Qatar’s sovereign wealth fund is investing $1 billion in Reliance Retail as India’s largest retail chain looks to expand its operations and enter new categories. The Qatar Investment Authority’s investment will secure it a 0.99% stake in Reliance Retail Ventures, valuing the Indian company at $100 billion.

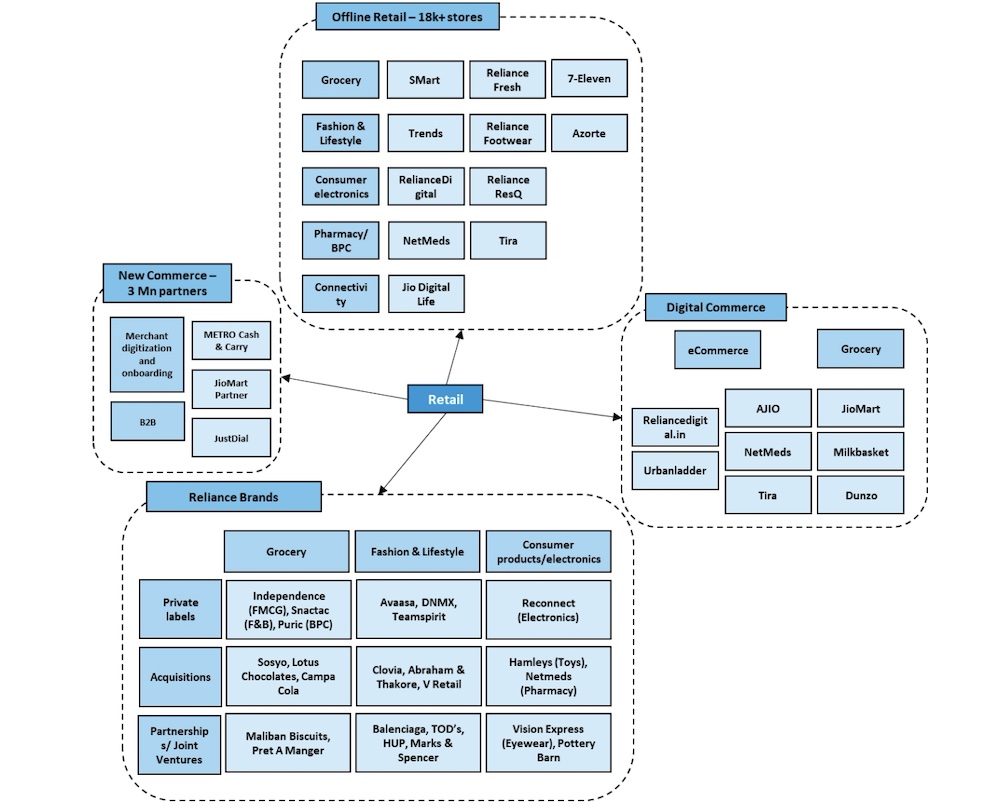

Reliance Retail — which operates 18,500 stores and digital commerce platforms, selling everything from electronics to fashion and pharma — was last valued at $62.4 billion in 2020, when it raised over $6 billion from investors including Saudi Arabia’s Public Investment Fund and private equity giant KKR.

The investment comes at a time when Reliance Retail is expanding into new categories, including low-cost fast-fashion and is also considering a public listing. The company, which also recently partnered with Shein to help the Chinese e-commerce firm reenter India, has purchased and integrated a number of other businesses.

The Reliance Retail maze (Image and research: Bernstein)

The Qatar fund — which has also backed food delivery startup Swiggy, edtech platform Byju’s, and food firm Rebel Foods — said it sees high-growth potential in India’s fast growing retail market.

“We are looking forward to Reliance Retail Ventures Limited, with its strong vision and impressive growth trajectory, joining our growing and diverse portfolio of investments in India,” said Mansoor Ebrahim Al-Mahmoud, chief executive of QIA, in a statement.

Reliance Retail has also made push into e-commerce in recent years, including maintaining a tie-up with Meta’s WhatsApp to sell grocery through the instant messaging app. Though Walmart-owned Flipkart and Amazon India currently lead the e-commerce market in the South Asian market, analysts believe that Reliance will eventually outpace both the firms.

AllianceBernstein estimated in a note earlier this year that Reliance’s robust retail network, a sweeping mobile network, a holistic digital ecosystem and a “home field advantage” in a notoriously challenging regulatory landscape will help the Indian conglomerate beat online rivals.

“The medium-term investment case for RIL is driven by: (1) strong cash flows and ability to invest in growth businesses and (2) potential value-unlocking in the medium term: We believe the operating earnings downgrade cycle for RIL is likely behind us, with energy driving FY24 and consumer pick-up likely in FY25. Jio+Retail capex should fall sharply from FY25 even as earnings pick up. Beyond earnings, we believe potential value- unlocking via stake sales/IPO/listings could be a material stock price driver over the next 2-3 years,” wrote JP Morgan analysts in a note this month, accessed via CapitalIQ.

Reliance Industries, which owns the majority of Reliance Retail Ventures and is the largest company by market cap in India, has aggressively expanded into a wide-range of sectors, including telecom and on-demand video streaming, in the past decade as it diversifies from its reliance on oil. Isha Ambani, the daughter of Ambani, leads the retail business.

She said in a statement: “We look forward to benefitting from QIA’s global experience and strong track record of value creation as we further develop Reliance Retail Ventures Limited into a world class institution, driving transformation of the Indian retail sector. The investment by QIA is a strong endorsement of a positive outlook towards Indian economy and Reliance’s retail business model, strategy and execution capabilities.”