reported strong top and bottom line numbers for the quarter ended March 31, 2024, fueled by advancements in artificial intelligence (AI) integrated into its cloud. The company’s stock surged about 5% during after-hours trading.

The Windows maker’s net profit in Q3 FY24 surged 19.8% to $21.9 billion from $18.3 billion in the corresponding quarter last year. Its revenue increased 17% to $61.8 billion in the quarter from $52.8 billion in the year-ago period.

“It was a record third quarter, powered by the continued strength of the Microsoft Cloud,” said Satya Nadella, Chairman and Chief Executive Officer of Microsoft, during the earnings call.

In Q3, Microsoft Cloud revenue reached $35.1 billion, up 23% year-over-year, “driven by strong execution by its sales teams and partners.”

Microsoft is a key player in the cloud computing industry, competing with Amazon Web Services and Google Cloud. During Q3 FY24, it clocked a 31% year-on-year revenue growth in Azure and other cloud services.

“The number of Azure AI customers continues to grow—and average spend continues to increase,” Nadella remarked.

He said the number of $100 million-plus Azure deals increased over 80% year-over-year, while the number of $10 million-plus deals more than doubled.

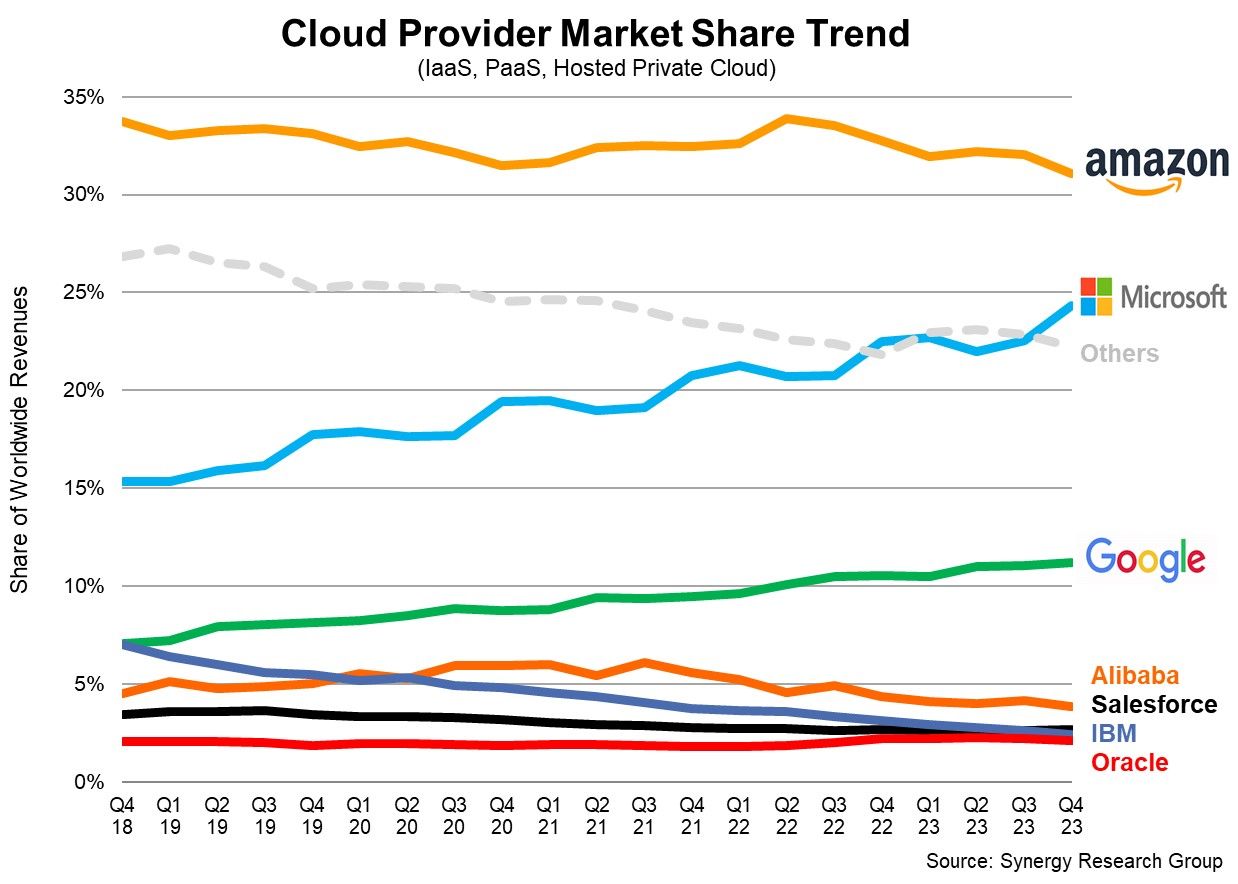

Microsoft strengthened its competitive positioning among the largest cloud providers, increasing its worldwide market share by almost two percentage points in Q4 2023 compared to the previous year, reaching 24%, according to data from Synergy Research Group.

<figure class="image embed" contenteditable="false" data-id="543380" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/CISQ423-1714107097139.jpg" data-alt="Cloud market share" data-caption="

Image credit: Synergy Research Group

” align=”center”>

Image credit: Synergy Research Group

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Business segments

The Redmond-headquartered firm broadly categorises its revenue under three segments—productivity and business processes, intelligent cloud, and more personal computing.

Microsoft’s productivity and business processes clocked in $19.6 billion in revenue in the quarter, up 11.7% year-over-year. Revenue for intelligent cloud, which includes the Azure cloud computing platform, rose 21% to $26.7 billion in the March-ended quarter.

Revenue for more personal computing—which includes revenue from Windows OEM, devices, Xbox content and services, search and news advertising, and Windows Commercial products and cloud services—was up 17.5% at $15.6 billion in the quarter.

Speaking about gaming, Nadella said the firm set records for game streaming hours, console usage, and monthly active devices in Q3. It is expanding its games to new platforms, bringing four of its fan-favourite titles to Nintendo Switch and Sony PlayStation for the first time.

In gaming, revenue increased 51%, with 55 points of net impact from the Activision acquisition, said Amy Hood, Executive Vice President and Chief Financial Officer of Microsoft, during the earnings call. She added that results were ahead of expectations primarily driven by the Call of Duty game.

On October 13, 2023, Microsoft completed the acquisition of Activision Blizzard, the developer of Call of Duty, marking its largest-ever and the gaming industry’s biggest deal. Xbox content and services revenue increased 62%, with 61 points of net impact from the Activision acquisition, she noted.

Microsoft has been rapidly infusing AI across every layer of the tech stack and every role and business process. In the third quarter, its AI-driven capital expenditures approached $1 billion.

In LinkedIn, the firm’s business and employment-oriented online service, new AI features are helping accelerate LinkedIn Premium growth, with revenue up 29% year-over-year.

“Features like LinkedIn AI-assisted messages are seeing a 40% higher acceptance rate and are accepted over 10% faster by job seekers, saving hirers time and making it easier to connect them to candidates,” he added.

Speaking about the outlook, Hood noted that the company expects capital expenditures to increase materially on a sequential basis driven by cloud and AI infrastructure investments.

“We are leading the AI platform wave and are committed to bringing that value to our global customers as we enter the final quarter of our fiscal year,” she said.

Edited by Suman Singh

![Read more about the article [Funding alert] Mamaearth raises $52M led by Sequoia at $1.2B valuation](https://blog.digitalsevaa.com/wp-content/uploads/2022/01/Imageqanx-1589042485564-300x150.jpg)