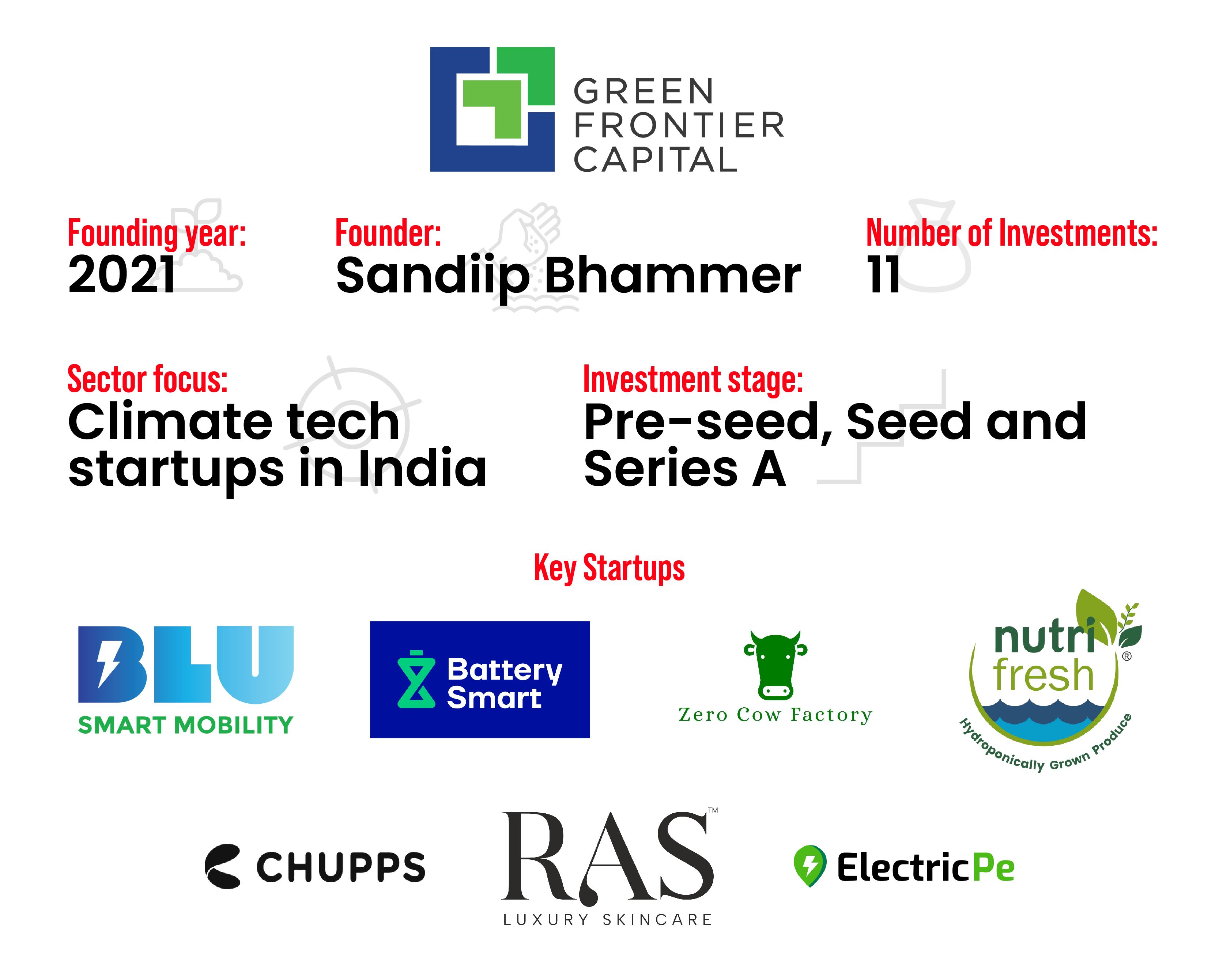

Green Frontier Capital–a US-headquartered early-stage venture capital fund solely focused on climate tech startups in India–believes these new-age companies will play a key role in boosting the sustainability index not just in India but around the world as well.

Buoyed by the potential of climate tech startups in the country, the VC firm plans to double down on its activity here and create a dedicated fund for India at a potential size of $100 million.

Founded in 2021 by Sandiip Bhammer, a seasoned financial services professional with experience in investment banking and equity markets, Green Frontier has invested in 11 startups in India till now.

The VC firm bets on sectors such as agritech, foodtech, electric vehicle ecosystem, and sustainable lifestyle. The startups in its portfolio include ride-sharing company BluSmart Mobility, Battery Smart Swap Station, charging aggregator ElectricPe, vegan footwear brand Chupps, bioengineered milk producer Zero Cow Factory, and agritech startup Nutrifresh.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Typically, Green Frontier invests at the early stage–seed and Series A–through three routes: direct investments, partnerships, and investment platforms. Now it is looking to create a dedicated fund at a size of $100 million and has applied for a licence for the same.

In an interaction with YourStory, Bhammer says, “Our vision is to invest in companies that are digital in design and those who are driving India’s sustainability goals.”

Climate change is real

According to Bhammer, given the size of the Indian economy, the country is the third-largest emitter of greenhouse gas after China and the United States.

“The country (India) is a significant contributor to, as well as a vulnerable recipient of, the adverse impact of climate change,” he remarks.

“Combating climate change is not merely a trend but an urgent necessity,” says Green Frontier’s founder, adding that the world cannot achieve its net-zero targets unless India and China are part of the narrative.

And this is where Indian climate tech startups will play a big role–not just in India but across the globe as well, he says.

The rapid pace of urbanisation in the country has put sustainable practices under the spotlight, especially in the areas of water conservation and combating pollution. Climate change also has an effect on agriculture, and this also calls for resilient farming techniques.

Bhammer believes there is increased awareness and commitment towards sustainability especially among the younger generation, and this in turn could drive more businesses to adopt sustainable practices.

Green Frontier strives to make contributions in this regard with investments in agritech startups involved in tackling climate change. For instance, it has invested in Pune-headquartered hydroponic startup Nutrifresh, which grows fruits, vegetables and herbs in a soilless environment with 90% less water consumption.

Investment strategy

Green Frontier typically invests around $0.5 million at the pre-seed stage, $1 million at seed stage, and $2 million during Series A.

A critical criterion for the firm while making investments is that the startup should have measurable sustainable development goals (SDG) impact, and this information must be put out on a public domain.

Speaking of impact, Bhammer points out that Green Frontier’s portfolio of startups in the EV mobility space has generated over 1.5 billion zero-emission kilometres, which is equivalent to savings of over 22 million litres of fuel. This has led to a reduction of 400,000 tonnes of carbon dioxide, he adds.

While putting in money, the VC firm also looks at a startup’s ability to generate an internal rate of return of 20-25% over six to seven years.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

According to Bhammer, the VC firm has deployed $30 million-$32 million in India. The current market value of its investments stands at around $150 million.

Green Frontier Capital invested in Battery Smart in 2021 at a valuation of $13 million, and now the startup is valued at over $400 million.

The valuation growth at Nutrifresh has also followed a similar trajectory, he says. Green Frontier invested in Nutrifresh in May, 2022, at a valuation of $15 million (Rs 120 crore approx). Now the startup is valued at around Rs 460 crore.

“We have done very well as one can see from our portfolio. Many of them have actually gone on to become bellwethers for the sectors,” says Bhammer.

The founder of Green Frontier, citing an analyst report from McKinsey, notes that investments in climate tech companies are outperforming investments in other sectors, across venture capital and private equity.

VC funding in climate tech startups is an emerging area, with the presence of a few dedicated investment firms, such as Avana Capital, focused on the space.

Bhammer says, “I think that we were the only fund that started with a climate focus from day one. That’s how we differentiate (ourselves).”

He also notes that the team at Frontier Capital has decades of experience in investing and technology.

Challenges in the current environment

Bhammer does not see the current funding winter having any kind of impact on climate tech startups.

According to him, VC funding in climate tech startups globally touched $70 billion in 2022, marking an 89% increase from 2021. He expects the current year to see some moderation; but there will not be a steep decline, he adds.

Bhammer also lists out certain challenges while investing in climate tech startups from a venture capital perspective.

The major challenge pertains to how startups can build an innovative solution that is also scalable. Secondly, adopting new solutions involves high capital costs. Lastly, investments in research and development (R&D) may not be really forthcoming as one is not sure of the outcome.

Bhammer says the Indian economy operates in cycles, wherein one theme plays out followed by another. For instance, liberalisation was followed by the internet boom and then the telecom revolution. The next 20 years will be climate-focused, he reiterates.

He believes many of the solutions to combat climate change that emerge from India will also be applicable across the world, especially in the emerging markets.

Edited by Swetha Kannan

![Read more about the article [Jobs Roundup] Work with new messaging tech unicorn Gupshup with these openings](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/gupshup-1617887800113-300x150.png)