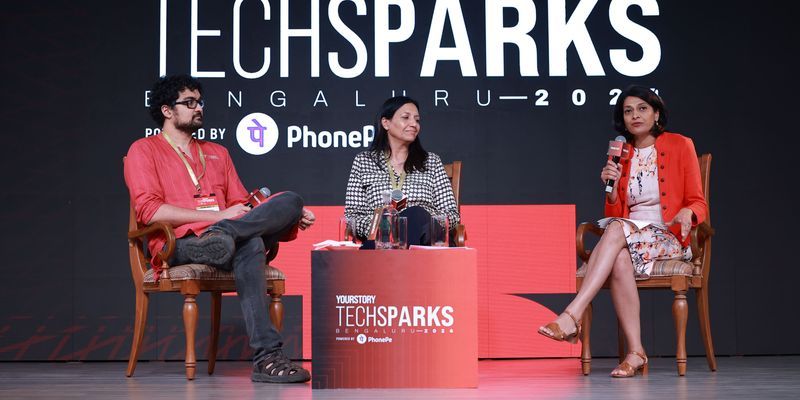

At TechSparks Bengaluru 2024, venture capitalists (VCs) advised Indian startup founders to focus on building a sound business rather than on valuations as capital gets attracted to such ventures.

During a panel discussion on the topic ‘What are India’s VCs betting on now?’, LetsVenture Founder Shanti Mohan said, “The basic fundamentals of building a company do not change and founders need to realise that they do not need that much capital to build companies.”

Participating in the discussion, Siddarth Pai, Founding Partner, Chief Financial Officer and ESG Officer, 3one4 Capital, said, “Build a good business and the VCs will come to you.”

The Indian startup ecosystem continues to witness a slower inflow of capital, raising questions on how the VCs are now assessing startups and their founders.

Pai emphasised that capital is always available but there is a challenge of finding good VCs. He further noted that funding winter ensured a correction in the ecosystem.

Both investors were of the view that due to funding winter, the founders are more focused on building sustainable businesses with profitability in mind. In addition, many of them have become frugal in utilising the capital.

On how they identify the startups to back, Mohan said, “It is always the team and founder at the early stage.”

According to Pai, the biggest risk that VCs take while investing is the people’s risk.

“Founders are talking about revenue, product differentiation, profitability early on. This is a maturing ecosystem,” said Mohan.

At the same time, there is another big positive for the Indian startup ecosystem, with many companies looking to go public. Pai remarked that the Indian startup ecosystem always grappled with the question of exits and added that the public market is now showing the way.

This year, six companies from the Indian startup ecosystem were listed on stock exchanges and many more are lined up. Overall, there has been a positive reception from the public markets.

Both investors emphasised the importance for startup founders not to lose their focus on governance issues as they are the guardians of the reputation of the company.

![Read more about the article [Weekly funding roundup Nov 9-15] VC inflows record a sharp rise](https://blog.digitalsevaa.com/wp-content/uploads/2024/05/Weekly-funding-roundup-1670592545805-300x150.png)