As with any new technology, understanding crypto transactions, Web 3.0 and decentralised applications or dApps as they are known, can be intimidating for those taking their first steps in the world of cryptocurrencies. This is where Transak is trying to make a difference.

Transak is a single integration for applications to enable fiat-to-crypto on-ramp from a global user base. Despite the benefits of decentralised applications, mass adoption remains a challenge due to complicated user onboarding.

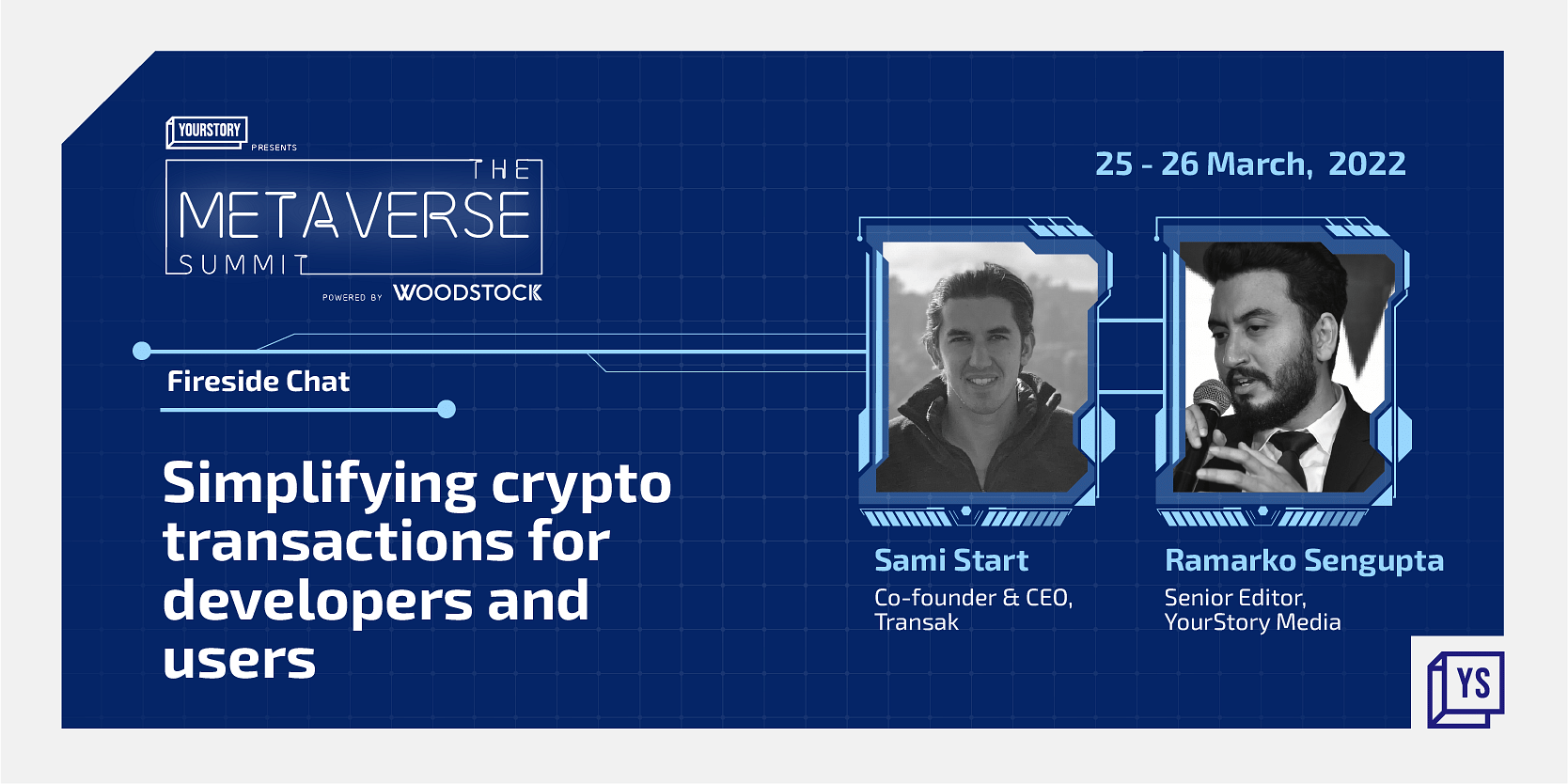

To help us understand how they’re simplifying crypto transactions for developers and users, and their plans for India, Sami Start, Co-founder and CEO, Transak shared his first-hand views over a freewheeling conversation at YS’s The Metaverse Summit. Here are some of the key takeaways.

Payment insights that have helped inform Transak’s product

Sami drew upon the dual aspects of his prior experience in fintech, and his own perspectives as a cryptocurrency investor to help build powerful and relevant user experiences for Transak.

Currently, most dApps are only open to users who already own cryptocurrencies or understand how to buy and use them, but Transak is simplifying the complex payments experience and allowing users to acquire crypto assets with their existing bank accounts directly via bank transfer, card payment, or local payment methods.

“To use an application that involves Web 3, you need a crypto wallet. And most people in the world don’t have a crypto wallet right now. Different people want to pay in different ways in different countries. On top of that, the compliance around launching new countries was also very difficult, We had to use so many different compliance vendors. It’s extremely difficult to build and scale, globally,” said Sami.

“My personal experience as a user also helped tremendously. I’m someone who’s been investing and interested in finance since a young age—I realised at one point in time, I had 20 different accounts, and it was getting so hard to manage it all,” added Sami, narrating how his personal experience helped him realise the critical importance of simplifying the onboarding and trading experience, both for developers and for end users.

“When I came across Web 3 and cryptocurrency wallets, that seemed like a really elegant solution in order to do that,” he added.

Understanding dApps and its impact potential

“To put it simply, a dApp, or a decentralised application is basically like a normal application, except that the code is written and executed on the blockchain. So in a normal application, the code is running on the company’s server, but with decentralised apps, the code just runs in a decentralised network, it’s distributed, and it’s all coordinated together using the blockchain,” said Sami.

Sami also spoke about the misconception of thinking that decentralised applications are going to “arrive” and usher in “big changes”.

“What’s happening is that applications are starting to incorporate blockchain more than ever. Apps are not going to disappear; there are just going to be a new wave of dApps by companies incorporating more and more blockchain,” he adds.

“We’re starting to see a lot of financial applications that when users deposit their money on those apps, instead of them storing it in a bank, they’re storing the money on smart contracts on the blockchain – which means that they’re earning higher interest rate – an obvious benefit,” he says, contextualising the rising popularity of blockchain as a financial instrument among its diverse use cases.

Sami also spoke about how blockchain is creating a different kind of dynamic in gaming, where in-game items can have a real world value and gamers could potentially earn a living from gaming as well.

He also spoke about the potential impact of incorporating blockchain into any kind of application.

“A social network, for instance, could incentivise behaviour – i.e. rewards for positive actions. This creates a kind of creator economy,” he said.

“Just like app developers use AI to make their apps better, I believe that the same could be true with apps using Web 3 and blockchain,” he added.

On being the ‘Lego’ for Web3 developers

“We’re not trying to build apps ourselves. What we’re trying to do, instead, is to give a developer toolkit that enables applications to use some of the building blocks,” said Sami as he likened the Transak toolkit to Lego blocks.

“We’ve focused on challenges that are extremely difficult from a compliance and payments point of view, which are typically the things that can take the longest time to build when you have a company,” he added.

“So if you’re building a company, and you want to get financial regulation, create payment operations and handle people’s money, it can take years to build. So if you want to get a product in months and not years, Transak allows you to do that,” said Sami.

A shout-out to prospective job seekers in the Web3 space

Sami concluded the conversation on how Web 3.0 offers tremendous opportunities for India, especially with it having the world’s largest number of English speaking software developers. He also revealed that Transak was looking to fill more than 150 open positions with local talent.

“You don’t need a lot of experience in Web 3 to work in Transak. We’re hiring mostly for people who are smart, with a track record of success of doing what it is that they’re doing. If you’re a software engineer with a track record of delivering projects to a high standard, you can pick up the principles pretty quickly,” he said.

“We’re noticing that having really good people is more important than having people who have a year of experience in blockchain. If you’re interested in that, then we want to talk to you,” added Sami.

![Read more about the article [Budget 2022] Govt to introduce EV battery swapping policy: FM Nirmala Sitharaman](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/Featured-image-01-1643704133368-300x150.png)