Seema, a 31-year-old architect based in Mumbai, felt unusually experimental in 2022. Part of her new year’s resolution was to explore a new skincare product every month. But just three months in, she found herself growing tired of the multitude of options, and ended up committing to a single brand. And she doesn’t think she will change her mind anytime soon.

Seema’s experience sums up the year for consumer brands. In the last few years, consumers have been offered plenty of options—right from skincare to restaurants—only to witness a rise in both distraction and exhaustion. Consumers now want to double down on their favourite products and no longer wish to make room for brands that don’t make the cut.

Quite naturally, this has prompted brands to go the extra mile. From ramping up marketing spends to diversifying the product portfolio, brands have tried it all.

The upcoming year is going to bring a whole new set of challenges, including directing attention to unit economics, navigating the dried-up funding ecosystem, and keeping up with the ever-changing consumer preferences.

Tough road to profitability

Unless a brand has a single product that helps it stand out from the rest, most of them rely on marketing to do the job. Although it is not new for D2C brands to spend heavily on marketing, companies have invested more in marketing this year than ever, making it a crucial differentiating factor.

D2C beauty brand spent 32% of its total expenses on promotions and advertising in 2022. The spend increased 184% compared to the previous year. Rival brand ‘s marketing spends too spiked 2.2X to Rs 391 crore in FY22.

Similarly, meat delivery firm ’ marketing spends increased by 70% this fiscal compared to last year.

“Firms have started allocating a vast majority of their budget towards advertising to differentiate themselves from the flood of other brands. It also aids in brand discovery,” Ameve Sharma, Founder and CEO of , says. He adds that the nutraceutical company spends close to 80% of its expenses on marketing, with a focus on educating potential customers through newspapers, blogs, and social media. Kapiva spent nearly 60% of its budget on marketing last year.

According to Pitch Madison Advertising Report 2022, the ecommerce segment (part of the consumer ecosystem) in India was the second-largest contributor to India’s advertising expenditure, doubling in size to Rs 6,000 crore in less than a year.

The momentum is expected to continue, says Dipanjan Basu, Partner at venture capital firm . He adds that the adoption of newer forms of marketing like influencer marketing will also transform the way companies put themselves out there. Moreover, creating brand awareness has become a top priority as it could help a product stand out from the rest.

But it also means that the road to profitability will be tough. “Most new-age brands are trying to attract customers online, which has already caused a significant spike in the customer acquisition cost,” says Rahul Maheshwari, Partner at -backed V3 Ventures.

The upcoming year is likely to see increased attention on unit economics and profitability, according to Vinit Garg, Founder and CEO of mom and baby care brand, .

The year 2022 saw only a handful of consumer brands attaining profitability. Some top names include , under its flagship brand Milky Moo, which turned profitable in July this year; and , a homegrown D2C brand that sells tech and lifestyle accessories, which recently said it is profitable on an annualised revenue run-rate (ARR) of Rs 100 crore.

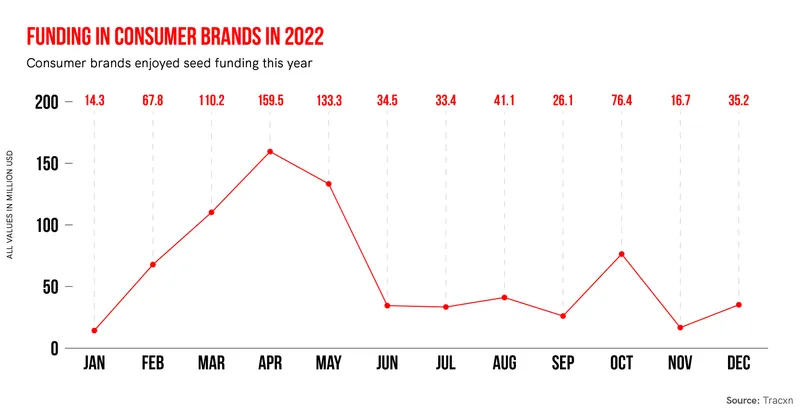

The space also witnessed an inflow of seed funding. In total, companies in the space raised nearly $750 million in early and late-stage funding, according to market research firm .

Infographic by Nihar Apte

Investors have also changed the way they evaluate the space. “Investors are looking beyond me-too brands with fancy packaging. The go-to-market strategy is being looked at closely alongside valuation. Firms must also be aware about not posting inflated forward multiples as it can affect the ability to raise funds. The run rate must be justified,” Rahul adds.

Ultimately, the plethora of options is making it difficult for brands to retain customers. Consumers have also become demanding, making differentiation all the more necessary.

“One clear trend is the expectation around faster delivery times from the consumer. With quick commerce rising and the maturity of ecommerce players, same-day or next-day delivery are becoming expectations from consumers from online consumer brands as well,” says Mylo’s Vinit.

Omnichannel for the win

Offline expansion has been the norm since 2021, with 2022 accelerating the speed. Reliance-backed Clovia, for instance, opened its 47th offline store last month, while consumer electronics company Noise has established its presence in over 8,800 offline stores to date. Pet care brand is gearing up to open 20 new outlets in the current year and 20-25 stores every year for the next three years.

“With an approach to expand our reach at a pan-India level and to ensure our products reach a wider set of consumers, we have not limited ourselves to online distribution channels only. We aim to make new-age innovation available to every consumer, even the ones who prefer offline platforms to experience the product first and then make the purchase decision,” says Amit Khatri, Co-founder of .

Investors Rahul and Dipanjan note that the omnichannel approach will be the way to go. “Today, the line between offline and online is fading. Companies need to be present in different forms to be able to leverage potential customers,” says Fireside’s Dipanjan.

Consolidation is key

2022 witnessed more than 200 M&As across sectors, with some most notable ones in the consumer segment being -owned Moj’s $600-million purchase of , HUL’s investments in and , ‘s acquisition of grocery delivery platform , Reliance’s acquisition of lingerie brand , and ‘s purchase of Japanese eyewear brand Owndays.

Infographic by Nihar Apte

Consolidation in the consumer brand space is certainly a bright spot for the sector and gives founders the validation of having built a successful business. “I am optimistic that 2023 will follow a similar trajectory,” says Pankaj Vermani, Founder and CEO, Clovia.

House of brands, a concept that refers to consolidating multiple companies under one roof, portrayed a muted presence in 2022. “I have witnessed several founders aiming to build houses of brands over the last few months. It is the talk of the town. But it isn’t easy building one. So, 2023 could be an insightful year to see how that will pan out,” says V3 Ventures’s Rahul.

![Read more about the article [Funding alert] Bikayi raises $10.8M in Series A led by Sequoia Capital India](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Image6xbm-1599641408155-1630309241895-300x150.jpg)