India’s eB2B market is projected to grow from $5-6 billion in CY 2022 to $90-100 billion by 2030 at a compound annual growth rate (CAGR) of 40-45%, according to a report released by .

It stated that platforms catering to retailers constitute 70-80% of the eB2B market, while the remaining deal with wholesalers.

Mrigank Gutgutia, Partner at Redseer, noted that the market growth will be led by deepening penetration among retailers across categories and geographies, and a higher wallet share for eB2B platforms.

“Retailers will get habituated and reap the benefits offered by these platforms, such as cheaper procurement, faster deliveries, higher fill rates, and consistency in product quality,” he added.

According to the report, while general trade drives 83% of the overall $950 billion retail market, it makes up for more than 90% of the grocery market. The eB2B market is expected to solve the challenges in the unorganised retail segment dominated by general trade.

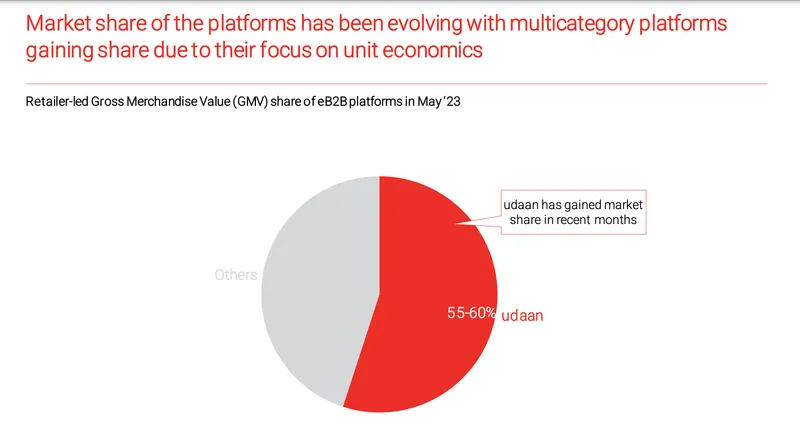

Redseer also observed that there are limited multi-category eB2B platforms with pan-India operations across categories such as grocery (staples and FMCG), electronics and accessories, general merchandise, fashion, and others. The rest of the eB2B platforms operate in fewer categories or verticals across regional and national levels.

“Over the last few months, many of these vertical platforms have been struggling, and across categories have shown limited growth/been flat or declined due to challenging unit economics and prevailing macroeconomic conditions, while multi-category platforms like have gained market share to reach 55-60% of the retailer-led eB2B market,” added Mrigank.

Image Source : Redseer Strategy Consultants

The report further added that the multi-category approach also helps optimise go-to-market (GTM) and credit costs.

Vertical platforms focused only on grocery or discretionary categories have a tough time managing GTM costs because of low retailer density, which results in lower throughput per feet-on-street (FoS), and because of low demand predictability. However, multi-category platforms optimise GTM costs by leveraging the same tech across all categories or portfolios and further through the aggregation of sub-categories within portfolios.

Reflecting on the credit costs, the reports noted that a multicategory first-party model leads to higher collection efficiency enabled by better underwriting efficacy and lower collection costs as the delivery agent helps with collection. Further, cross-leveraging the same collection infrastructure across all categories and sub-categories would also enable cost optimisation.