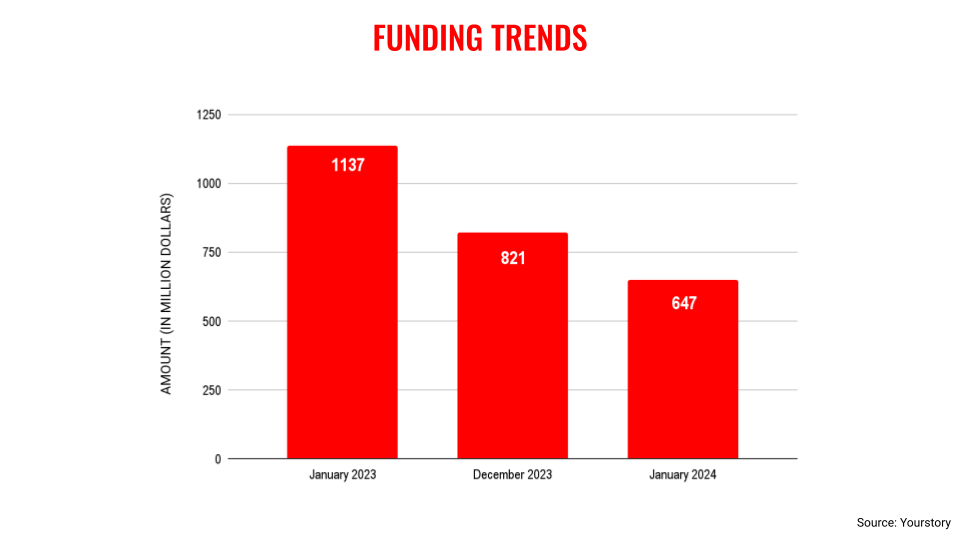

Indian startups raised $646 million in funding in January 2024, a 43% decline from $1.1 billion secured a year ago. Still, the amount is substantial given the challenging environment the ecosystem continues to face.

When compared on a quarterly basis, the fall in venture capital (VC) funding was 21% from December 2023 when the total amount raised was $820 million.

Given that the Indian startup ecosystem saw total funding of $10.8 billion for 2023—a 53% decline when compared with 2022—the expectation was low in terms of any sharp rebound in January 2024.

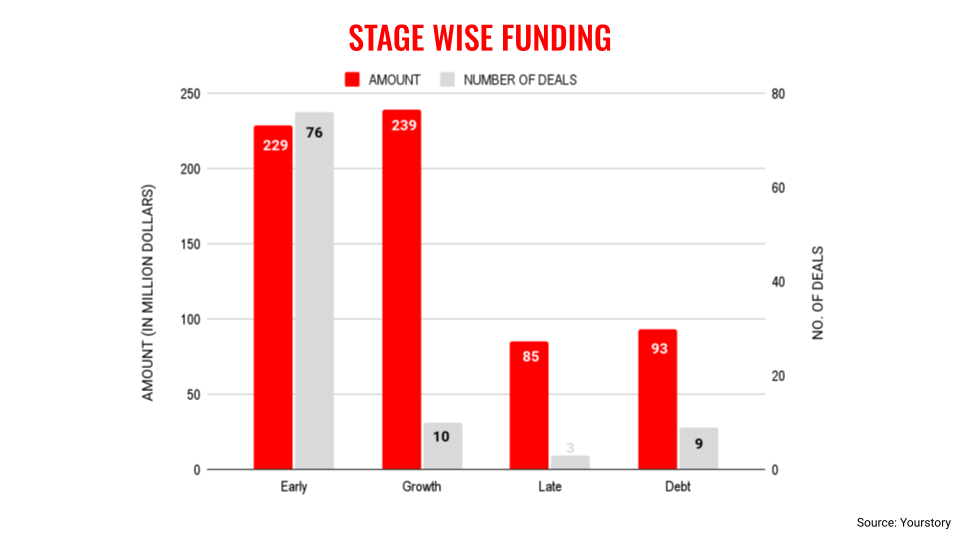

In total, January saw 98 deals, with the most activity in early-stage funding—a trend that follows from 2023 as investors continue to remain cautious about writing large cheques.

Only seven transactions this month were above $20 million, with the highest being $75 million secured by Vivifi Finance.

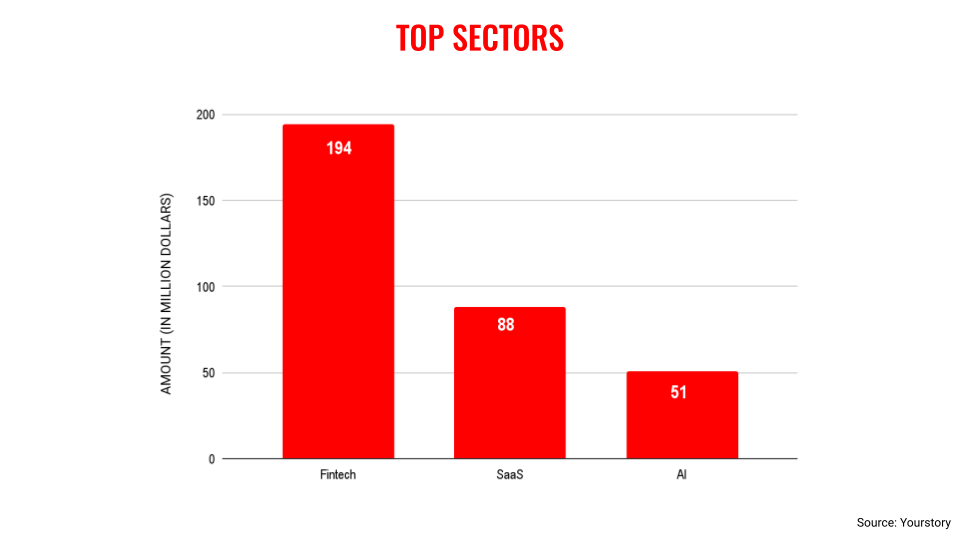

On a positive note, India finally saw the emergence of a new unicorn—a feat that has become rare in the startup ecosystem. Bhavish Aggarwal’s Krutrim, an Artificial Intelligence (AI) startup, entered the $1 billion valuation club in late January.

This also brings up another emerging trend in the ecosystem: heightened investor interest in AI startups.

However, the sector that topped the list in terms of VC funding for the month was the fintech segment, followed by software-as-a-service (SaaS) and AI.

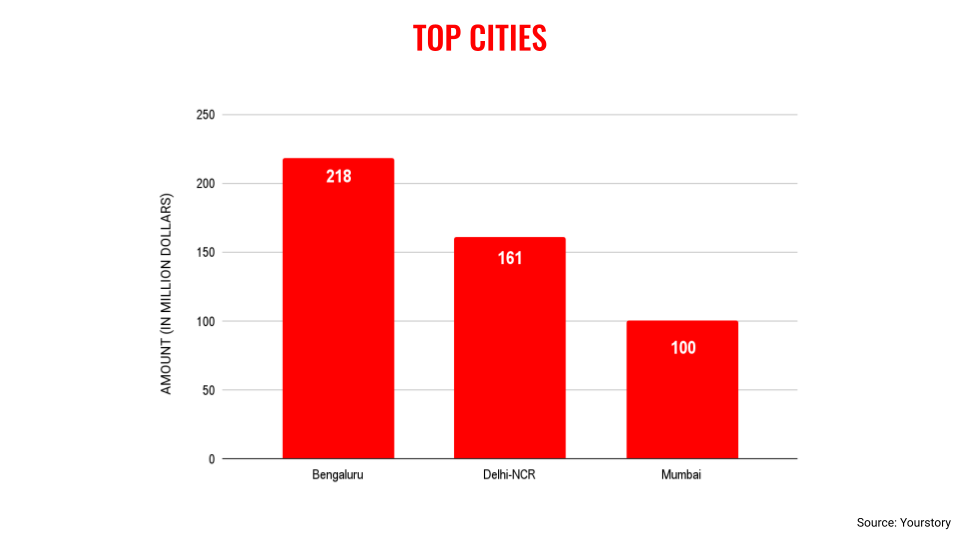

In terms of cities, the top three spots were taken by Bengaluru, Delhi-NCR, and Mumbai. By and large, there has been no change in this pecking order though investors are also looking at companies from other metros such as Chennai, Hyderabad, and Pune.

The VC funding for January is a continuation of the trend seen from July 2023 when the total monthly fundraise never crossed $1 billion except in October.

Given the underwhelming funding raised in January, the present trend is likely to continue for at least the first quarter of the year. Industry observers believe any pickup in the funding amount is likely to happen only in the second half of the year.

Edited by Affirunisa Kankudti

![Read more about the article [The Turning Point] This techie started an agritech startup to help farmers earn a fair price for their produc](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/startup-26-1577364095208-1619776248658-300x150.jpg)