We look into the dark side of the pressure to grow and scale rapidly that has led to problematic sales tactics and mis-selling by startups

Move fast and break things — that’s the mantra that most startups live by. This not only manifests itself in the form of innovation or tech, but also scale and revenue growth.

But as the product and company matures, this streak of ‘aggression’ can lead to lapses in the culture, people management and even the business model itself. It’s one reason why the likes of BharatPe, Zilingo, Bikayi, Pristyn Care and others have been among the headlines recently.

So this Sunday we decided to look into the dark side of the pressure to grow and scale rapidly that has led to problematic sales tactics and mis-selling by startups. Is this a symptom of the lack of profits and unsound unit economics in many business models?

We will look to answer that, but first here’s a look at our top stories this week:

- ⏬ The Downfall Of Vauld: What is the fate that awaits the Coinbase-backed crypto lending platform after it halted operations in July. We go behind the scenes

- 🤝 Ola-Uber Merger? After reports of a potential merger, Ola and Uber have separately denied that the companies are in talks to join forces

- ⚔️ Edtech Battle Escalates: Coaching giants are looking to approach the Prime Minister’s Office (PMO) and other ministries against edtech’s expansion tactics

🥊 The Hard Sell Life For Indian Startups

Two stories this past week have revived the debate around the brutal sales culture at many startups and how employees are often forced to cut corners due to commissions, incentives and the pressure of targets.

Firstly, we dove deep into the disarray at Sequoia and YC-backed Bikayi, where we saw some sales people looking to game the incentive structure by signing up low-quality users throughout 2020 and 2021. As a result, Bikayi’s core SMB-focussed retail tech business is now struggling with revenue slowdown and also had to cull several of these sellers.

The drive to bring in as many customers as possible without a thorough assessment of their paying capacity has left Bikayi at a crossroads.

The other story was reported by The Morning Context, which looked at the sales tactics and underhanded methods alleged to be used by Pristyn Care to sell its surgery packages. The company’s salesforce allegedly coerced prospective customers into buying these packages through fear tactics and mischaracterizing the extent of any health issues.

And even before this the aggressive sales culture at BYJU’S and WhiteHat Jr have been highlighted with the edtech giant being accused of selling courses to parents without informing them about how its monthly payments worked.

🔢 Funding Chase Drives Sales Frenzy

While both stories are different in nature, the fact remains that Indian startups definitely have a sales problem. One could argue that the quest for rapid growth has forced these startups and others to cut corners to prove their product-market fit or show the scale that brings in the VC dollars.

In a rush to attract investors in the past year, startups have taken every step in the book — even unsavoury ones — to show growth and scale.

But the reality is that some models require a constant flow of sales — this is particularly true for models that are looking to disrupt long-tail, tech-shy segments. Think the likes of Zilingo which looked to revamp the fashion supply chain or BharatPe, which was looking to bring digital payments to paanwalas and other small retailers.

Both Sequoia-backed companies were hit by allegations of sales malpractices in the wake of the controversies related to their founders.

These B2B customers typically do not have great paying capacity because they don’t want to strain their margins, so the startups opted to scale up rapidly to play the high volume game. Another major problem is that without timely financial reporting, there’s no transparency when it comes to these sales practices or revenue recognition.

“You will only find such tactics in models where there is intense unit economics pressure. One can argue that even Zomato and Swiggy are exploitative with how often they show ads on YouTube and other social media,” according to the cofounder of a Delhi-based fintech startup, who was earlier a senior leader at a now-public tech company.

🎯 Will Regulations Target Sales Practices?

In the case of healthtech unicorn Pristyn Care, the situation is even more serious because it directly affects an individual’s quality of life. And it won’t be long before the long arm of regulators looks to clean up the sales tactics of Indian startups.

We could say that the government’s eye is on the edtech sector. According to recent reports, the Department of Consumer Affairs has reportedly taken a serious note of certain edtech companies in India over the alleged misselling of courses.

The aggression in sales and the hunger to sell at any cost could very well become a ticking bomb for other sectors as well. Besides tactics, the government’s attention might very well fall on other aspects related to sales such as revenue recognition, tax avoidance, GMV inflation and more which many say stem from the rush to raise funding.

⚠️ The People Caught In The Middle

“Startups are not great for work-life balance. We know that. But the pressure on the sales team is something else. Abusive language was a routine at Bikayi,” says a former Bikayi employee who was one of the 200-plus employees that have been asked to leave or terminated since May 2022.

And it’s not just Bikayi of course. BYJU’S, Unacademy have also reportedly seen incidents where managers have created a toxic work atmosphere. In the case of BYJU’S, a video of a manager abusing a subordinate a few years ago had even prompted the company to take down the video from most sites. But the startup attracted quite a bit of backlash before the scrubbing.

From 500-600 employees, Bikayi’s workforce has now gone under 200 as per the latest information from sources. Since our story was published on Thursday (July 28), several other employees have resigned as the mandatory move back to the office kicks in tomorrow (Aug 1).

As companies change their sales tactics and models amid the global slowdown and lack of easy VC money, they rely on technology and digital tools to drive growth and cut back on the salesforce.

We routinely hear that automation is the future, but many startups only turn to automation to save costs in a crisis, while hiring excessively when access to capital is easy, as we saw in 2021, the founder quoted above added.

The realisation that a people-heavy operation cannot possibly deliver sustainable growth comes only when things turn tough. And often it comes too late.

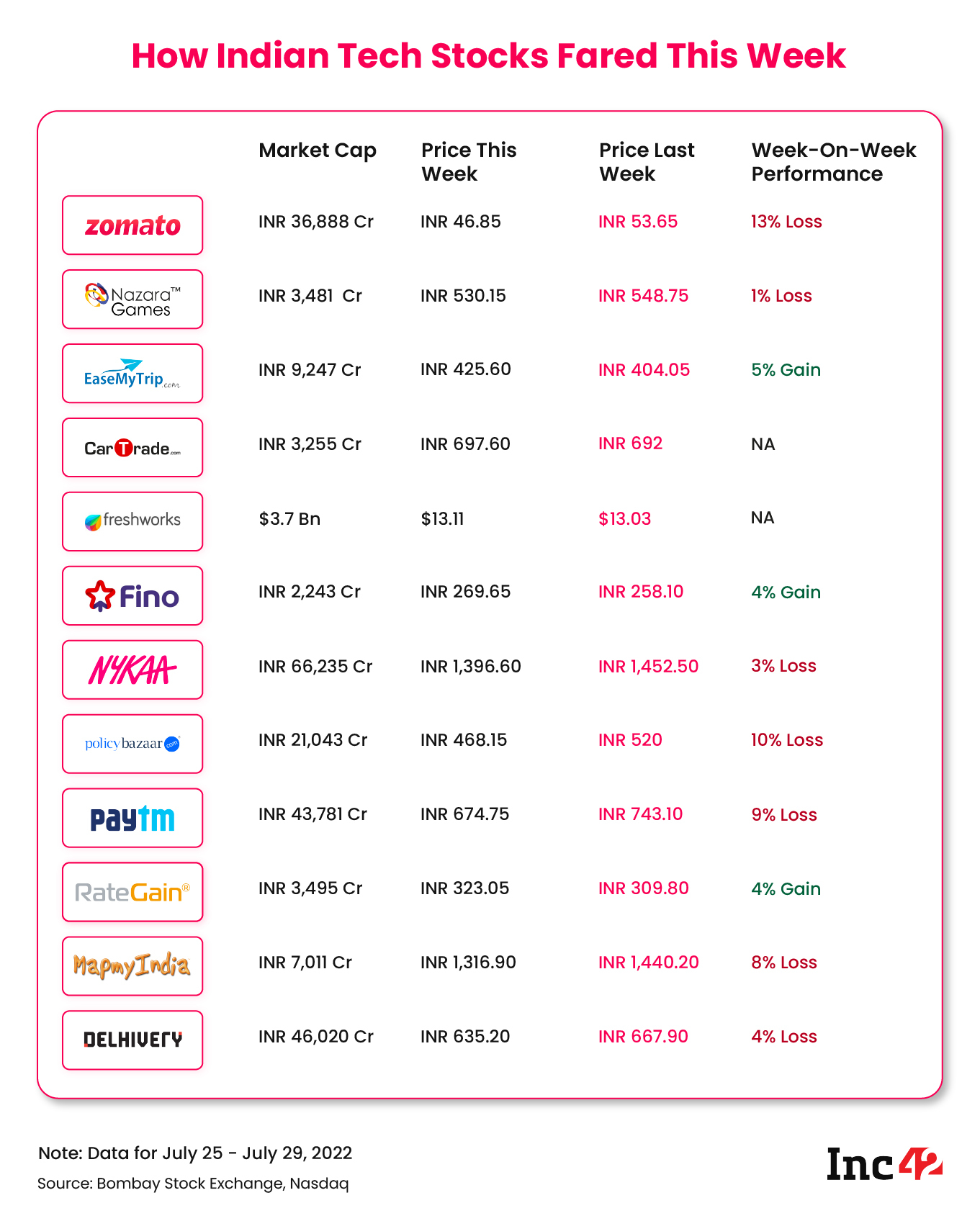

📊 Tech Stocks & Startup IPO Tracker

- 💥 Amid Zomato’s crash, Aswath Damodaran, known popularly as the dean of valuation, has pegged the new target price to be INR 35.32. Zomato closed the week 13% lower than the previous Friday

- 🪑 As a part of a restructure ahead of the $300 Mn IPO in India, Pepperfry’s management has redomiciled the company from Cayman Islands to Mumbai

- ✈️ IPO-bound ixigo reported a loss INR 21 Cr in FY22 as against a profit of INR 7.5 Cr last year as the second and third Covid waves hit travel demand adversely

- ⬆️ EaseMyTrip’s consolidated profit after tax more than doubled to INR 33.7 Cr in the April-June quarter, more than 2X the profits reported in the same period last year

- 🎮 Boosted by esports and real money gaming revenue, Nazara has reported 22% growth in profits at INR 16.5 Cr in Q1 FY23

- 🚘 CarTrade has turned around a profit of INR 3.31 Cr in Q1FY23 on the back of 47% YoY growth in revenue, while expenses shrank by 30%

Here’s how the past week has been for the listed tech companies we are tracking:

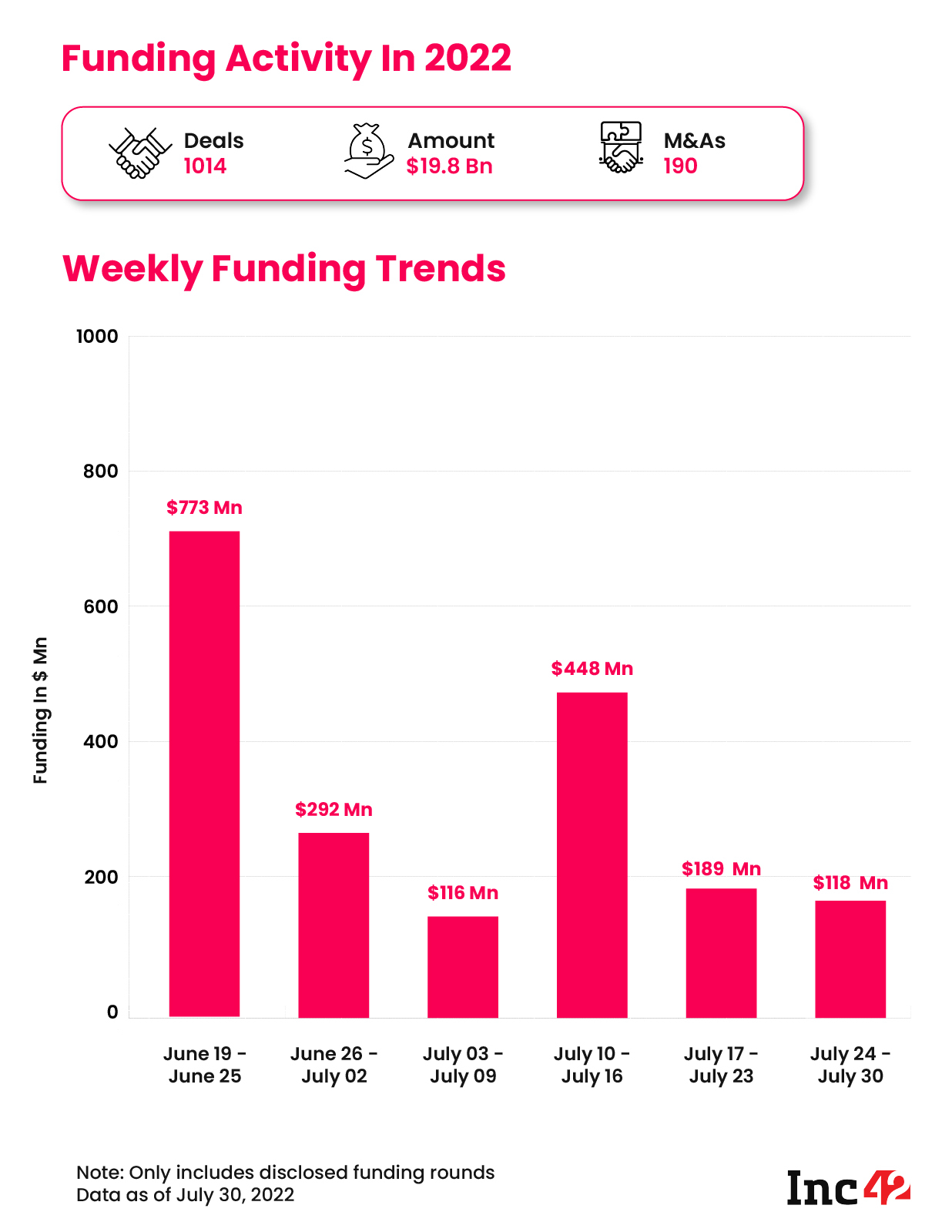

💸 Startup Funding Tracker

⭐ BYJU’S Controversy & Other Top Stories

That’s all for this week. Look forward to seeing you next Sunday with another weekly roundup.

![Read more about the article [Funding alert] Plix raises $5M from Guild Capital and RPSG Capital Ventures](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/Imagetozv-1639550068688-300x150.jpg)