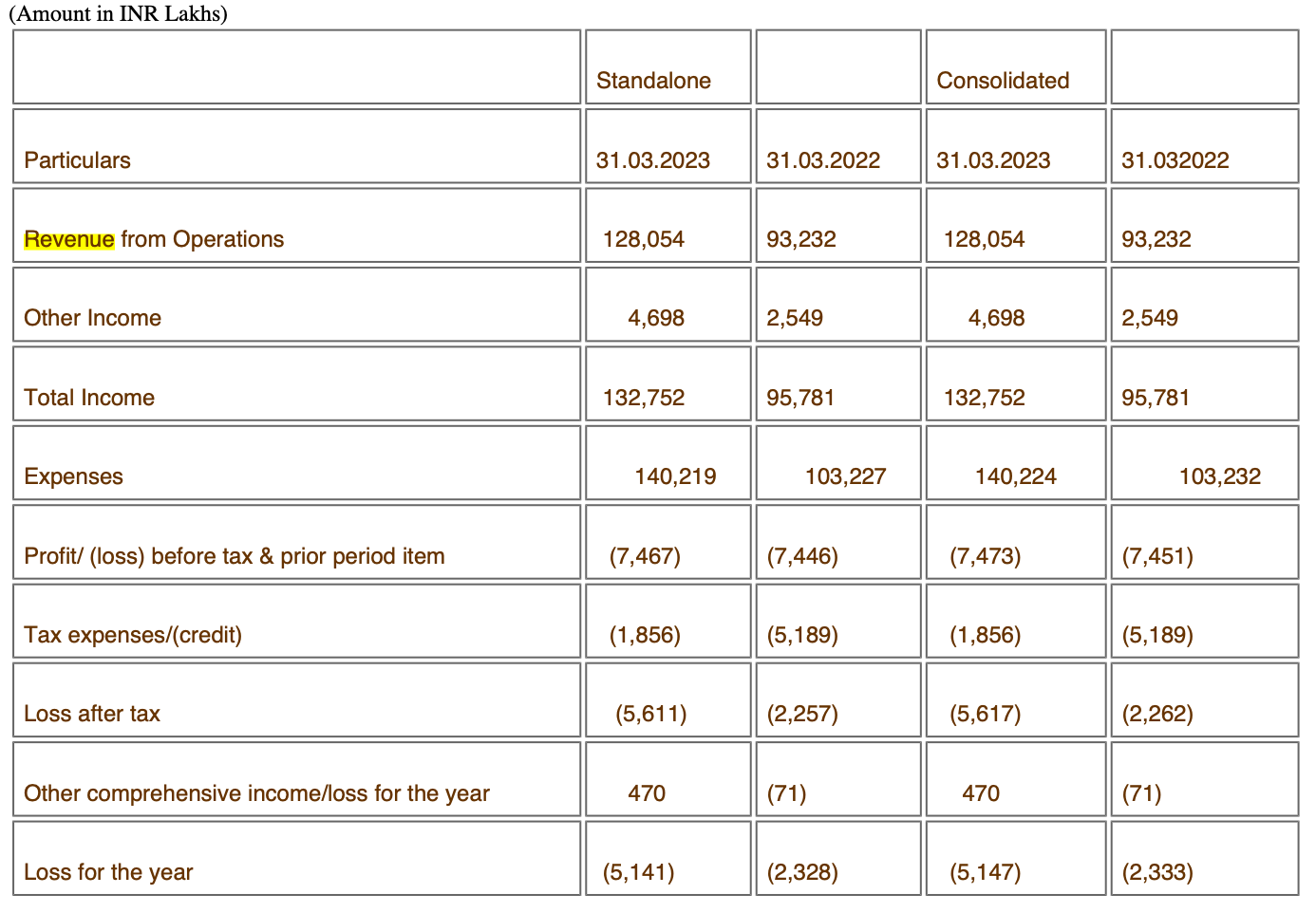

Fintech unicorn reported a 37% jump in operating revenue to Rs 1,280.5 crore in the financial year ended March 2023. The consolidated revenue was Rs 932 crore in the previous fiscal year.

The losses of the merchant commerce platform ballooned by almost 2.5X—from Rs 22.6 crore to Rs 56 crore in FY23.

As per the financial statement, the Point of Sale (PoS) machine provider derives its major revenue from digital payments, including transaction processing fees, aggregator services to merchants (settlement fees paid by merchants depending on transaction value), POS installation and programme integration fee, and Buy Now Pay Later (BNPL) services.

It earned revenue from cashback and other subscription-based services in the form of one-time installation of hardware/software, gift cards, and co-branding (credit cards) fees.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Pine Labs’ expenses for the fiscal were up by 35% to Rs 1,402 crore compared with Rs 1,032 crore in the previous year. The major contributor to the outlay was employee benefit expenses (Rs 606 crore) and legal professional fees (Rs 114 crore). The company doubled its advertising and promotional spend from Rs 25 crore to Rs 42.4 crore in FY23.

One of the largest PoS players in the country, Pine Labs entered into the online gateway space with the launch of Plural in 2021. Recently, the company launched ‘Mini’—a visual and audio confirmation payments machine for merchants that allows contactless card payments as well as QR code scanning, in completion with its fintech peers Paytm, PhonePe, and BharatPe.

Backed by investors including Peak XV Partners, Actis Capital, Temasek, PayPal, and Mastercard, the fintech major recently became the latest Indian unicorn to see a valuation markdown after Fidelity Investments slashed its valuation by about 9.2% to $4.5 billion, as per its SEC filing.

The Noida-based firm has reportedly deferred its initial public offer (IPO) plans in the US to next year. Initially, the fintech unicorn had plans to list in 2022.

Edited by Kanishk Singh

![Read more about the article [Funding alert] SaaS startup Chargebee raises $125M in Series G round led by Sapphire Ventures, Tiger Global,](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Imagekcpu-1611379989687-300x150.jpg)