The rise of Banking-as-a-Service (BaaS) is creating a deep impact on the financial services landscape. The need for solutions that can enable intelligent banking and unlock new opportunities is required more than ever, especially when it comes to building scale and resilience.

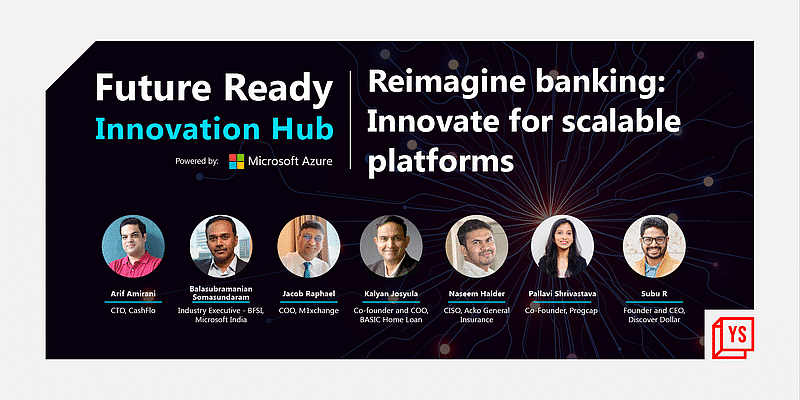

To understand the role APIs are playing in revolutionising the financial sector, along with the trends that will propel the growth of the financial services landscape in the coming years, Microsoft and YourStory co-curated a roundtable discussion titled ‘Reimagine banking: Innovate for scalable platforms’.

Naseem Halder, Chief Information Security Officer, Acko General Insurance; Jacob Raphael, COO, M1xchange; Arif Amirani, CTO, CashFlo; Pallavi Shrivastava, Co-founder, Progcap; Kalyan Josyula, Co-founder and COO, BASIC Home Loan; Subu R, Founder and CEO, Discover Dollar; and Balasubramanian Somasundaram, Industry Executive – BFSI, Microsoft India shared their thoughts on creating a wholesome customer experience, innovations in the insurance sector, role of collaborations, and more.

Evolution of the banking sector

Speaking about the recent shift in the financial services industry, Subu mentioned that the scope of innovation was limited in the space as most enterprises were risk-averse, and followed safe, global standards for technology.

“In the last couple of years, there is a huge interest and intent in the desire for innovation. People are willing to take risks with startups, try out new technology, and are also open to failures. It’s a great welcome change, and it’s only going to get better,” he added.

Kalyan shared that the emergence of new channels of banking has helped them gain more access to the masses. APIs are changing the way banking is done today, heralding a new era of neo-banking that can extend these features, even to rural areas.

As per experts, it is an exciting phase for the fintech sector and reiterating the same, Arif spoke about the democratisation of data that has steered innovation, bringing in new use cases. He also highlighted the benefits of data being accessible to all in India unlike other countries where data is available only to a select few organisations.

“There is also the rise of embedded finance. Today, financial transactions are no longer being thought of as a post-facto action; they are being embedded into every journey of the user, from social to business apps. We were looking at data in a dated format, especially when we were doing underwriting. Today, because the data is available in real-time, all the decisions are being made quickly,” he added.

Differentiated customer experiences

Balasubramanian shed light on customer-centric experiences and how organisations today work towards serving the customers’ needs in their entire lifecycle.

“Making the organisation customer-centric has three perspectives — How can we have a unified profile of the customer across different functions within the company? How do we tailor and create goal-centric customer experiences? How do we generate insights out of customer interactions?,” he said, adding that at Microsoft, they are consistently working at integrating the three clouds that they offer to create differentiated customer experiences at different touchpoints, for their clients.

Adding to Balasubramanian’s perspective, Pallavi spoke about the importance of product-market fit because one-size-fits-all isn’t a feasible solution for a business that’s looking to scale. She also mentioned that a good go-to-market strategy is also crucial for success. Pallavi also reiterated the importance of delivering a world-class uniform customer experience at scale, while navigating all the regulatory compliances and other challenges.

Innovation in the insurance sector

Speaking about the challenges in the insurance sector, Naseem explained the issue of insurance being equal for everyone irrespective of the requirements and lack of simplification and transparency in the insurance business.

“At Acko, we consider all the new technologies, so that we can offer a real-time underwriting of your data, and accordingly offer a real-time customised product to you,” he added while highlighting that with insurance being purchased online, the user has the option to access all the information right there so there is no assurance required from any third party.

Shift in the supply chain finance base

Highlighting the time when there would have been balance sheet assessments, ledger audits, background checks through references to avail funds or other banking services, Naseem mentioned how the last decade was a period of transformation for supply chain finance.

“Today, it is as simple as clicking the photo of your invoice and uploading, and the next morning you have the funds in the bank. The customer does not have to go through multiple verifications running pillar to post, to coordinate all the inspections,” he added.

The road ahead

With so much and more happening in the financial landscape, there’s a lot that is anticipated in the future. India is the world’s largest fintech ecosystem, next only to the US and China, and is expected to grow 22 percent year on year. Balasubramanian reiterated that the industry is looking forward to more collaborations and at the same time, it is critical to figure out how to leverage all the data, and meet the compliance requirements of the country in terms of data privacy, confidentiality, and making the system secure.