Multiples Alternate Asset Management (“Multiples”) has announced the successful first close of its Fund IV, with a subscription of over USD 640 million. This major fundraise further establishes Multiples as a leader in India’s domestic private equity market.

Fund IV brings together a diverse range of investors, including global institutional investors like the Canada Pension Plan Investment Board (CPPIB) and International Finance Corporation (IFC), local institutions such as State Bank of India (SBI) and private insurance companies, and leading domestic family offices.

Sudhir Variyar, MD & Deputy CEO of Multiples Alternate Asset Management, expressed his excitement about the future prospects of the fund: “This fundraise is yet another important milestone in the growth and evolution of Multiples as an institution providing wings to the dreams and aspirations of entrepreneurs. We are excited about the India opportunity and the tremendous entrepreneurial energy that’s propelling the country forward.”

He also acknowledged the trust placed in Multiples by its investors, and pledged to continue creating value and delivering consistent cash-on-cash returns.

Multiples Private Equity is India’s leading private equity platform, recognized for its long and successful history of partnering with Indian entrepreneurs. The firm has backed 30 Indian businesses in building aspirational, distinctive, and responsible ventures. Multiples focuses on core sectors such as financial services, pharma & healthcare, consumer, and technology.

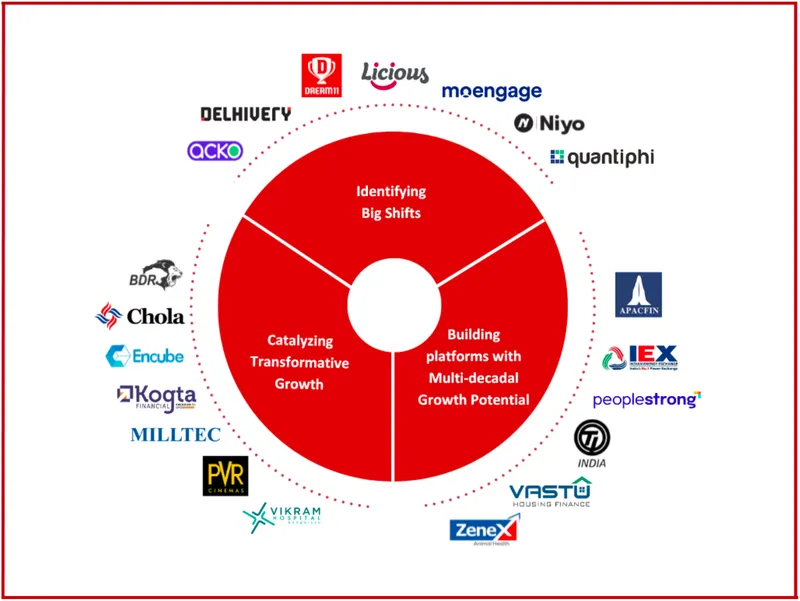

Some of the company’s most notable investment partnerships include Encube, Zenex, PVR, Delhivery, Dream Sports, Quantiphi, Vastu Housing Finance, ACKO, Licious, and MoEngage. Multiples seeks opportunities that benefit from significant shifts in its chosen sectors, collaborating with exceptional entrepreneurs and management teams to create transformational growth.

Over the past decade, Multiples has specialized in three main strategies: a) identifying tech-led big shifts and investing in them at their inflection point, b) catalyzing transformative growth, and c) investing in platforms for multi-decadal growth potential. This approach has enabled Multiples to deliver exceptional performance across industries and timeframes.

In an earlier interview with Yourstory, Renuka Ramnath, Founder, MD & CEO of Multiples, shared that the Multiples team believes in bringing both heart and mind to their work as investors. Her overall message to startups is to chase purpose over valuation.