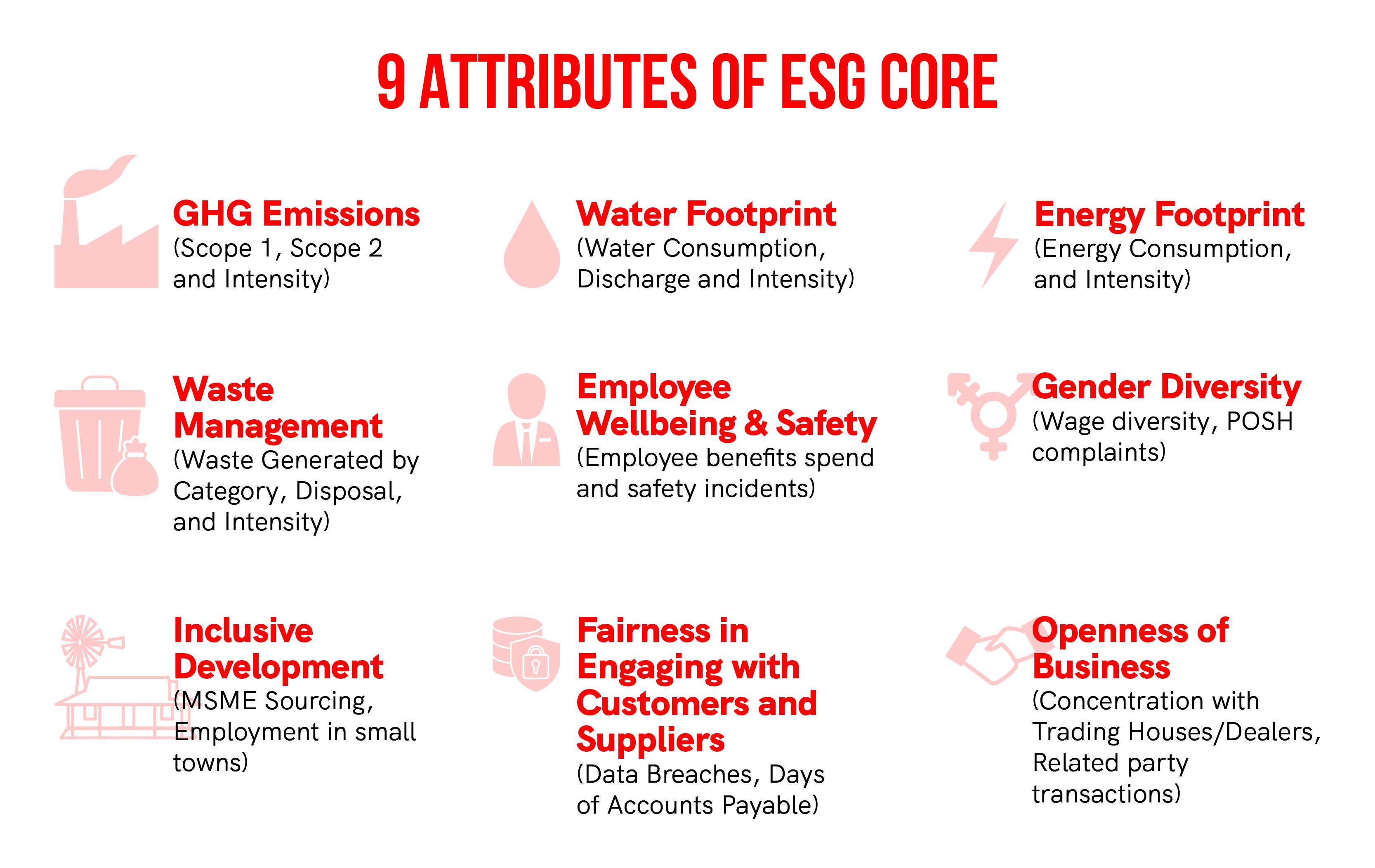

The BRSR Core is a subset of the BRSR, consisting of a set of key performance indicators (KPIs)/metrics under nine ESG attributes (see below). Listed entities will now be required to get reasonable assurance on these attributes starting next year, which essentially means that the bar for accurately measuring and reporting these metrics is quite high and that an independent assurance provider will need to certify these.

Given the heavy lift that most companies will have to undertake, SEBI has provided a glide path for BRSR Core, starting with the top 150 companies in FY 2023-24 and incorporating all 1,000 companies within four years.

In addition to this, SEBI has mandated that these listed companies must make ESG disclosures for their value chain according to BRSR Core as part of their annual report. The value chain must include both upstream and downstream partners of the listed entity, comprising at least 75% of its purchases/sales (by value) respectively.

While the responsibility to report remains with the listed company, the value chain partners risk losing business from such companies if they do not report on all mandatory ESG parameters or fail to align with the company’s sustainability policies. Therefore, for SMEs and startups that are part of the value chains of the top 1,000 companies. This is not just a matter of compliance but also a matter of staying relevant.

We don’t have to look far to understand how this impact will unfold. Companies that are part of global supply chains serving US and European customers or companies that receive funding from impact investors have been meeting similar requirements for years. These requirements manifest in the following ways:

- ESG due diligence: We anticipate that SMEs and startups will increasingly be required to undergo ESG due diligence as part of vendor selection at large listed companies. This is similar to the scrutiny many startups undergo for information security or privacy-related audits. Sometimes it will involve answering ESG questionnaires, while at other times, more rigorous ESG audits will be necessary, demanding significant time and effort.

- ESG reporting: Once onboarded, SMEs and startups will be expected to regularly report key ESG metrics in standardised formats. Initially, this process will occur annually but may become more frequent depending on the reporting requirements of the listed companies themselves. Some of these reporting procedures will resemble annual audits, as commonly seen in quality assurance fields.

- ESG target setting and improvement: Within a few years, we anticipate a shift from reporting to target setting and improvements. As listed companies commit to NetZero and other ESG targets, these targets will trickle down to their value chains, beginning with the partners which have the greatest environmental impact (not value). This will also create opportunities for SMEs and startups to distinguish themselves from competitors and capture a larger market share.

Startups and SMEs need to prepare for this eventuality by investing in leadership-level understanding and appointing at least one individual within their organisation who can drive this function. Additionally, they should establish systems to collect and report relevant data on ESG factors to facilitate due diligence and audits.

Finally, for SMEs and startups in sectors where ESG will become a differentiating factor, it is crucial to integrate ESG into their business practices, influencing important decisions regarding product development, process optimisation, facilities management, employee and supplier policies, and company governance.

There is a unique opportunity for startups and SMEs to take the lead in the ESG space and leverage it to establish long-term win-win relationships with their large listed customers and suppliers.

(Ankit Jain is Co-founder and CEO of StepChange.)

(Infographics by Nihar Apte.)

Edited by Kanishk Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![Read more about the article [Funding alert] Skylark Drones raises $3M led by InfoEdge Ventures and IAN Fund](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/skylarkdronesfounder-1625463804457-300x150.png)