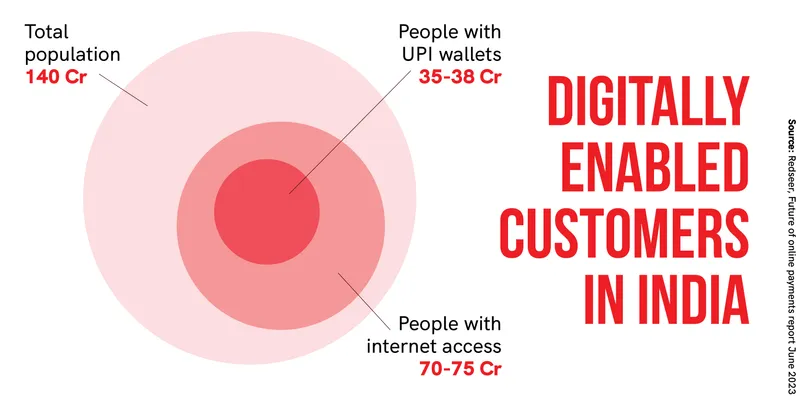

India is rapidly embracing digital payments. While 75% of India’s seven crore businesses are currently digitally empowered, 85% of businesses in the country are projected to be digitally enabled by FY26, as per a report.

The report prepared by Redseer Strategy Consultants, in collaboration with Plural by Pine Labs, suggested this transformation will be driven by the widespread use of smartphones and the internet, as well as favourable government policies,

It predicted that the Indian ecommerce market, currently valued at around Rs 400,000 crore, will reach approximately Rs 900,000 crore by FY26, with growth primarily driven by customers from Tier II and smaller cities. The number of online shoppers in India is expected to grow by 50% in the next three years, surpassing 30 crore by FY26.

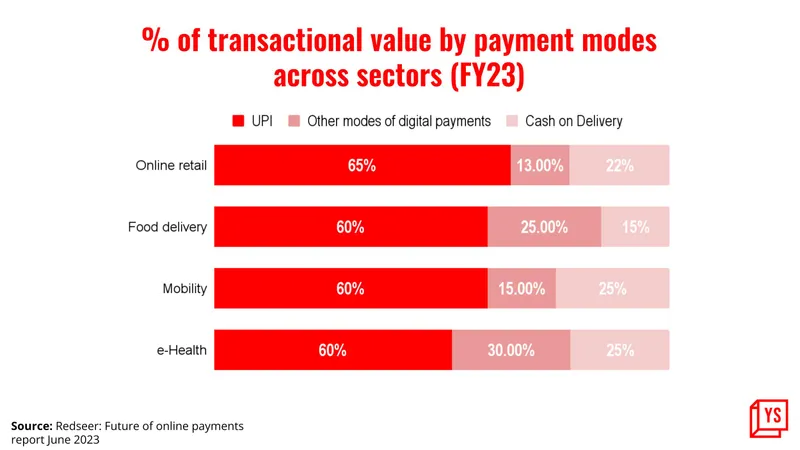

The Unified Payments Interface (UPI) dominates the digital payments ecosystem, representing 84% of the total digital payments volume as of FY23.

Additionally, the report forecasted a compound annual growth rate (CAGR) of around 30% between FY23 and FY26 for the Bharat Bill Payment System (BBPS), which facilitates bill payments by linking utility providers and payment services. Currently, PhonePe and Paytm hold the top spots for processing payments through BBPS

Digital transactions by Indian households currently account for approximately 35% of all transactions, with 80% of grocery, food delivery, and travel purchases being done digitally. By FY26, it is estimated that over 50% of household transactions will be conducted digitally, facilitated by seamless mobile payment solutions.

The report also mentioned RBI-driven BBPS, operated by the National Payments Corporation of India (NPCI), is projected to witness a 30% increase in transaction volumes—from 110 crore transactions in FY23 to 240 crore transactions by FY26.

Another emerging trend is embedded insurance where customers can purchase insurance coverage during their product or service transactions. Major players in this market include Symbo, Zopper, Toffee, Cover Genius, Digit, and Bajaj Finserv. The report stated that the embedded insurance sector is experiencing growth due to a revised perception of risk and increased product innovation.

In recent years, BNPL (buy-now-pay-later) disbursals in India have seen a remarkable growth of around 70% between FY21 and FY22. Furthermore, the embedded insurance market is expected to expand by approximately 80% over the next three years.