Money remaisn a hush-hush topic in India. Adults hardly discuss finances with each other, much less with their kids, and, as a result, Indian children grow up without any real understanding of money management.

In fact, numerous studies have revealed that young Indians don’t manage their finances until the age of at least 24, when they finish college and start earning. Add to that the fact that most banks are not tech-first and therefore can’t fit the sensibilities of the younger crowd – the end product is financially irresponsible but earning young adults.

Realising the importance of prudent financial management, parents have begun seeking solutions that could help them empower their children — and fintech startups have filled that space well in the form of neobanks.

Neobanks are steadily gaining traction because of their specialised offerings and tech-first approach, which appeal to the sensibilities of the “Instagram” and “Swiggy” generation by providing on-demand services at the tip of their fingers.

One such startup is Walrus, founded in 2020 by ex-IITian Bhagaban Behera (CEO), strategy consultant-turned-entrepreneur Nakul Kelkar (also the COO), and ex-Hewlett Packard executive Sriharsha Setty (CTO of Walrus). The engineering trio comes from varied career backgrounds, but the vision to make the younger generation money-smart inspired them to take the entrepreneurial plunge.

“The Indian youth is underserved when it comes to banking. India has over 300 million young people under the age of 24 — almost 20 percent of India’s population, but still, banks do not focus on this segment as they do not have jobs, do not earn much or take loans etc,” Bhagaban tells YourStory.

Founders of Walrus

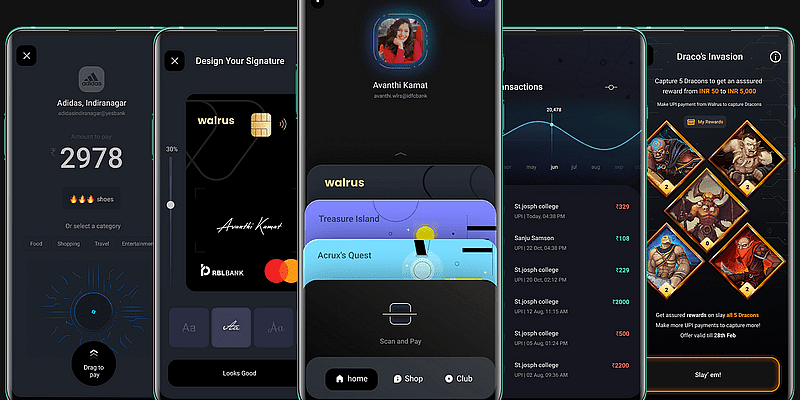

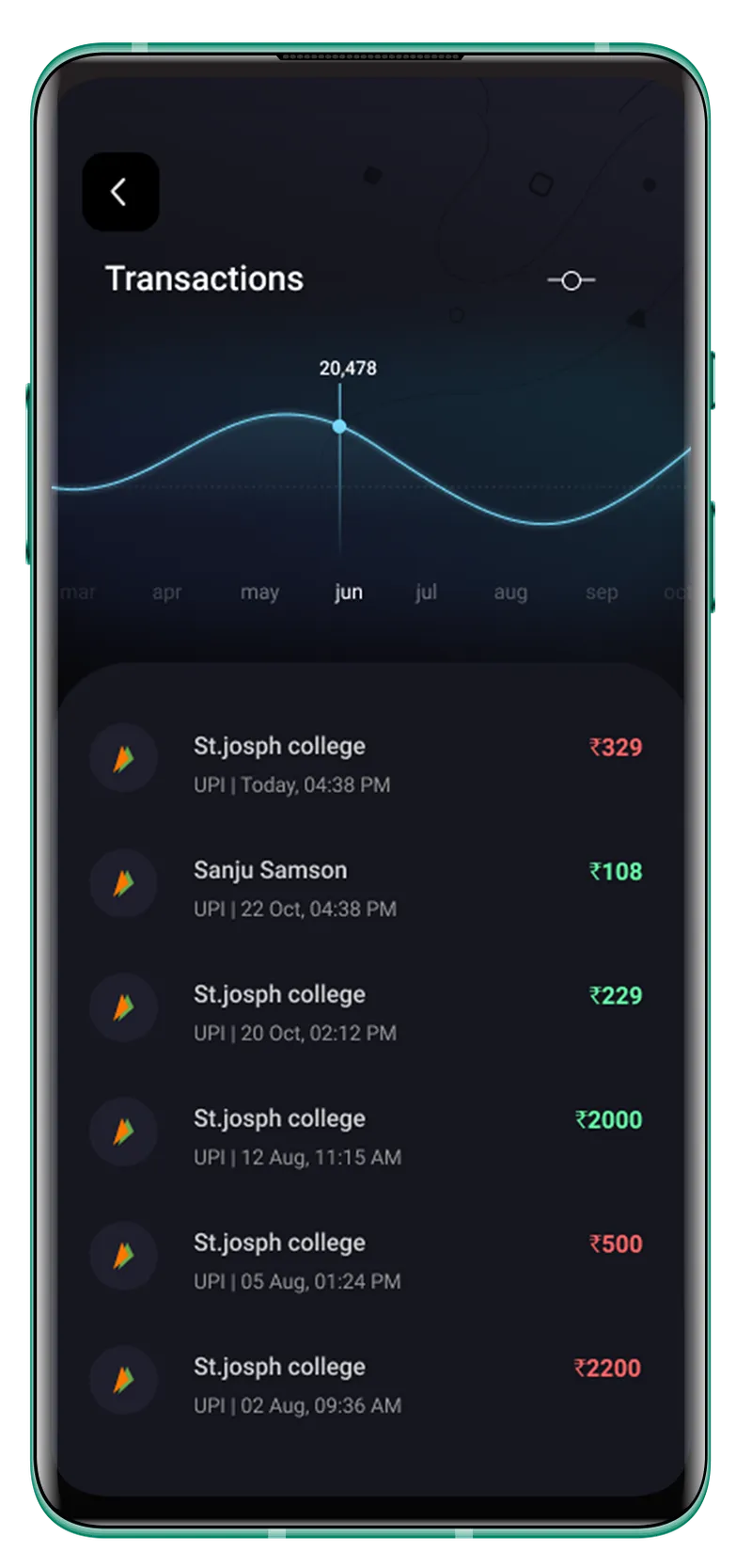

Walrus solves this problem by providing a platform exclusively geared for the Indian youth that can help them not only access their banks on their phones, but also learn about managing money thanks to the payments analytics feature that helps track savings and expenditures.

More than a savings account

Going beyond savings and online transactions, Walrus aims to educate users about the world of financial services, including investment instruments and loans. The next set of features it is developing will include investment and smart savings features.

“By gamifying savings, investments etc Walrus intends to lead the younger generation towards a journey to strong financial smartness,” Bhagaban says.

Downloadable only via the Playstore currently, the app requires digital KYC completion to register new users. Users and their parents can transfer funds to their new Walrus account via netbanking, debit card, or UPI. The startup, which offers banking services in partnership with RBL Bank and Mastercard, also issues debit cards to its customers, which they can then use for online purchases.

Still barebones, the app expects to add more features such as investing and credit services soon.

“The younger generation today has very high expectations from their bank account, and Walrus aims to provide them with the premium experience they deserve,” Bhagaban says.

To date, Walrus has 200,000 registered users on its platform, with transactions in crores of rupees. The startup aims to reach 10 million active transacting users in India by 2022.

Fintech for the future

Having raised a pre-seed round from Better Capital and angels such as Raghunandan G (Ex-CEO of Taxi4Sure) and Raveen Sastry (Co-founder of Myntra), the neobank is seeking a Series A in the near future.

The fintech startup makes its revenue primarily from card transactions that happen via the Walrus card it issues to its users. In the future, it hopes to charge its user base for curated products.

Because of its digital nature, Walrus can be accessed by users from across the country. It is currently focused on expanding its user base and adding more features to its product in India, but would also like to explore the Southeast Asian market, Bhagaban says.

Walrus’ main competitors include startups such as Birdfin, a fintech app that teaches children money management through gamification; FamPay, India’s first neobank for teenagers that lets parents track spending and savings; and Finin, a neobank that provides AI-driven insights on expenditure and tracks savings.

While the market size for fintechs catering to children and young adults is not immediately discernable since it’s still in its infancy, the fintech market overall is projected to grow to $85 billion by 2025, from $26.3 billion in 2019, at a CAGR of 22.7 percent according to ResearchAndMarkets.com.

Fintech startups that focus on the adults of tomorrow are poised to take a big slice of the pie.