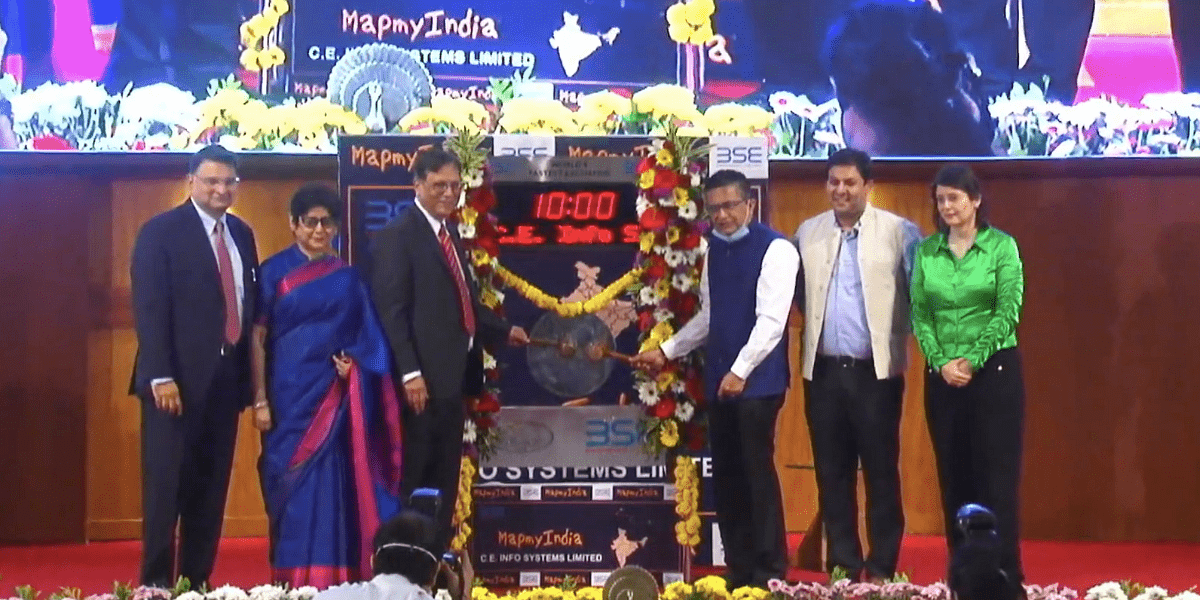

Location and geospatial technologies company C.E. Info Systems, which operates MapmyIndia, listed on the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange of India) at Rs 1,581 per share and Rs 1,565 per share respectively, on Tuesday.

C.E. Info Systems opened 53 percent higher than the issue price of Rs 1,033 per share on the BSE. Similarly, on the NSE, it opened 51.5 percent higher than its issue price.

“It is the passion of the teams and efforts of MapmyIndians that we could take up the task of building the digital map of our country,” said Rakesh Verma, Chairman and Managing Director of C.E. Infosystems, which trades on the stock exchanges with ‘MAPMYINDIA’ ticker.

The Rs 1,040-crore IPO of MapmyIndia was oversubscribed by 154.7 times in total.

“Listing Mapmyindia is an important milestone for our strategic vision, combined with a good execution process driven by people, culture and customers,” said Rashmi Verma, Co-founder and Chief Technology Officer of C.E. Infosystems, at the listing ceremony at BSE.

MapmyIndia, she said, has a great future ahead based on three factors: rise of new data sources, machine learning and artificial intelligence, and evolution of user requirements like smart city, connected mobility, and real-time applications.

“This is boosting the demand for products and solutions,” Rashmi said. “We are making significant investments in platforms and technologies.”

Rohan Verma, CEO of MapmyIndia, said, the company will stay focused on building a strong business with strong fundamentals.

C.E. Info Systems was founded in 1995 as a service for enterprises around digital maps of India.

It has an active client base of 500 enterprises, though it depends on a smaller number of customers for a significant portion of its revenues.

It clocked Rs 192.3 crore in total income in fiscal year 2021.

The number of customers that account for 80 percent of MapmyIndia’s operational revenue was 17, 22, 25 and 18 in FY 2019, 2020 and 2021, and in the six month period ended September 30, 2021, respectively, according to its red herring prospectus.

The MapmyIndia stock touched a high of Rs 1586.85, up 53.6 percent compared to its issue price on the BSE. At it’s listing day low of Rs 1,282.2 a share, the stock was down 24.1 percent compared to the issue price.

Also at the day’s low, the stock was down by 19.2 percent in comparison to its day’s high.

At the end of the day’s trade, MapmyIndia closed at Rs 1,394.55 per share. While this was 35 percent higher than the issue price, it was lower by 11.8 percent and 12.1 percent than the opening price and day’s high on the BSE respectively.