Image credits: Leapfunder

Leapfunder, an Amsterdam-based platform that aims to help startups find early-stage financing, announced that it has published the “State of the Startup Market Q1 2022” report. The report explores the upcoming startup hubs in the Netherlands and Germany, as well as the important industries in which startups operate.

Here are the key takeaways from the report.

Has the Dutch workforce mastered all digital skills? Find out

Rotterdam for circular economy and health startups

According to the report, Rotterdam is a good hub for circular economy and health startups in the Netherlands. Equipped with co-working spaces and network events, the ecosystem in Rotterdam is worth checking out, adds the report.

Amsterdam, the capital of The Netherlands, remains the fastest growing startup hub currently in the country. In Q1 2022, around 16+ startups signed up with Leapfunder.

Emerging startup city

Hamburg is emerging as a startup city in Germany, says the report.

“It’s not uncommon for Berlin startups to travel to Hamburg in search of smart capital,” says the report. Over 13+ startups from Berlin signed up for Leapfunder, followed by Hamburg with over 6.

Field of startups

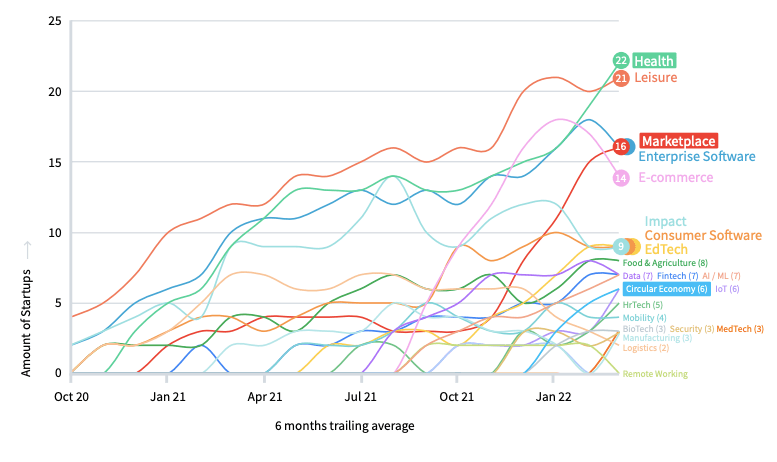

Leapfunder termed ‘Marketplace’ startups are the fastest-grower, Circular Economy startups as Interesting Newcomers, and Health startups as Biggest Overall. The rate at which startups have signed up with Leapfunder using specific industry tags can be seen in the image below.

Talking about the marketplace-related startups, Bas Rieter from Dutch Founders Fund says in an interview with Leapfunder, “We also see an uptick in (B2B) marketplaces, as current market conditions provide an opportunity for early-stage B2B marketplaces and platforms. The covid-19 pandemic and subsequent war in Ukraine put continued pressure on B2B supply chains. Moreover, market volatility increased over the last few months, but record levels of dry powder are available to support early-stage companies. The ongoing macroeconomic and geopolitical instability, combined with supply chain disruptions and continued emphasis on more transparent and sustainable supply chains are making B2B marketplaces more relevant.”

Sharing his advice for the investors, Rieter notes, “Following classic marketplace rationale, cutting out the middleman usually leads to margin efficiencies and is, therefore, the first thing we look at – how many nodes in the supply chain does this marketplace circumvent/cut out? We see that our best founders have usually been a middleman themselves – they have experienced first-hand what it’s like to deal with inefficiencies and bureaucracy. People who turned their frustration into a lucrative business are high on our list, also because they have extensive industry experience. So to answer your question I’d say they should really look for marketplace founders that know their industry (and pain points) well.”

Some of the Dutch startups that have signed up with Leapfunder recently include:

- GetEase

- Werktools

- Silatha

- Breeze

- CO2 Masters

- Whatifolution Holding

- I Like Local

- Wristler B.V.

- Aerolytix

- PreMal BV

- VindiQu BV

- Fitee V.O.F

- ProTouch Sta B.V

- BullsAI

- Saclé B.V.

- SEMiLLA Health B.V

- New Dutchmen

- Medical Device Development Group B.V

- Chopstick District

- WERI B.V and more

Catch our interview with Paul Down, Head of Sales at Intigriti.