Ola Electric filed its much-awaited draft red herring prospectus with the market regulator on Friday, giving it a headstart in becoming the first pure-play electric vehicle maker to go public in India.

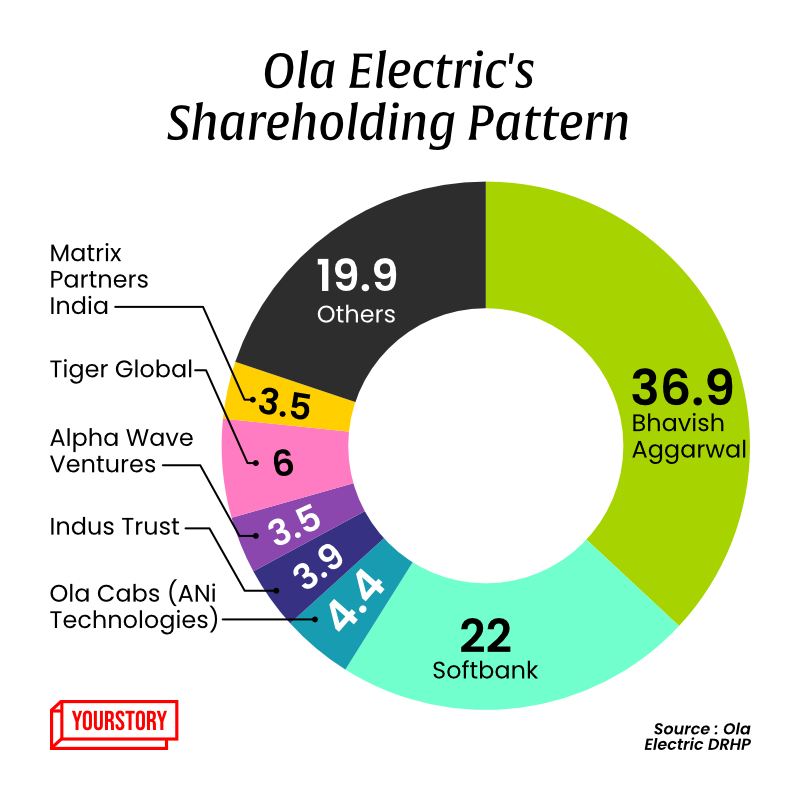

While the Softbank-backed company said it would issue fresh shares up to Rs 5,500 crore, it did not disclose the value of the ‘offer for sale’ shares. Still, the nearly 450-page-long document included interesting information about the company’s fund utilisation plans, updates on new products, technologies, and financial health, among many other details.

Here are the key takeaways from Ola Electric’s draft red herring prospectus (DRHP) filing:

Innovation drive and powering up the Gigafactory

The company said it will use the Rs 5,500 crore of proceeds from the fresh issue for expanding its cell manufacturing plant, research & development, repaying debt, and for organic growth initiatives through its Ola Electric Technologies unit, among other things.

Of that, a big chunk—Rs 1,600 crore—will be used for R&D investment over the next three years, with Rs 450 crore expected to be deployed in fiscal year 2025. Ola undertakes R&D activities in India, the United Kingdom, and the United States, focusing on developing new EV products and core EV components such as battery packs, motors, and vehicle frames.

Earlier this August, the company announced a line-up of four new electric motorcycles as well as the addition of three scooters namely Ola S1 X (2 kWh), Ola S1 X (3 kWh), and Ola S1 X+ to its current EV portfolio.

As per the DRHP, the company is aiming to commence deliveries of scooters by the first half of fiscal 2025 and bikes by the first half of fiscal 2026.

The company dedicated around 24% of its on-roll employees to R&D across product development, vehicle and software engineering, vehicle design and cell development. These funds will also be used for post-assembly tests on manufactured vehicles as well as on-road tests of prototypes.

During the last three fiscal years, Ola Electric had entered into working capital financing arrangements amounting to Rs 1,405 crore with Bank of Baroda, Axis Bank and YES Bank. As of October 31, payables outstanding related to these arrangements totalled around Rs 860 crore with interest rates running from 8.7% to 9.4%. The company plans to use around Rs 800 crore from its fresh issue towards repayment of these working capital loans and ease the pressure on its balance sheet.

Furthermore, Ola plans to utilise Rs 1,226 crore to fund its capital expenditure requirements for expanding Ola Gigafactory’s manufacturing capacity from 5 GWh to 6.4 GWh. The company will use this amount for construction, buying machinery, and utilities. The facility is expected to be operational by March next year, with the completion of Phase 1(a) and a capacity of 1.4 kWh.

Further, the company intends to use Rs 350 crore for business expansion. This involves investment in its organic growth initiatives with the specific purpose of covering rental expenses for its current experience centres, increasing the footprint of new experience centres, and expanding the network of its charging infrastructure.

The company plans to add 300 new experience centres to the current 935 and add an estimated 900 hypercharger guns by 2026. The rest of the fresh proceeds will be used to fund the day-to-day activities of the EV company.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Surging sales

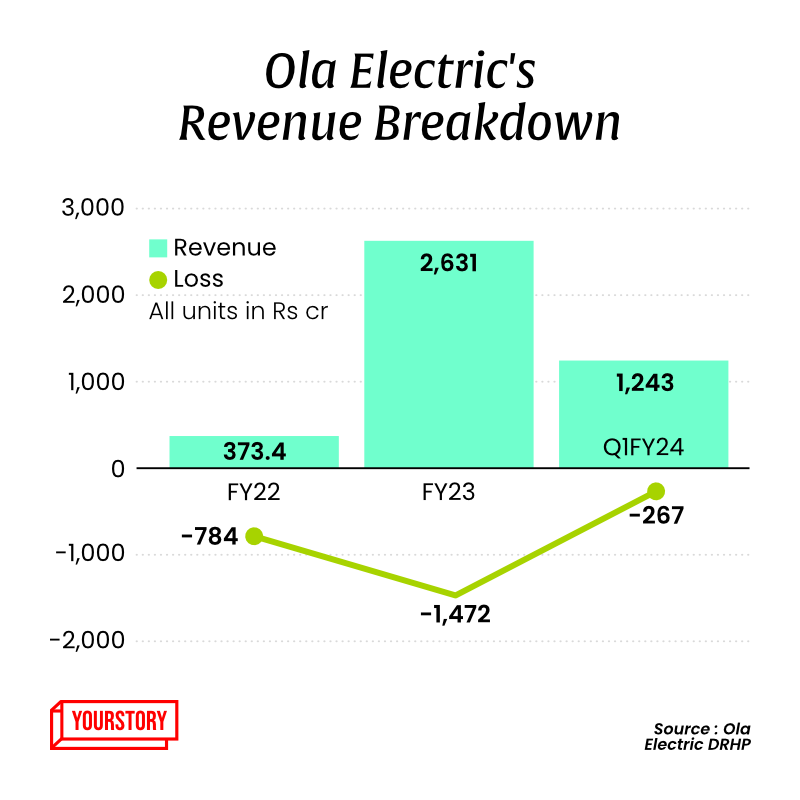

Since its first electric scooter launch back in 2021, Ola has seen a rapid rise in sales over time. While it sold a total of 1.56 lakh scooters in the financial year ended March 2023, the current fiscal year’s first quarter sales—at 70,000 units—have alone touched nearly half of that.

With rising sales, the company’s revenues too have surged. Ola Electric recorded revenue from operations of Rs 1,242.7 crore for the first three months of fiscal year 2024, compared with Rs 2,630.9 crore in the whole of FY2023.

Of about 8.3 lakh electric two-wheelers sold in 2023, Ola Electric garnered a market share of over 30% with 2.54 lakh registrations of its scooters, as per the latest data from the transport department’s Vahan database. Since the opening of its first experience centre in September 2022, it has expanded the network to 935 such centres as of October 2023, according to the DRHP.

Challenges

With reports of incidents of Ola Electric’s scooters catching fire in the recent past, the company, in its DRHP, mentioned any such cases of fire or smoke emitting from lithium-ion cells used in its vehicles was one of the risk factors as it could result in “adverse publicity”.

For instance, Ola cited that, on March 26, 2022, one of its Ola S1 Pro scooters caught fire in Pune, Maharashtra. It said that it received a show cause notice from the joint secretary to the Government of India, Ministry of Road Transport and Highways on May 31, 2022, for initiation of proceedings under the Motor Vehicles Act, 1988, “stating that the cells used in the Ola S1 Pro failed the nail penetration test conducted at the Naval Science Technological Laboratory by the Centre for Fire, Explosive and Environment Safety, Defence Research and Development Organisation and that the cell was not sorted by capacity.

Even though the company filed its response to the notice that any further proceedings arising out of the notice should be dropped citing certain grounds, the authority imposed a penalty of Rs 15 lakh, which Ola paid.

The company has also mentioned that it has been made a party to certain proceedings before various consumer dispute redressal commissions by its customers alleging non-delivery of vehicles, delivery of defective vehicles, improper servicing, and so on. There are 189 such matters against Ola involving an aggregate amount of ₹4.5 crore, according to the DRHP.

It also added that its customers can charge their scooters at its standard and hyper charger guns for free until December 31, 2023, after which, it may charge for such services and such a policy change could result in customer dissatisfaction and deter some customers from purchasing its scooters.

But the regulatory challenges don’t end here. In March this year, Ola Electric received a show cause notice from IFCI Limited alleging that it had been skirting the regulations for FAME subsidies by mispricing the ex-factory price of its EV scooters by selling chargers and intrinsic software separately and importing parts directly and indirectly through various domestic supply companies. As a result, the release of the subsidies was put on hold. The company had to change its policies by including chargers in the total ex-factory price and refunding Rs 142 crore to its existing customers who had bought the scooter earlier.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

In May 2023, the company faced a second setback in terms of subsidies when the government reduced FAME subsidies for electric two-wheelers from 40% of the EV cost to 15% of the ex-factory price, effective June 1, 2023. Consequently, the retail prices of Ola S1 and Ola S1 Pro increased by Rs 22,784 and Rs 37,106, respectively. This led to a substantial 58.1% month-on-month decline in orders for June 2023 compared to May 2023. Ola Electric heavily relies on government subsidies through schemes like PLI (Production Linked Incentive) and FAME (Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles), and the reduction in these subsidies poses a potential threat to its competitive advantage due to higher prices, thereby impacting its business and financial performance.

Apart from the dynamic regulatory environment, the EV mobility company is also facing the challenge of attracting and retaining super-specialised talent for its EV manufacturing and designing operations. The company mentions in the DRHP its dependence on acquiring talented employees with niche expertise in the nascent electric mobility industry along with its high attrition rate of 42.1% for fiscal 2023 and 47.5% for April-October 2023.

Tesla model coming to fruition supported by govt initiatives

Ola is trying to lead the EV race in India by largely emulating the Tesla model by adopting a vertical integration strategy. This involves owning and building the entire ecosystem of vehicle manufacturing and battery manufacturing and operating D2C distribution across the country.

According to the DRHP, Ola’s EV hub, which it is building in Krishnagiri and Dharmapuri districts in Tamil Nadu, is pivotal to creating an EV supply chain ecosystem that is efficient and resilient. The hub includes its Futurefactory for vehicle manufacturing, the upcoming Ola Gigafactory for cell manufacturing, and co-located suppliers in Krishnagiri district. 700 acres of land has been reserved by the Tamil Nadu government for two years for allotment to its suppliers that co-locate within the EV hub in accordance with a memorandum of understanding in February this year. Currently, three of the company’s direct and indirect suppliers are co-located in the hub.

As the company imports EV components from China including battery cells, it has also incorporated a subsidiary in the country to bring the sale of electronic materials and import and export of goods and technologies under its ambit.

Its unit Ola Electric Technologies also acquired some business undertakings of group company Ola Fleet Technologies for Rs 136 crore in July. Ola Fleet was operating its experience centres and service centres until June this year, for which Ola Electric was paying a fee.

Among other things, the company highlighted that operating company-owned experience centres grants it agility in adapting to market changes and allows it to implement new product launches, updates and adjustments in service protocols swiftly.

By FY25, Ola also intends to further its offerings of more affordable Ola S1 models to target the business-to-business and last-mile delivery segments. Moreover, it also facilitates financing for customers for its scooters through its group company Ola Financial Services and in partnership with 12 financial institutions that offer loan tenures of up to five years. Its arrangement with Ola Financial also includes the distribution of insurance policies for its EVs.

Ola, with all its aggressive expansion plans and push to become a prominent EV player, has been a beneficiary of PLI schemes. The company, citing a Redseer report, said it is the only EV manufacturer in India that is a beneficiary of two PLI schemes—for cell and automotive manufacturing. Under these schemes, the company is eligible for cash incentives for all the advanced chemistry cells and EVs that it manufactures and sells.

Additionally, under its MoU with the Tamil Nadu government, it has been awarded a package of capital and revenue assistance for setting up an industrial project in the state. Accordingly, Ola Electric recognised a revenue grant aggregating to Rs 1.7 crore and a capital grant of Rs 175.8 crore.

(Disclaimer: Shradha Sharma, Founder and CEO of YourStory, is an independent director in Ola Electric.)

Edited by Jarshad NK