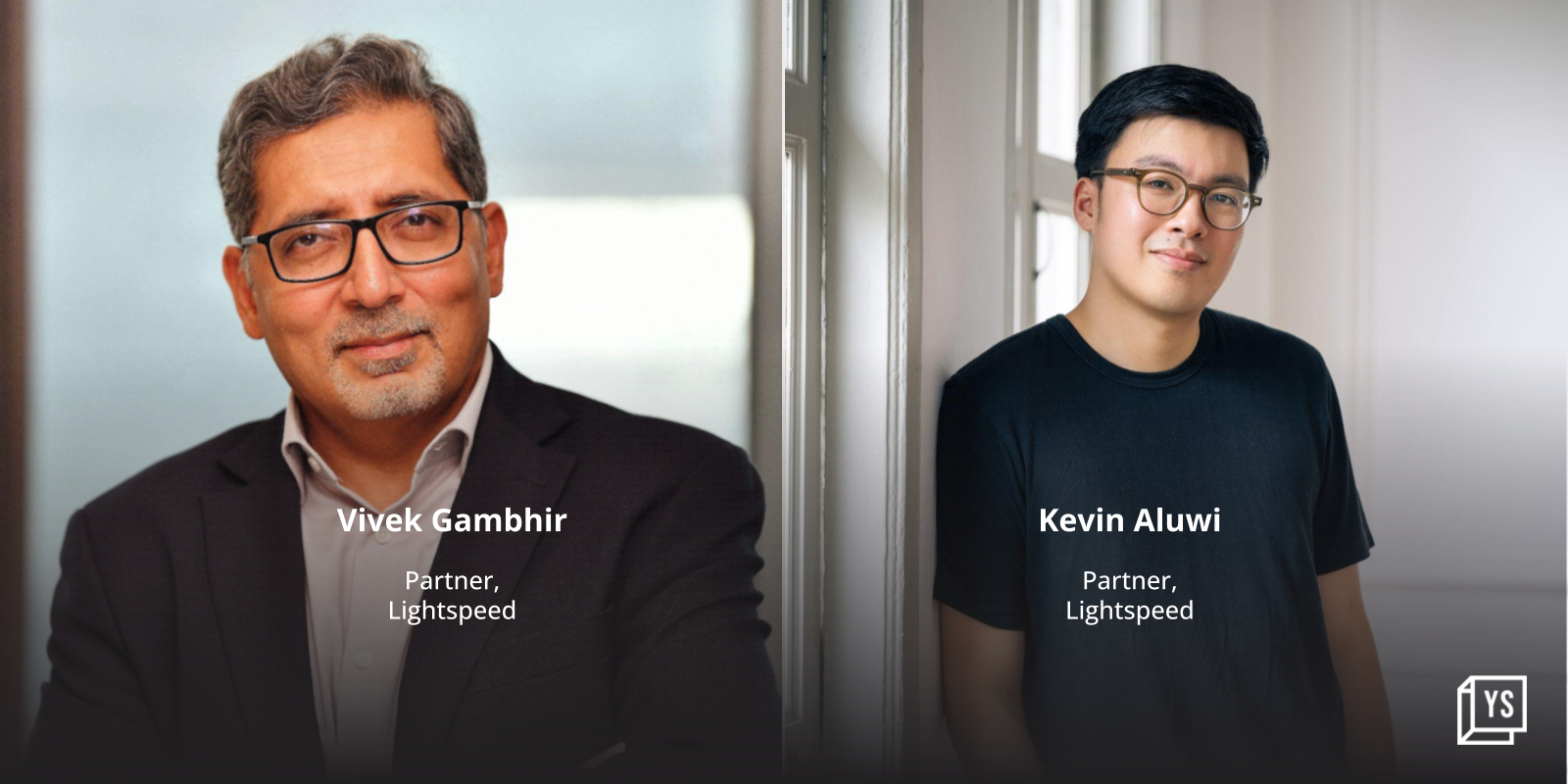

Early-stage venture capital firm Lightspeed Venture Partners has inducted two seasoned professionals, Vivek Gambhir and Kevin Aluwi, as partners.

Gambhir is a management professional with 30 years of experience as CEO, chief strategy officer, and board member in the consumer goods and consumer technology domains and management consulting in India and the United States.

Till recently, Gambhir was the CEO of boAt and later became a board member. He was also CEO at Godrej Consumer Products Limited. Prior to Godrej, he was a founding member of Bain & Company’s consulting operations in India. He also serves on the boards of Metropolis Healthcare, Honasa Consumer (Mamaearth), and Samast Technologies (Magic Pin).

According to a statement from Lightspeed, Gambhir specialises in partnering closely with founding teams to scale up their businesses.

Aluwi was most recently Co-founder and CEO at Gojek, a multi-service digital platform for Southeast Asia.

<figure class="image embed" contenteditable="false" data-id="535996" data-url="https://images.yourstory.com/cs/2/e641e900925711e9926177f451727da9/shutterstock601189310-1598434726276.png" data-alt="Venture Capital" data-caption="

” align=”center”>

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

On the new appointments, Bejul Somaia, Partner, Lightspeed said, “In their roles as venture partners, they will be collaborating with founders, shaping their journeys, and contributing to the growth and development of our portfolio companies in the region.”

Lightspeed has a presence across the United States, Europe, India, Israel and Southeast Asia, with $25 billion in assets under management across sectors such as enterprise, consumer, health and fintech. Its key investments in India include OYO, Udaan, Innovaccer, PocketFM, Darwinbox, and Razorpay.

Edited by Swetha Kannan

![Read more about the article [Funding roundup] FreshR, Spardha, PMaps, TGP raise early-stage capital](https://blog.digitalsevaa.com/wp-content/uploads/2022/06/spardha-1654763165974-300x150.jpg)

![Read more about the article [Funding alert] AR startup Plutomen raises $300k from GUSEC Seed Fund, DeVX Venture Fund, and HNIs](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Image15j5-1624433581283-300x150.jpg)