India is home to over 600 D2C brands, estimated to have reached a market size of around $55 billion in 2022. D2C brands enjoy greater flexibility in adapting, realigning, and launching new products due to streamlined operations and efficient supply chains. By tapping the D2C channel, companies forge emotional connections with their customers, creating a distinct brand identity and a compelling value proposition.

The rise of D2C or digital-first brands has been significant. These brands leverage online platforms to sell directly to consumers, bypassing the traditional distribution network of wholesalers, stockists, and retailers.

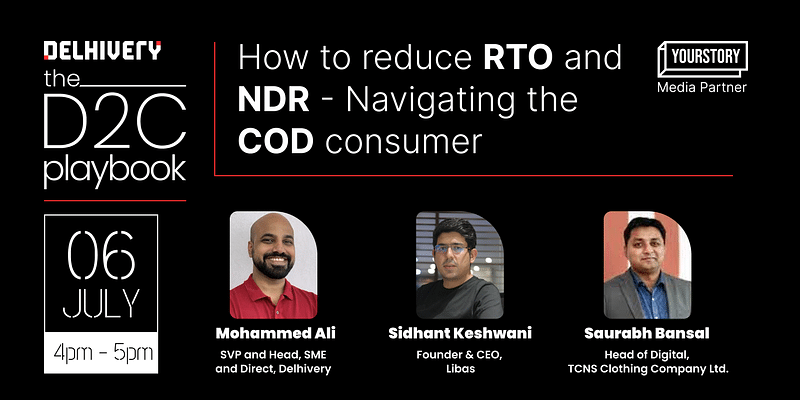

Delhivery, in association with YourStory, hosted an in-depth discussion with industry experts and founders, Mohammed Ali, SVP and Head, SME and Direct, Delhivery; Saurabh Bansal, Head of Digital, TCNS Clothing Company Ltd; and Sidhant Keshwani, Founder and CEO, Libas; on how to reduce RTO and NDR- Navigating the COD consumer.

The general dilemma

“In the B2C space, there’s one common problem amongst brands. Everybody’s either trying to tackle COD’s or return-to-origin. That has also been one of our problem statements. It’s been two years now since we began solving it and I think we’ve come a long way. But, of course, even after all the tech implementation, it still remains a recurring problem,” Keshwani said.

Despite going digital, one factor that influences buyers to shop online is cash payments. About 80% of shoppers from Tier I and Tier II cities prefer cash on delivery as a payment method. Meanwhile, in metropolitan cities such as Delhi, Mumbai, and Bangalore, prepaid payment methods are more popular.

A behavioral change is observed as customers get more comfortable and return for more purchases: they move to alternative payment methods.

“There is a dearth of brands and channels here. But, fundamentally what we see is that India is a trusted market for brands to build trust. With any channel, it takes time to build that trust. For a new customer acquisition, or for a consumer who’s buying after a long time, COD rates are still pretty high. We don’t incentivise consumers who opt for prepaid. So we find a split between COD and prepaid consumers across random sites. The gap has reduced drastically with the advent of UPI,” Bansal said.

He added that in womenswear brands, specifically listed brands, their share of offline brands is higher for the overall online business. In more premium marketplaces, like Myntra or Nykaa, the share of prepaid is much higher for his company’s brands. In marketplaces that offer more discounts, the COD share continues to be higher.

Digitisation and its impact on purchase patterns

Keshwani said India is moving towards digitisation, and the government is doing a great job digitising the economy. “There’s not much new customer acquisition happening in metros. Those customers have already shopped online and have had multiple transactions. So, in metros, the prepaid rate is always going to be higher. The next level of growth is really coming from Tier II and Tier III cities. And I think we are still at the cusp,” he said.

Today, people are looking for more frictionless solutions. When the confidence level of consumers in smaller towns starts growing over the next one or two years, there will be a shift in consumers opting for prepayment solutions.

Keshwani shared an interesting example regarding ordering online.

“If I’m ordering from my house and I’ve had a really smooth experience, I’ll continue to choose prepayment. But if I’m at a relative’s house, which is not a usual address and could be hard to locate, we tend to opt for COD because we know that if we prepay, either the good is not going to reach us, or it’s going to get lost.

“Then there’s going to be a huge conversation with the team to get that money refunded. When consumers order to new addresses, if there’s a fixed frictionless delivery, the next COD purchase rate is lower,” he said.

Ali spoke about trying to address this issue from a brand perspective and posed an insightful question involving Return to Origin (RTO), the largest risk with COD. The costs involved in returning items are pretty high and make the seller vulnerable to losses.

“There are two parts to it. One is, we know it is friction, we acknowledge it, and we try to prevent it. Merchants pay an additional fee to logistics providers to handle the cash and handle the RE attempts. They want to make sure that their shipment is delivered. Because if it’s not, it’s returned, and it’s not a pleasant thing for brands,” he said.

The panelists agreed that COD is here to stay. Companies can either incentivise customers by giving them a 5% discount for prepayment or charge a certain amount of money for COD, which leads consumers to believe that prepayment is a better option.

For any new brand, the focus should be on acquiring newer consumers rather than adding friction. Adding that cost input to the product is better than creating more friction for the consumer.

![Read more about the article [YS Learn] How video translation startup Vitra.ai attracted investors, starting with 100X.VC](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Innovative-Business-1605700787694-300x150.png)