In today’s rapidly evolving economy, the traditional notions of making money—solely through jobs or business ventures—are undergoing a seismic shift. As we sail through 2024, it’s clear that to thrive financially, one must adapt to a more expansive money mindset. This article will guide you through breaking free from the stigma of traditional money-making avenues, embracing new strategies for growth, and cultivating habits that foster a rich mindset.

Breaking the Stigma: Beyond Jobs and Businesses

For decades, earning money was pigeonholed into two main categories: employment and entrepreneurship. While these remain viable and essential, the digital age has democratised income generation, offering myriad avenues to those willing to explore. The stigma surrounding non-traditional methods—think gig economy, digital platforms, and passive income streams has faded, making way for a more inclusive understanding of wealth creation.

New Ways to Grow Money

The key to adapting a money mindset lies in recognising and leveraging new wealth-building strategies. Cryptocurrency investments, stock market trading via apps, and peer-to-peer lending platforms represent just the tip of the iceberg. Crowdfunding real estate investments and participating in e-commerce dropshipping are also gaining traction. These avenues not only diversify income but also open the doors to exponential growth potential.

Cultivating Money-Making Habits

Adapting a money mindset requires more than knowing where to invest; it demands cultivating habits that align with financial growth. Here are some to consider:

– Financial Literacy: Commit to learning about finance. Regularly consume content that enhances your understanding of the market, investments, and economic trends.

– Budgeting: Embrace the 50/30/20 rule or a similar budgeting framework. Allocate 50% of your income to necessities, 30% to wants, and 20% to savings and investments.

– Savings and Investments: Prioritise building an emergency fund and necessary insurance then explore investment options. Consider low-cost index funds for starters, and as your knowledge grows, diversify into other assets.

– Smart Spending: Develop a critical mindset towards spending. Ask yourself if a purchase is a want or a need, and whether it aligns with your financial goals. Use the 24-hour rules which says that when you see an offer, instead of making a purchase immediately, you should wait for 24 hours and ask yourself again whether that item was really necessary or not!

Books to Boost Your Financial Wisdom

Knowledge is power, especially when it comes to money. Here are a few must-reads to fuel your financial journey:

– “The Psychology of Money” by Morgan Housel offers profound insights into how our behavior shapes our financial decisions.

– “Rich Dad Poor Dad” by Robert Kiyosaki challenges conventional wisdom on earning and investing.

– “The Intelligent Investor” by Benjamin Graham provides timeless advice on investment philosophy.

– “Your Money or Your Life” by Vicki Robin and Joe Dominguez encourages a holistic approach to managing finances and living.

Embracing Technology and Automation

In the age of smart technology, automating savings and investments can significantly impact your financial health. Apps that round up purchases to the nearest rupees for savings or automatically allocate funds to investment accounts can help you build wealth effortlessly. Furthermore, leveraging financial management tools for budget tracking and expense analysis can provide valuable insights into your spending habits, enabling more informed financial decisions.

The Social Dimension of Money

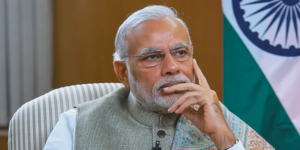

Finally, it’s crucial to recognise the social aspect of money. Networking, both online and offline, can open up new opportunities for income generation. Engaging with communities focused on investment, entrepreneurship, or specific industries can offer valuable resources, mentorship, and partnerships.

Adapting a money mindset in 2024 is about breaking free from traditional constraints, embracing new opportunities, and cultivating habits that promote financial growth. By expanding your financial literacy, leveraging technology, and engaging with like-minded communities, you can navigate the path to financial freedom with confidence. Remember, the journey to wealth begins with a mindset shift—embrace it, and watch your financial world transform.

Edited by Rahul Bansal

![Read more about the article [Funding alert] Urban Company enters unicorn club with $2B valuation, following $188M fund raise](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/urban-clap-founders-1619536891684-300x150.png)

![Read more about the article [Startup Bharat] This home décor startup is keeping Indian handicrafts alive by working with artisans from remote parts of India](https://blog.digitalsevaa.com/wp-content/uploads/2022/01/ImageBranding-Amisha2-1642074728191-300x150.png)