The Indian business-to-business (B2B) ecommerce marketplace is expected to surpass sales of $125 billion by 2027, according to a report by investment banking firm .

The report estimated the country’s B2B market size to be $20 billion for 2022 in terms of GMV (Gross Merchandise Value, or the total sales made by an ecommerce marketplace over a specific period of time). The GMV growth rate is estimated to be 44% from CY 2022 to CY 2027, as per the report.

It further determined that there are over 100 listed B2B companies in India commanding market capitalisation of over $1 billion each. These include Reliance Industries Limited at $193 billion, and Larsen and Toubro at $39 billion, among others. Overall, the listed companies command a total market capitalisation of over $900 billion.

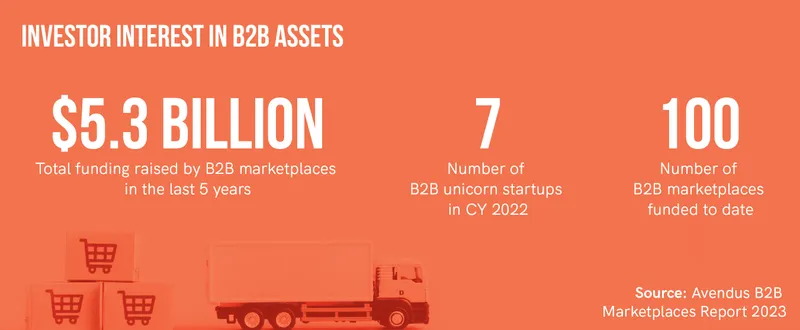

The report noted that in the private market, B2B marketplaces have managed to raise $5.3 billion over the last five years, with nearly 67% of the capital being invested over the last two years. It also expects the number of unicorns—or startups valued at over $1 billion—in the B2B marketplace segment to grow from seven in CY 2022 to over 20 by CY 2027.

Investor interest in B2B marketplaces

“The market has largely been created over the last three years and the pace of adoption is going to be stronger. Even for the next 12 to 18 months, there is reasonable interest from investors,” Ekta Parashar, Vice President of Digital and Technology Investment Banking at Avendus Capital, told YourStory.

While B2B marketplaces in both manufacturing and retail are likely to attract investments, it is likely to be skewed in favour of the former. The report expects six to seven of these marketplaces to publicly list by 2027.

Growth in GMV for B2B Marketplaces

“The Total Addressable Market (TAM) for B2B marketplaces in the manufacturing segment is higher, as are Average Order Values. They also tend to scale and become capital efficient faster than the marketplaces on the retail side,” said Varun Gupta, Managing Director, Digital and Technology Investment Banking at Avendus Capital.

The report listed export opportunities, private labels and value addition by the marketplace as the key drivers of margin expansion for these companies. It further added that successful players in the space have employed a cluster-based expansion approach with a feet-on-street salesforce and tapping into institutional clients for large orders.

It further noted that the evolution from a classifieds model of pre-2015 to full-stack integrated marketplaces addressing quality, reliability and credit discovery helped the B2B marketplaces register growth in recent years.

![Read more about the article [Year in Review 2021] From strategy to skills](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/Creativity-2b-1640496366983-300x150.png)

![Read more about the article [Funding alert] CoinSwitch Kuber raises $25M from Tiger Global at over $500M valuation](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Co-foundersCoinSwitchKuber1-1602568459719-300x150.jpg)