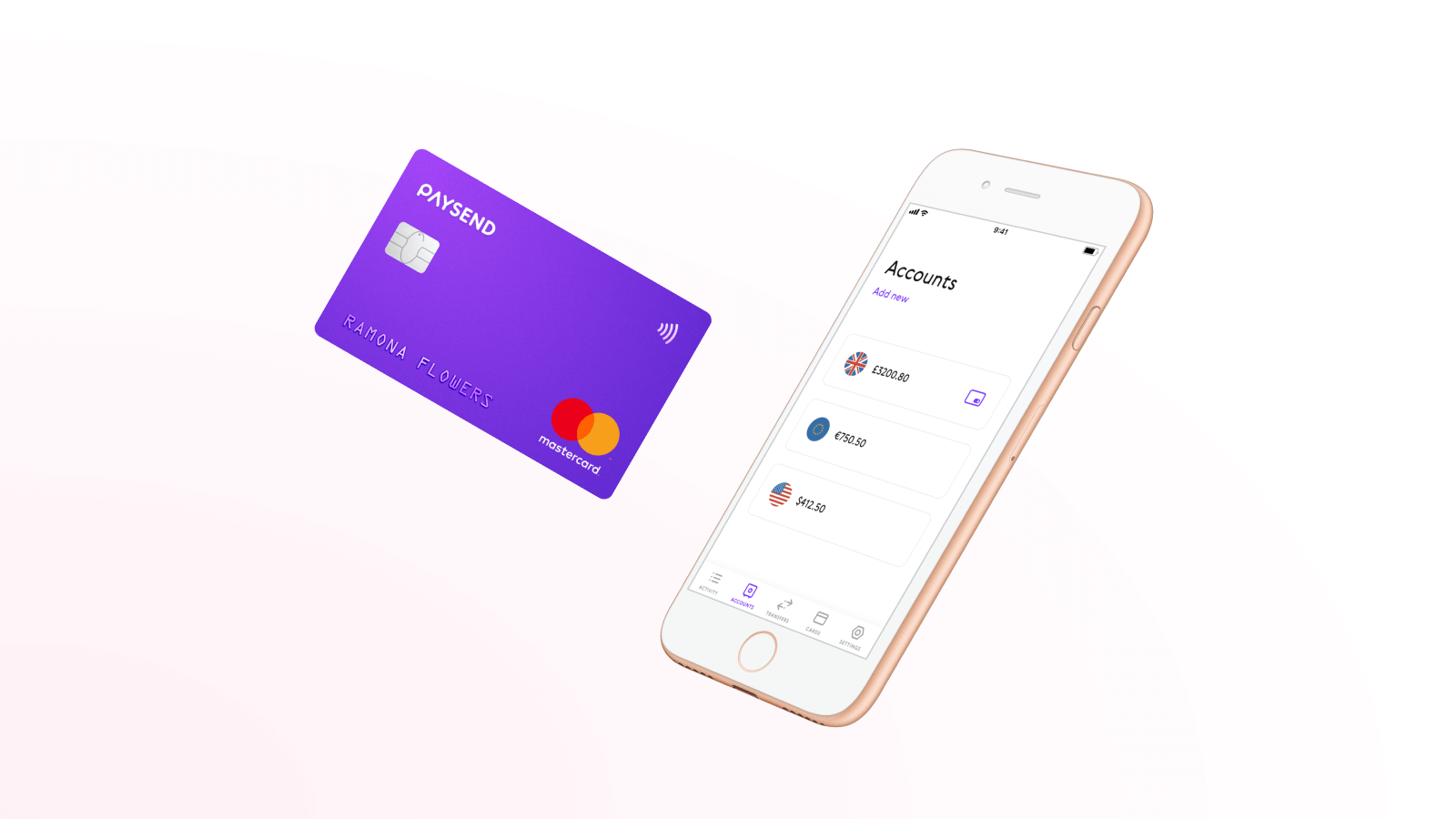

Image credits: Paysend

Investment in Fintech has been growing since the last global financial crisis. It is largely a technological response to the shortcomings of the traditional financial services industry, which came under extreme pressure during and after the crisis.

London-based Paysend is one such company that was born out of frustration by the time and complexity of traditional bank systems.

Here are the ten top international startups shortlisted for the 2021 Future Hamburg Award

Secured €102M

Recently, the UK fintech company has secured $125M (approx €102.4M) funding in a Series B funding round led by One Peak. According to TC, the company is currently valued at around $720M.

Other investors like Infravia Growth Capital, Hermes GPE Innovation Fund, and existing long-term investors including Silicon Valley-based Plug and Play, also participated.

One Peak is a growth equity firm investing in technology companies in the scale-up phase. The funding will be used to expand its international footprint and speed up product innovation, targeting the $133T (approx €109T) opportunity in the cross-border payment industry.

Next-gen money transfer platform

Founded by Abdul Abdulkerimov and Ronnie Millar in 2017, Paysend is a next-generation money transfer platform allowing its users to send funds from card to card from 40 to over 60 countries. Notably, 90 per cent of the arrives in 15 seconds or less, claims the company.

The fintech company has its global network of banks, international and local payment systems. It has partnerships with the major international card networks Visa, Mastercard, and China Union Pay as a principal member and certified processor.

The UK company has opened its US and Canada operations and secured a partnership with Alipay to grow its global footprint. Paysend claims to removes the need for third-party acquirers or processors, delivering savings and efficiency back to end-user consumers and SMEs.

The company’s card-to-card service slashes fees by as much as 60 per cent, with instant transfers through the Paysend app, unlocking up to $5.4B (approx €4.4B) in annual savings for consumers and SMEs by 2025 and millions of hours.

3.7M consumer

Right now, it has 3.7 million consumers using its transfer and global account services and over 17,000 businesses to its platform. It provides over 40 payment methods for online SMEs.

Paysend currently supports connections between 12 billion cards globally across Mastercard, Visa, China UnionPay, and local card schemes.

Partnership with Plaid

Last month, the fintech company announced a collaboration with Plaid, an open finance platform, and financial data network, to provide customers with a more streamlined experience in connecting and transacting from their bank accounts to Paysend’s money transfer app.

As a part of the partnership, Plaid will provide instant authentication when customers are redirected to third-party banking providers to speed up Paysend’s transactions.

According to the company, this will eliminate the need for Paysend customers to enter their online banking login details or conduct manual bank transfers, reducing the time it takes to connect accounts and make transfers by 80 per cent.

Ronnie Millar, CEO at Paysend, comments, “ This $125M B Round investment will allow us to take our platform to the next stage, innovating and expanding geographically to target the $133T opportunity in cross-border payment flows. There remain significant barriers to entry for consumers and SMEs to pay and send money globally; our platform aims to democratise the service by providing a one-stop-shop to pay and send money to families, suppliers, employees, and partners in any currency anywhere in the world at a significantly reduced cost.”

Here’s how to build one that doesn’t, according to this expert…