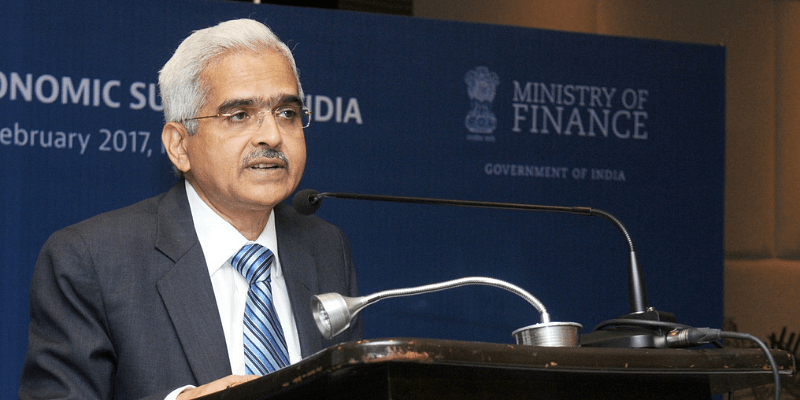

Reserve Bank of India(RBI) Governor Shaktikant Das on Tuesday released the country’s most popular Unified Payments Interface (UPI) service for feature phones.

The service, known as UPI123PAY, will allow 40 million feature phone users in India to use the payment service without the Internet.

Making payment with UPI has already been accessible through the USSD method, but this new method will allow various digital payment options to users across the country, especially rural India.

Earlier, UPI was only supported on smartphones in India, but now, feature phone users will also be able to make payments and receive them via UPI.

To provide extra support, the central bank has also introduced DigiSaathi, a 24-hour helpline for digital payments, which will help users enquire via website or chatbot. Users can get more information at http://www.digisaati.info/ or by calling 11430 and 1008913333.

According to recent data, there are 304 banks residing on the UPI system, and collectively 4,527.29 million transactions occurred in February 2022. Last month, about Rs 8.26 lakh crore worth of transactions were made by UPI. Still, a large part of India’s population couldn’t access to UPI as it required a smartphone for that. To fill the gap, the Reserve Bank of India (RBI) has introduced this new payment feature.

Even though feature phones have NUUP (National Unified USSD Platform) as an option for basic payment services via the shortcode *99# has not been broadly embraced.

Similar to how smartphone users initiate their UPI transactions, feature phone users will likewise need to use their bank details (debit cards) to connect their bank account with their phones. They will also need to set up a UPI PIN. Whenever that is done, there are four new options available for users from which they can carry out financial and non-financial transactions.